Why US Inflation Can Unexcited Transfer Bitcoin’s (BTC) Save

The US Non-public Consumption Expenditure (PCE) Index, the most accepted inflation gauge of the US Federal Reserve, rose 2.9% every one year and zero.2% monthly final December. So-called Core PCE elevated by 0.1% monthly but declined by 3.2% yearly, making for a spell binding one year forward for Bitcoin.

Stock futures had been a little bit decrease initially of the US buying and selling day, while cryptos and Bitcoin remained largely flat. Forward of the US inflation news, Bitcoin traded at $41,122.08 and declined marginally sooner than improving to $41,831.43 at press time.

Why US Inflation is Critical to Bitcoin

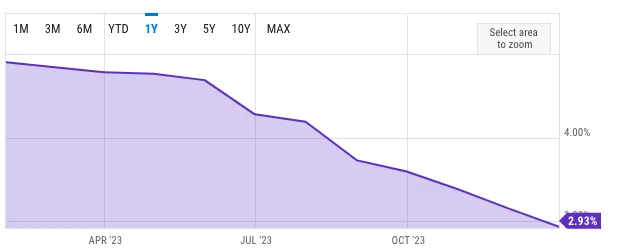

The PCE remains to be above the 2% target the US Federal Reserve is the utilize of to benchmark tightening effects. The central bank has introduced the Federal Funds price to between 5.25 and 5.5% since March 2022, which has seen costs in most sectors chilly off greatly, except for for refuge.

Of us promote perilous assets once they in actual fact feel the central bank could per chance presumably also induce a recession by tightening fiat forex insurance policies too aggressively. Investors then circulate to safer investments cherish authorities bonds, that are backed by the authorities’s fleshy faith. When the bank starts cutting rates, the costs of perilous assets cherish Bitcoin can rise as chance stride for meals grows.

Read more: 7 Ways To Take care of Retirement With Rising Inflation

The US Treasury plans to roar its borrowing plans for 2024 on Jan. 31, 2024. Larger authorities borrowing can imprint that the authorities is prepared to determine on on more chance and decrease the allure of authorities bonds since more debt will enhance the potentialities of a default. This potential that, some investors could per chance presumably arrangement shut Bitcoin.

Why Of us Will Make investments in Bitcoin

The approval of particular swap-traded funds (ETFs) that song the tag of Bitcoin straight technique that the asset has a large gamble to keep itself as a frail funding automotive. An ETF enables an investor to salvage say exposure to BTC tag adjustments with out the necessity to cast off Bitcoin straight.

A co-founder of the important gold ETF, Hector McNeil, says a Bitcoin ETF automotive will expand adoption. He likens it to how a gold ETF removed the bother of digital asset management but impressed more other folks to make investments in the asset.

“ETFs are at their most extremely efficient once they offer market salvage entry to to great-to-swap asset classes. [ETFs] democratize ownership. Having asset managers cherish BlackRock and Invesco and Fidelity, that’s a large designate of approval.”

Read more: Bitcoin Save Prediction 2024/2025/2030

McNeil expects BTC’s provide constraints to push up the tag progressively. Despite the proven fact that most investors enact now not put it to use as a forex, Bitcoin remains to be regarded as a store of tag and has technological properties that originate it smartly-suited to operate as a forex, he believes.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is committed to honest, clear reporting. This news article objectives to offer staunch, smartly timed files. Alternatively, readers are suggested to study info independently and focus on with a legit sooner than making any decisions basically basically based completely on this content material. Please disclose that our Phrases and Prerequisites, Privacy Policy, and Disclaimers had been up to this point.