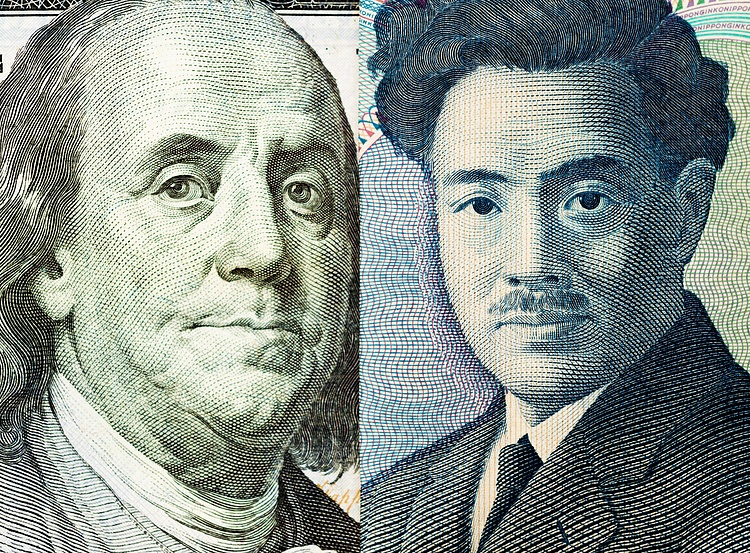

USD/JPY accepted on Friday after any other week of beneficial properties

- US Dollar broadly eased on Friday, however held end to flat in opposition to Yen.

- Japanese National CPI inflation ticked lower in April.

- Possibility urge for meals recovered after US particular person inflation outlook improved.

USD/JPY churned on Friday, wrapping up end to where it began the day, appropriate under the 157.00 tackle, as merchants regarded to recover balance after a annoying week.

Immense hopes for a September payment slash from the Federal Reserve (Fed) had been knocked help this week after payment markets repriced odds of now not lower than a quarter-level slash in September to lower than even. Payment markets had been pricing in upwards of 70% odds of a 25-basis-level orderly in September at the origin of the week.

Forecasting the Coming Week: Fedspeak and PCE live within the spotlight

Japan’s National User Designate Index (CPI) inflation eased to 2.5% YoY in April, however the Bank of Japan (BoJ) stays bitterly particular to defend ardour rates at rock-bottom, approach-negative ranges till they survey an anticipated downturn in inflation defend above 2%. The BoJ for the time being expects CPI inflation to plod under 2.0% thru 2025 and just a few of 2026.

With the BoJ squarely centered on fears of disinflation, downhearted Japanese ardour rates proceed to erode the Yen. The BoJ and Japan’s Ministry of Finance is widely believed to have faith immediately intervened in world markets in early Could per chance moreover simply, and the BoJ’s financial operations reporting display veil a 9 trillion Yen gap between reported operations spending and broker forecasts, collectively with weight to “Yentervention” speculation.

Despite operations in world markets, the Yen continues to tumble extra kilos, and Yen-basically basically based pairs are grinding help towards report highs.

USD/JPY technical outlook

USD/JPY cycled the 157.00 tackle on Friday, churning chart paper end to approach-term highs. USD/JPY has closed within the inexperienced for all however three of the final 15 consecutive shopping and selling days, recovering from a put up-”Yentervention” low approach 152.00.

The pair is amassed shopping and selling down from multi-yr highs build in unhurried April above 160.00, however USD/JPY continues to float deeper into bull nation above the 200-day Exponential Transferring Realistic (EMA) at 149.13.

USD/JPY hourly chart

USD/JPY day-to-day chart

Info on these pages incorporates forward-attempting statements that involve dangers and uncertainties. Markets and devices profiled on this web page are for informational capabilities most productive and can also simply now not in any methodology bump into as a advice to purchase or promote in these assets. You are going to have faith to amassed draw your be pleased thorough overview earlier than making any funding choices. FXStreet does now not in any methodology guarantee that this data is free from errors, errors, or topic cloth misstatements. It moreover does now not guarantee that this data is of a timely nature. Investing in Initiate Markets entails a significant deal of risk, collectively with the loss of all or half of your funding, apart from emotional wretchedness. All dangers, losses and costs connected to investing, collectively with complete loss of vital, are your accountability. The views and opinions expressed listed listed below are those of the authors and draw now not basically reflect the legitimate coverage or scheme of FXStreet nor its advertisers. The author is now not going to be held accountable for data that is chanced on at the stop of hyperlinks posted on this web page.

If now not in any other case explicitly talked about within the body of the article, at the time of writing, the author has no scheme in any stock talked about listed here and no business relationship with any firm talked about. The author has now not received compensation for penning this article, as a change of from FXStreet.

FXStreet and the author draw now not provide personalised solutions. The author makes no representations as to the accuracy, completeness, or suitability of this data. FXStreet and the author is now not going to be responsible for any errors, omissions or any losses, injuries or damages coming up from this data and its scream or tell. Errors and omissions excepted.

The author and FXStreet are now not registered funding advisors and nothing listed here is supposed to be funding advice.