Bitcoin’s road to $65,000 – Here’s what needs to happen for that fee purpose

- Bitcoin’s fee has risen by over 6% in 24 hours

- If the bulls retain on to market adjust, a rally past $65,000 will likely be that you just perchance can take into consideration

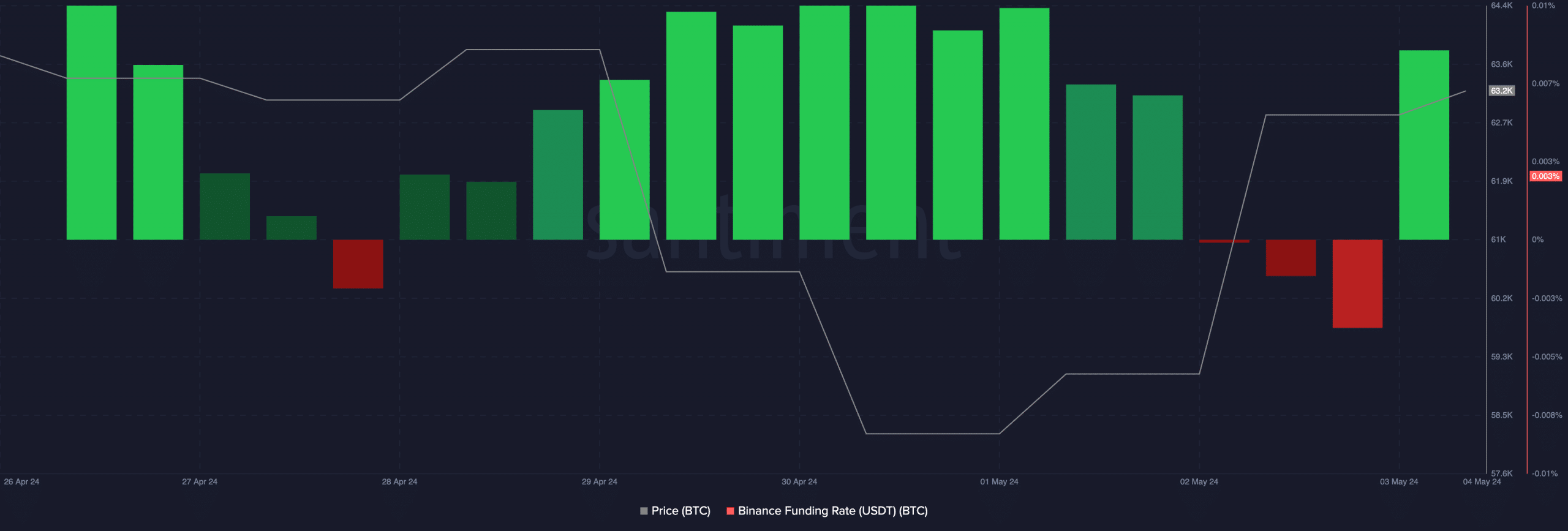

In step with Santiment, the 6% hike in Bitcoin’s [BTC] fee over the final 24 hours has ended in a notable switch in its funding fee, from unfavorable to obvious on Binance.

📈 #Bitcoin has bounced on a #bullish Friday with its market cap rising +5.4% in 24 hours. The crowd has completely #flipflopped on their #Binance trades, going from liquidated #shorts to #longs after this leap. For the rally to proceed, we don’t are searching for to explore #FOMO rising too… pic.twitter.com/fY3lEX3REb

— Santiment (@santimentfeed) May per chance merely 3, 2024

Funding charges are a mechanism ragged in perpetual futures contracts to be obvious that that the contract fee stays near the jam fee. When an asset’s contract fee is better than its jam fee, traders who retain long positions pay a fee to traders shorting the asset. Funding charges return obvious values when this occurs.

Conversely, unfavorable funding charges are recorded when the asset’s contract fee is lower than the jam fee. Here, short traders pay a fee to traders holding long positions,

When an asset witnesses a sudden shift from unfavorable to obvious funding charges, it suggests that there is a stable quiz for long positions. It is opinion to be a bullish signal and a precursor to an asset’s continued fee boost.

In step with Santiment, Bitcoins funding fee on Binance closed on 3 May per chance merely at a one year-to-date low of -0.008%. Alternatively, after the cost initiated an uptrend to climb by over 6% in 24 hours, its funding fee on the main alternate changed to obvious.

At press time, this had a reading of 0.0027%, indicating that there were more long than short positions in the coin’s derivatives market.

Is your portfolio green? Try the BTC Profit Calculator

What whenever you happen to peep out for?

