Q4’s stasis offered a launchpad for publishers’ Q1 marketing businesses

By Kayleigh Barber • March 12, 2024 • 5 min learn •

Ivy Liu

The fourth quarter of 2023 wasn’t so scandalous for all publishers. In actuality, overall the closing three months of the year ended up being a length of “stabilized development” for digital publishers’ marketing businesses, according to Boostr’s Q4 2023 Media Advert Gross sales Type Narrative, which lined extra than 100 U.S.-essentially based completely digital media corporations.

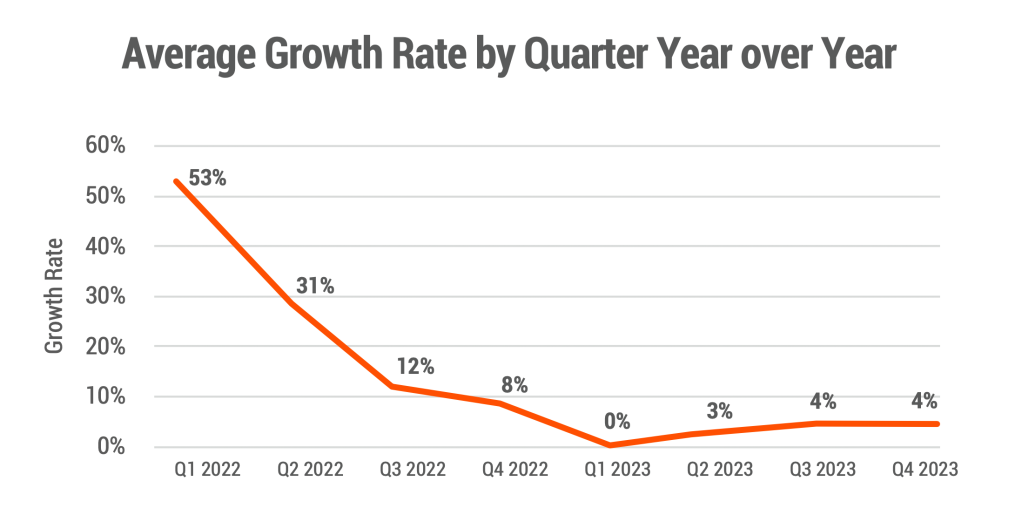

Patrick O’Leary, CEO and founding father of Boostr, told Digiday that publishers are seeing a return to balance with ad revenue having a median development rate of 4% in Q4. When put next with the outdated two quarters, this does trace a leveling out, versus the persevered steep declines skilled throughout 2022.

That reasonable is set on par with what Dotdash Meredith reported for its digital marketing commercial, which was up 3.7% year over year in Q4 2024. Nonetheless The New York Instances, Gannett and Dow Jones didn’t fare as neatly of their final earnings experiences for 2023.

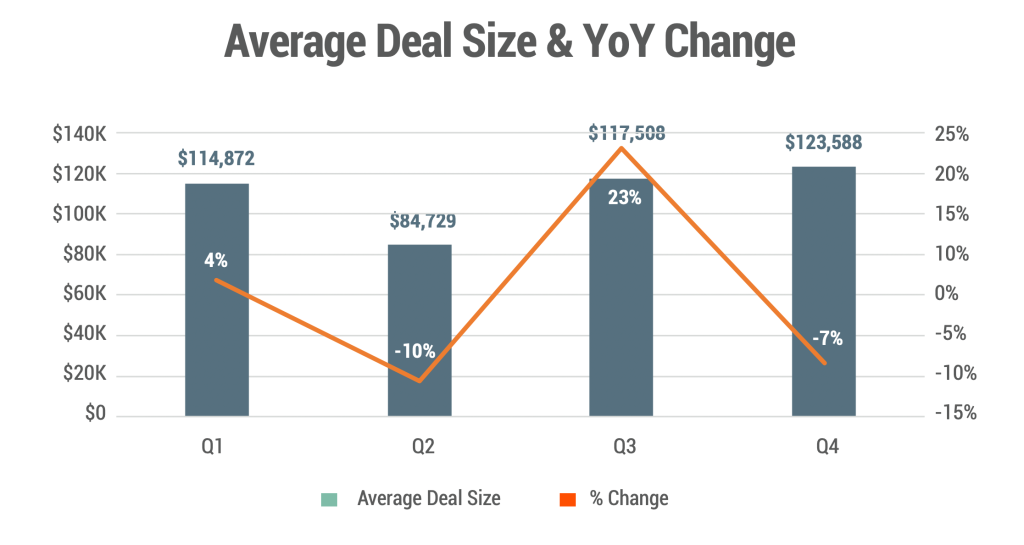

Reasonable deal measurement within the fourth quarter was the highest for the year at a median of $123,588. On the other hand that figure was down 7% year over year, according to Boostr data, which O’Leary stated signifies a surge of closing minute, in-quarter offers coming to spherical out the year.

The bulk of offers (66%) that closed within the quarter had been for campaigns that had been supposed to trot dwell in Q4 2023, versus offers signed prematurely of campaigns going dwell within the novel year. On the other hand, that fragment did decrease by 5% quarter over quarter and 3% year over year, according to Boostr, which helps the foundation that some advertisers had been returning to feeble behaviors and making some plans for 2024 campaigns ahead of the year even kicked off.

