Is Gendered Monetary Recommendation Greater For Women?

The foundations of the game for orderly saving possess changed. Enter: Money Moves, where we’re tackling all the issues or no longer it is miles a have to to know about private finances.

When Haley Kowalewski started her stout-time job as a recruiter at Apple, she chanced on herself in a room stout of girls folk colleagues attempting to establish retirement funds. No one knew where to initiate. “I couldn’t imagine nobody knew one thing else,” she tells PS. “Even my boss was love, ‘I possess no conception what I am doing.'”

Melancholy by the inability of monetary literacy among her colleagues, Kowalewski living out on a hasten to yelp her monetary future. On the present time, she runs Femme Monetary Coaching, a tutorial platform that helps girls folk study budget, place for retirement, and navigate the stock market. Of her blended 346,000 Instagram and TikTok followers, 95 percent are girls folk.

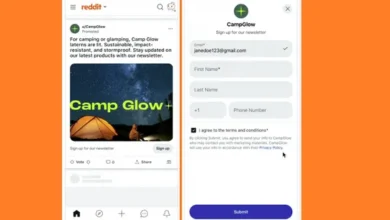

Kowalewski’s platform was original when it launched three years within the past, nevertheless now, or no longer it is one in every of many. Some current monetary training accounts marketed exclusively to ladies folk encompass @_sheinvests, @hotgirlfinance, and @intrepid.female.finance. In the closing two years, monetary wellness books with titles geared against girls folk, love “Filthy rich AF,” “Cash Is Queen,” and “Girls Valid Wanna Hang Funds,” possess hit the market. Corporations love Ellevest, Financielle, and Your Juno promote themselves as monetary wellness companies for ladies folk; they tout slogans love “Web your shit together!” and “The valid app to your monetary glow up!”

These outlets are a stark distinction to the males-dominated, suit-and-tie face of finance we as soon as knew. What’s more, by instructing girls folk place and make investments, they’re looking for to bridge the gap that leaves girls folk within the US with a median retirement savings that’s 50 percent decrease than that of males. But does private monetary training have to be divided between genders? Though finance educators love Kowalewski imagine there is an advantage to organising girls folk-geared yelp material, a lot of experts argue that form of messaging can perpetuate present stereotypes.

It is miles so glaring to me that to discuss finance, we must all the time discuss the total systemic boundaries that girls folk face in managing their cash.

Tori Dunlap, founder of Her First $100Okay and author of “Monetary Feminist,” says there is absolute self assurance that monetary training ought to restful be id-essentially essentially based. “It is miles so glaring to me that to discuss finance, we must all the time discuss the total systemic boundaries that girls folk face in managing their cash,” she says. “[Her First $100K] takes a truly jargon-heavy, non-approachable topic and makes it into one thing girls folk feel they’ll eradicate half in and anticipate questions about with out scare of judgment.”

In Dunlap’s journey, private monetary advice has historically looked very a lot of looking on its supposed audience. When focused at males, it specializes in growth — to find accurate property, initiate a industry, and make investments — while for ladies folk, it specializes in anxious — cease shopping for coffee, cease getting manicures, and deprive your self to the purpose of no enjoyment. “The advice for males is now and again, ‘Right here are five hot stocks comely now,'” Dunlap says. “For ladies folk, or no longer it is, ‘Right here are five meals you may as well make for below five greenbacks.'”

Kowalewski agrees, adding that she believes this distinction is basically which ability of the roles girls and males folk possess historically played within the family. “Men went out to own, while girls folk precise what the family already had,” she says. “Dads sat down with their sons and taught them about the stock market. Who managed the cash to your respect dwelling growing up: mom or dad?”

