Dogecoin’s 280K fresh addresses – Merchants, is this a lift heed for you?

- Unique query of for DOGE peaked within the heart of the week

- Memecoin’s MVRVA ratio hinted at a shopping quite quite quite a bit of too

In step with IntoTheBlock, the crypto-market’s main memecoin Dogecoin [DOGE] has recorded a principal spike in fresh query of. On 2 May perchance perchance maybe also, 28,000 fresh addresses were created to change DOGE. This figure marked a 102% hike from the month-to-month low in DOGE’s fresh query of that used to be space on 29 April.

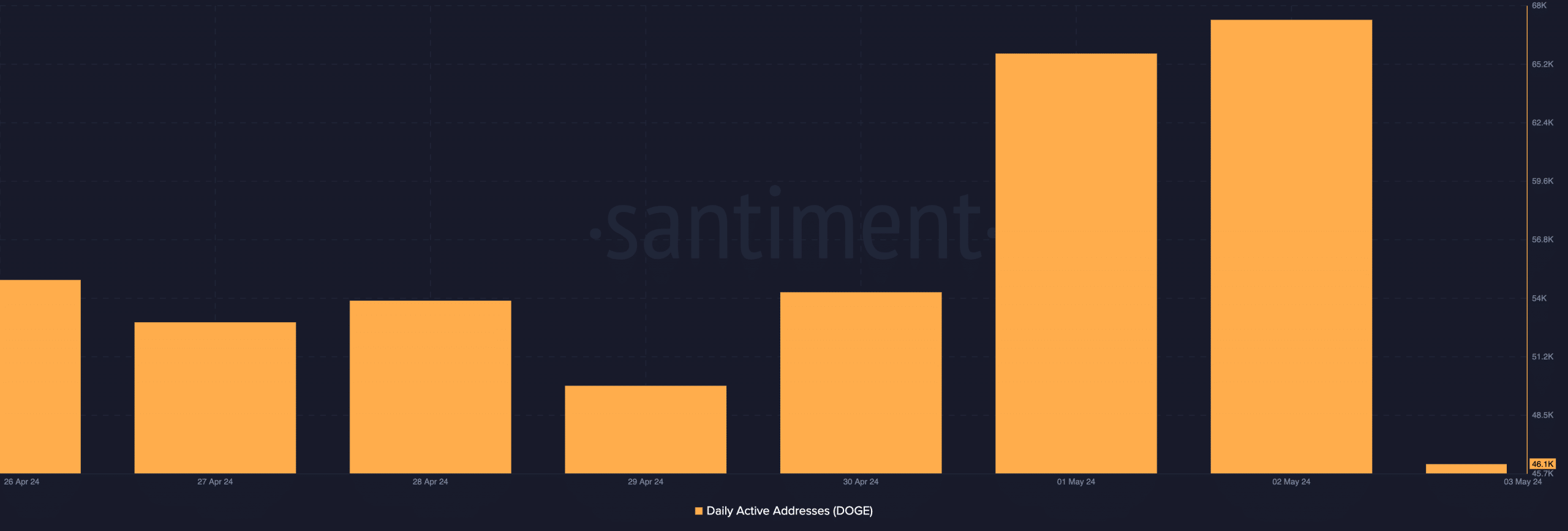

As fresh query of grew, the day-to-day depend of addresses serious about DOGE transactions also rallied over the final week. Basically, records from Santiment published that the memecoin’s day-to-day bright addresses hiked by 27% within the previous seven days by myself.