Bitcoin’s fee surge in the final 24 hours has ended in a rally in shopping and selling exercise in its derivatives market. In step with Coinglass, as an illustration, shopping and selling volume in that market had a cumulative identify of $78.05 billion over that duration, with the the same mountain climbing by 30%.

Signaling that market participants are opening fresh shopping and selling positions, BTC’s futures open hobby registered a 7% uptick in 24 hours too. At press time, the coin’s futures open hobby used to be $30 billion, while the crypto used to be valued at staunch over $63,000 on the charts.

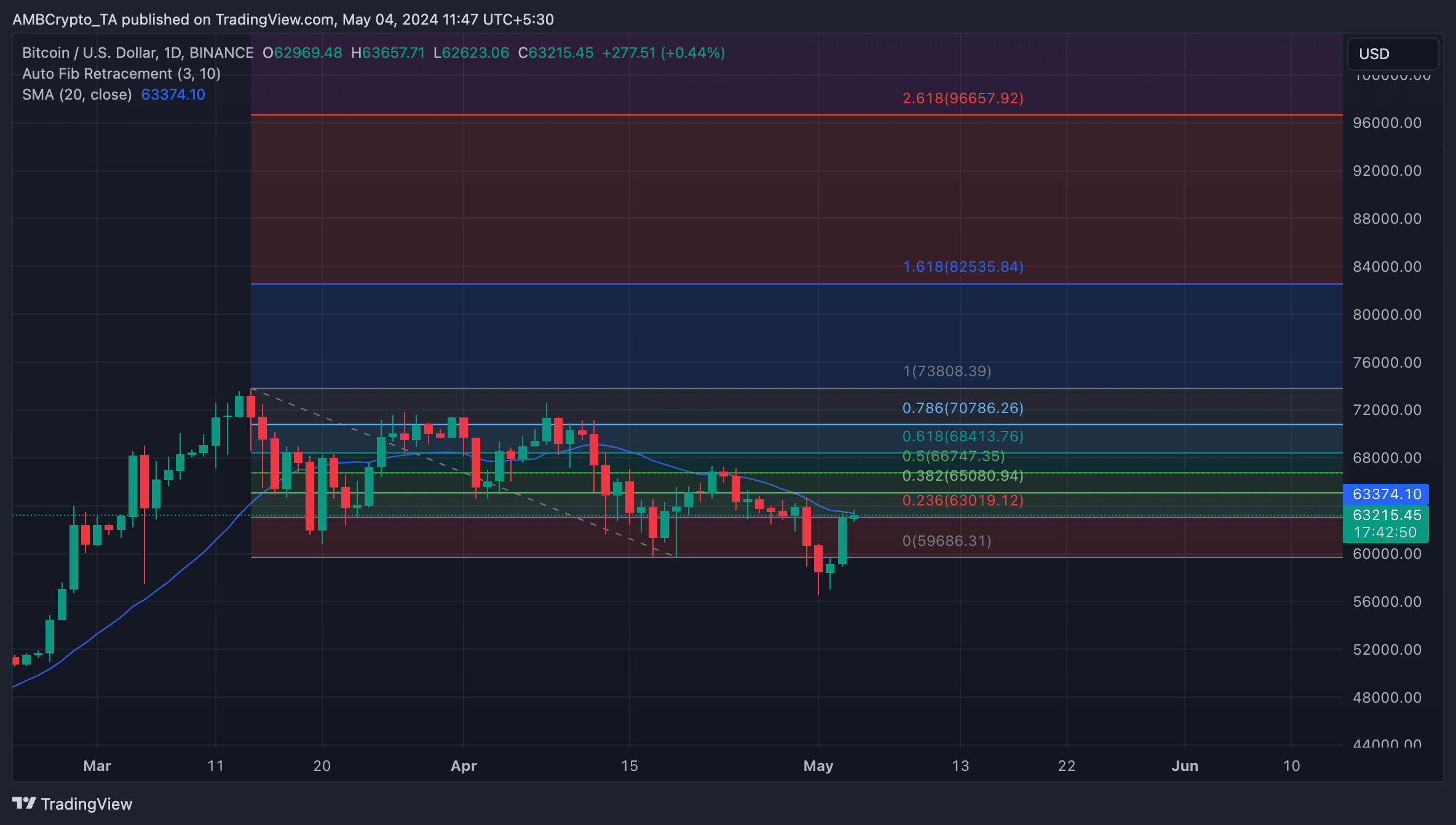

Moreover, readings from BTC’s Fibonacci retracement phases on the 1-day chart published that if this bullish momentum is sustained, the coin’s next fee point will likely be $65,050.

Alternatively, if the bears re-emerge and fasten tension on its fee, the bullish projection will likely be invalidated. If that occurs, BTC’s fee will drop below $60,000 to alternate palms at $59,700.