Kowalewski sees the results of these gendered conversations in her notice. “Women come into my one-on-ones and assert,” she says. “A form of them will notify I am the principle person they’ve ever talked to about cash.” Because many girls don’t seem to be taught about building their wealth growing up, girls folk are continually much less confident and more menace-averse than males when investing within the stock market, in line with investigate from investing advice firm The Motley Fool. On the opposite hand, this lack of self assurance can essentially own girls folk better returns, in line with Ylva Baeckström, PhD, a senior lecturer in finance at King’s College London. Women investors usually outperform males because they make investments with the prolonged-term in mind, while males make more impulsive decisions that don’t repay, she says.

Dr. Baeckström also claims girls folk usually feel more confident, and therefore make investments more cash, when suggested by a girl monetary adviser. Studying about private finance from a fellow lady can make the topic more inspiring. Larissa Machiels, a 25-three hundred and sixty five days-archaic sustainability marketing and marketing consultant from London, no doubt sees the attraction. “I am on a standard basis half of conferences where all my male colleagues are talking about investing, and I feel foolish for no longer shimmering what issues point out,” she tells PS. “There may be an accessibility discipline that I conception [these sites] may presumably maybe lend a hand me solve, and that is the reason what piqued my curiosity. [They seem] love a truly friendly jam to study the basics of investing — I imagine I acquired’t feel embarrassed to hold my hand or anticipate a foolish question.”

Bernice Ledbetter, Ed.D, founding director of the Heart for Women in Leadership at Pepperdine Graziadio Business College, sees the alternatives girls folk can yelp a lot of girls folk after they provide online private monetary training. That stated, she has concerns. “I deem the menace these styles of influencers eradicate is the possibility of being perceived as trite,” she tells PS, noting influencers who share their latest diets or makeup fixations alongside budgeting advice. Ledbetter notes that some pages are more about the presenters themselves, and their ability to persuade, in jam of about helping girls folk: “It makes one surprise about the depth of yelp material they’re going to offer.”

While some accounts possess important yelp material that doesn’t feel condescending against girls folk, Dr. Ledbetter says exhausting-hitting monetary advice, love engage an very honest correct funding yarn or lope about getting a mortgage, can usually glean lost within the stride. “Some that latest as finance pages are more about building self assurance and lifestyles administration,” she says. “The finance fragment exists in a salad — that also can simply even be unfounded.”

Dr. Baeckström agrees. “As a girl, I come by it quite patronizing,” she says of any monetary advice that is particularly geared toward girls folk. “Ought to it is probably going you’ll presumably maybe be discovering out a book about finance particularly written for ladies folk, in a contrivance it tells you that you couldn’t understand a book that was written for males.”

Dr. Baeckström believes the contrivance to equity in monetary training is now to no longer add a girls’ membership comely subsequent to the boys’, nevertheless quite to rethink how we discuss finance usually. “The industry was created for alpha males, so the language is terribly alpha in jam of catering to the mass market,” she says. “Now the supreme girls folk making it to the head are alpha females. What they have to attain is glean a bunch of various of us around the table and reinvent the language to make it accessible to all.”

Kowalewski and Dunlap, nonetheless, are confident that girls folk need more girls folk feature models to study to budget, place, and make investments. It is particularly indispensable to them because they understand the impact of girls folk gaining wealth. “Women reinvest lend a hand into the community after they’ve cash,” Kowalewski says, citing compare by Monetary institution of The united states. “Any time you anticipate girls folk what they’d attain if they got effectively off, donate is at the head of the listing. Guys factual are looking at shopping a lot of stuff.”

Indirectly, the impact of more girls folk reaching monetary wellness fuels Kowalewski and Dunlap’s passion for instructing girls folk. “The arena gets better when girls folk possess more cash,” Dunlap says. “If I’m in a position to glean more cash within the palms of girls folk, the total world starts to alternate.”

Samantha Fink is a POPSUGAR contributor and freelance writer masking standard of living and entertainment. Her a lot of work may presumably also be disguise in Cosmopolitan, Business Insider, Yahoo!, The WholeNote, and The Bookseller. Samantha graduated from Queen’s University with levels in English and psychology, and she has a master’s level in journalism from Metropolis, University of London.