Lindsey Abramo, CEO of World of Appropriate Brands, stated that Q4 “stayed the identical popular drumbeat” because the the leisure of the year and while “it didn’t nosedive by any manner,” ad revenue for the quarter didn’t soar up esteem it historically does.

What did happen in Q4, then again, was solidify WGB’s space heading into the novel year, something that many publishers haven’t been ready to in actuality feel confident about for the previous loads of years.

“It started clearly in Q4, nonetheless we now admire merely walked into the quarter virtually booked-to-goal, which is a in actuality solid plan to be. I haven’t seen that happen rapidly,” stated Abramo. She added that in-quarter selling (A.Adequate.A. campaigns going dwell within the center of the quarter they’re sold) is tranquil going to be the norm, nonetheless definite clients within the CPG and auto categories admire locked in seven-figure offers that will trot dwell later within the year.

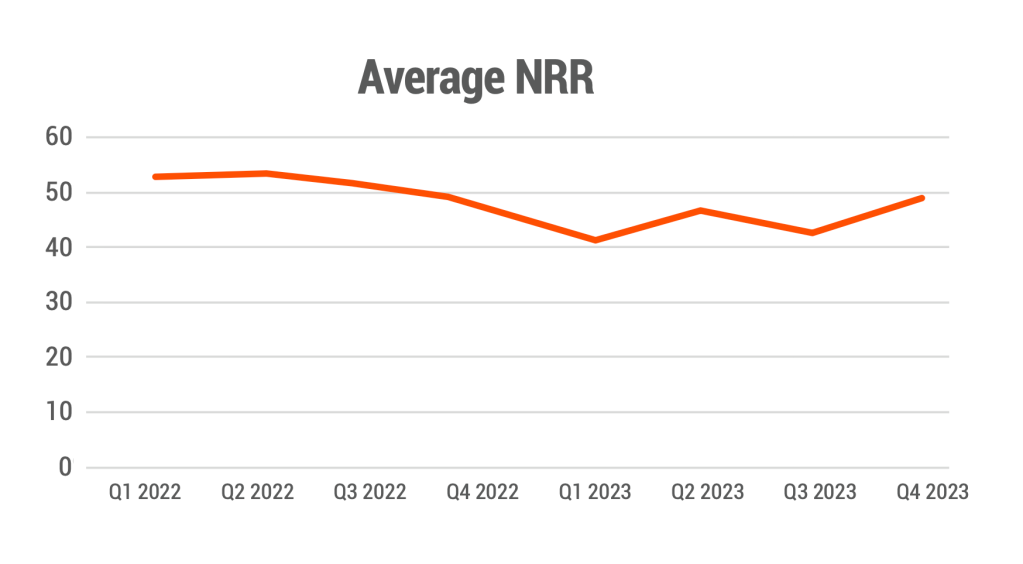

Boostr’s file discovered that the reasonable get retention rate (NRR) for publishers’ ad clients – calculated from the percentage of ad revenue that came from present advertisers within the outdated quarter – was a sore level for publishers in 2023. The fourth quarter was the highest NRR rate for the year (at 49%), nonetheless that tranquil supposed that the bulk of ad revenue in Q4 came from novel commercial. Between 2020 and 2021, O’Leary stated reasonable NRR hovered between 70-80% for most publishers.

Taking a gawk at this year, the publishers that are searching out for to develop their ad businesses will want to “admire a extra targeted effort [on retention] because it costs a bunch of cash [to pull in new clients]. It’s the feeble [lifetime value and customer acquisition cost] ratio self-discipline. In case you don’t retain them spherical, your unit economics are in actuality going to endure this year,” stated O’Leary.

One publisher told Digiday on the placement of anonymity in December that client renewals had been up in Q4, which they attributed to launching a brand novel client success personnel a year prior and interrogate will proceed a definite renewal vogue in 2024. “I have faith we invested within the lawful apparatus on the lawful time and that’s paying off for us now in renewals,” they stated.

At some level of the first quarter, Riva Syrop, president of House Remedy, stated that the firm’s “close rate is much increased than the leisure we’ve ever seen ahead of, nonetheless I have faith that’s in portion because most likely about 65% of our offers on the deliver-aspect to this level are renewals.” Leaning on the present client roster, Syrop stated that the firm was ready to head into 2024 with elephantine year bookings up 40% year over year.

https://digiday.com/?p=537576

WTF is server-aspect ad insertion?

March 11, 2024 • 3 min learn

The battle in opposition to ad blockading comes in loads of forms. Some are combating ad blockers true now, while others are taking a softer plan to appeal to readers’ morality. On the video aspect, a solution choosing up steam is server-aspect ad insertion, one plan that subverts ad blockers by combining video classified ads with the video enlighten that surrounds them. The premise is that by making classified ads and video true into a single streak, publishers will invent it harder for ad blockers to understand where one begins and the other one ends.

Why publishers issue Fb News tab disappearing may per chance most likely per chance admire microscopic affect on their social intention

March 11, 2024 • 5 min learn

Fb’s declining characteristic in sending web site traffic to publishers’ sites manner that adjustments to the platform – such because the removal of the Fb News tab – that extra deprioritize news will no longer be any longer unexpected and admire microscopic affect on social and target audience development strategies.

AI Briefing: Falling have confidence in AI poses a brand novel plan of challenges

March 11, 2024 • 5 min learn

Particular person have confidence in AI has fallen globally from 61% to 53%, according to Edelman’s 2024 Belief Barometer. Diversified study helps that vogue.