Here is how DOGE reacted

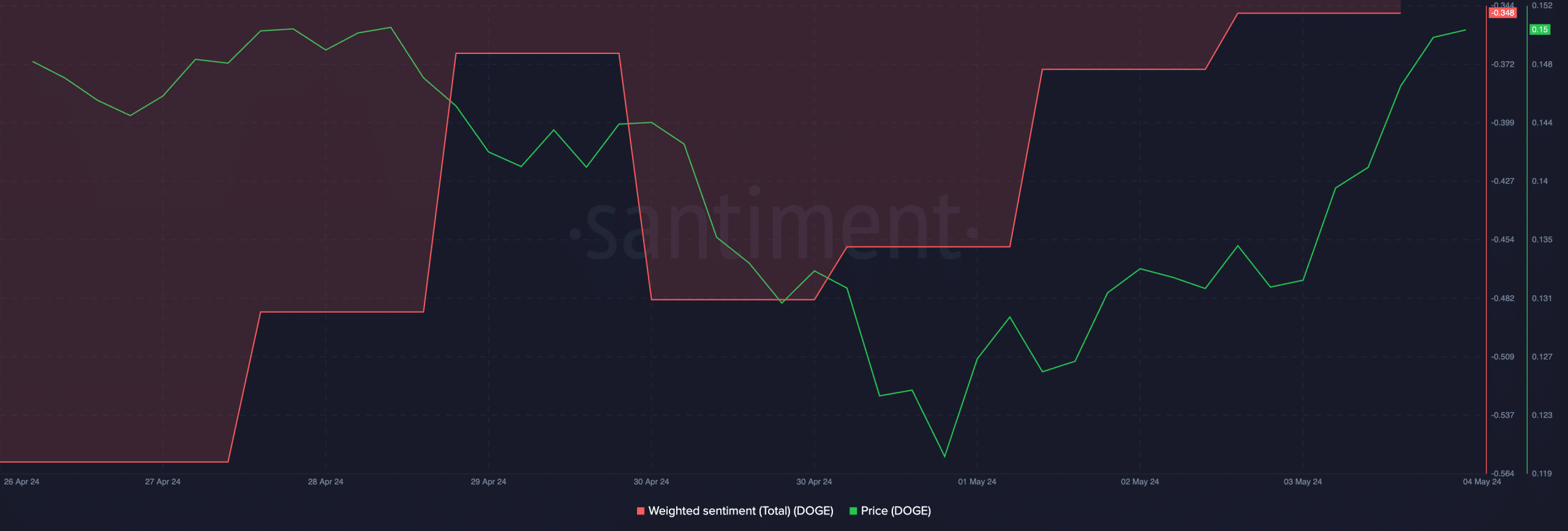

An uptick in an asset’s community exercise generally precedes a rally in its price. Nonetheless, this has no longer been the case for DOGE. The sustained query of for the altcoin over the final week didn’t impress any principal bounce in its price.

At the time of writing, DOGE used to be trading at $0.15. In step with CoinMarketCap, it recorded a cost appreciation of lawful 2% over the week, with most of it considered over the final 24 hours. DOGE’s minor price rally within the final seven days mirrors the usual market decline considered within the heart of that duration. Basically, the low trading recorded within the heart of the duration below overview pushed the cryptocurrency market’s capitalization below $2.3 trillion on 1 May perchance perchance maybe also, sooner than it rebounded.

Nonetheless, DOGE’s hike over the final 24 hours is an illustration of bullish sentiment.

Additionally, in step with Santiment, DOGE’s weighted sentiment is now poised to breach its heart line on an uptrend. This metric tracks the usual market sentiment about a crypto-asset. When it returns a rate above zero, market sentiment is particular. Conversely, market sentiment is predominantly bearish when its rate is below the zero line.

At press time, DOGE’s weighted sentiment used to be -0.348. This metric’s rate will upward push if trading exercise will improve and DOGE extends its beneficial properties within the short time duration.

Sensible or no longer, here’s DOGE’s market cap in BTC’s phrases

Now can even very neatly be your time

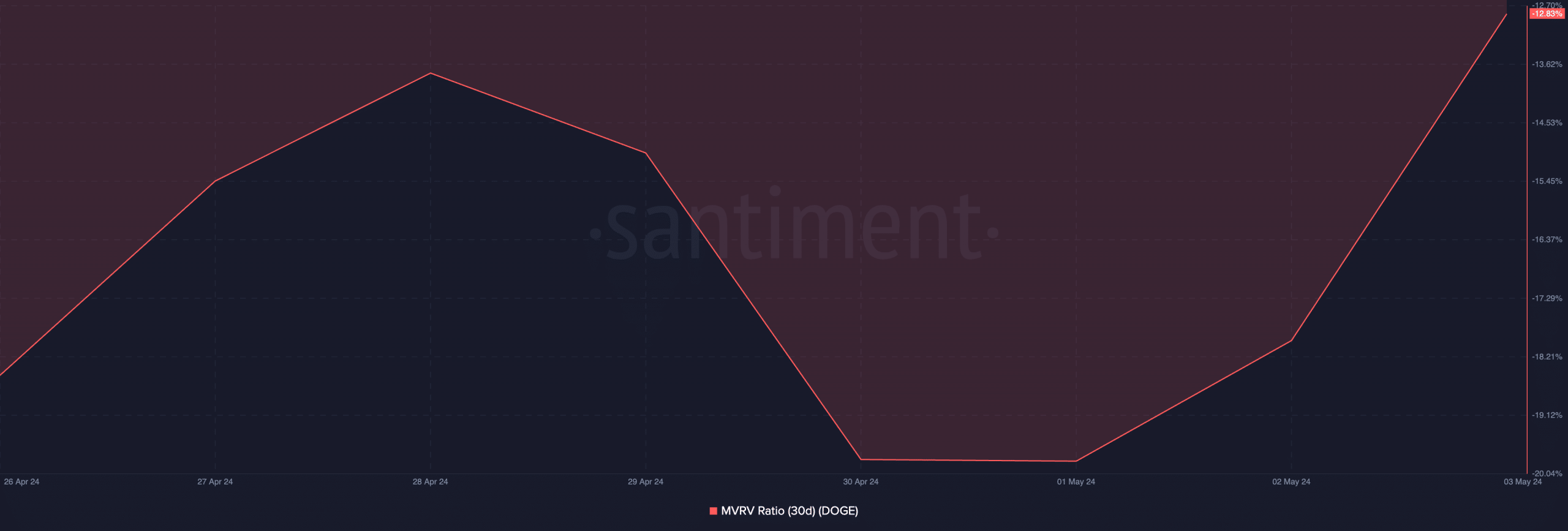

AMBCrypto’s review of DOGE’s Market Payment to Realized Payment (MVRV) ratio published that it is now flashing a lift heed. This metric, assessed over the 30-day intelligent common, returned a unfavorable rate of -12.83% at press time.

An asset’s MVRV tracks the ratio between the asset’s fresh market price and the everyday price of each coin or token obtained for that asset.

When its rate is above one, the asset’s market rate is seriously better than the rate at which most traders obtained their holdings. When this happens, the asset is claimed to be overrated.

On the assorted hand, when it returns a unfavorable rate, the asset is claimed to be undervalued, as its market rate is below the everyday dangle price of all its tokens in circulation.

Merchants make clear a unfavorable MVRV ratio as a heed to “lift the dip” in anticipation of a cost rally.