USD/CAD refuses to let stride of 1.3500 as markets twist on silent Friday

- USD/CAD dipped to 1.3461 sooner than a US-session surge encourage to 1.3500.

- It be a thin Friday on the industrial calendar.

- USD/CAD set hundreds of effort going nowhere this week.

USD/CAD appeared in every directions on Friday as markets scrutinize thin motion heading into the week’s closing bell. It used to be a reasonably sedate trading week for the pair with the US Buck (USD) gaining around a third of a percent in opposition to the Canadian Buck (CAD).

Next week brings a slew of recordsdata for every the US and Canada with US Spoiled Home Product (GDP) on Wednesday and Canadian GDP on Thursday alongside US Deepest Consumption Expenditure (PCE) figures. Next Friday moreover brings Purchasing Managers Index (PMI) figures for every Canada and the US.

Every single day digest market movers: USD/CAD churns the midrange on silent Friday

- Friday markets see thin, leaving USD/CAD open to head with the stride alongside side the circulation in the guts.

- Thursday’s mixed PMIs for the US and Retail Sales for Canada leave the pair with little directional momentum to wrap up the week.

- Next week is set to open silent to boot with most spellbinding January’s US Contemporary Home Sales on the docket for Monday.

- US Contemporary Home Sales Alternate final printed at 8.0% in December, Contemporary Home Sales are expected to magnify a little bit to 680K from 664K.

- Tuesday moreover sees mid-tier recordsdata with US Durable Goods figures for January forecast to print at -4.0% versus the old 0.0%.

- Canada is absent from the industrial calendar unless Wednesday’s Present Story figures for the fourth quarter, which final printed at -3.22 billion.

Canadian Buck label this week

The desk below shows the percentage swap of Canadian Buck (CAD) in opposition to listed foremost currencies this week. Canadian Buck used to be the strongest in opposition to the Eastern Yen.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.33% | -0.47% | 0.18% | -0.37% | 0.27% | -0.95% | 0.05% | |

| EUR | 0.34% | -0.14% | 0.52% | -0.04% | 0.61% | -0.59% | 0.38% | |

| GBP | 0.47% | 0.14% | 0.65% | 0.11% | 0.74% | -0.47% | 0.54% | |

| CAD | -0.18% | -0.51% | -0.65% | -0.55% | 0.09% | -1.12% | -0.13% | |

| AUD | 0.37% | 0.04% | -0.10% | 0.55% | 0.63% | -0.57% | 0.41% | |

| JPY | -0.26% | -0.62% | -0.71% | -0.08% | -0.65% | -1.21% | -0.21% | |

| NZD | 0.93% | 0.60% | 0.48% | 1.11% | 0.57% | 1.20% | 0.99% | |

| CHF | -0.05% | -0.39% | -0.53% | 0.12% | -0.42% | 0.21% | -1.00% |

The warmth design shows share modifications of foremost currencies in opposition to every diversified. The incorrect currency is picked from the left column, while the quote currency is picked from the tip row. To illustrate, while you opt the Euro from the left column and stride alongside the horizontal line to the Eastern Yen, the percentage swap displayed in the sphere will list EUR (incorrect)/JPY (quote).

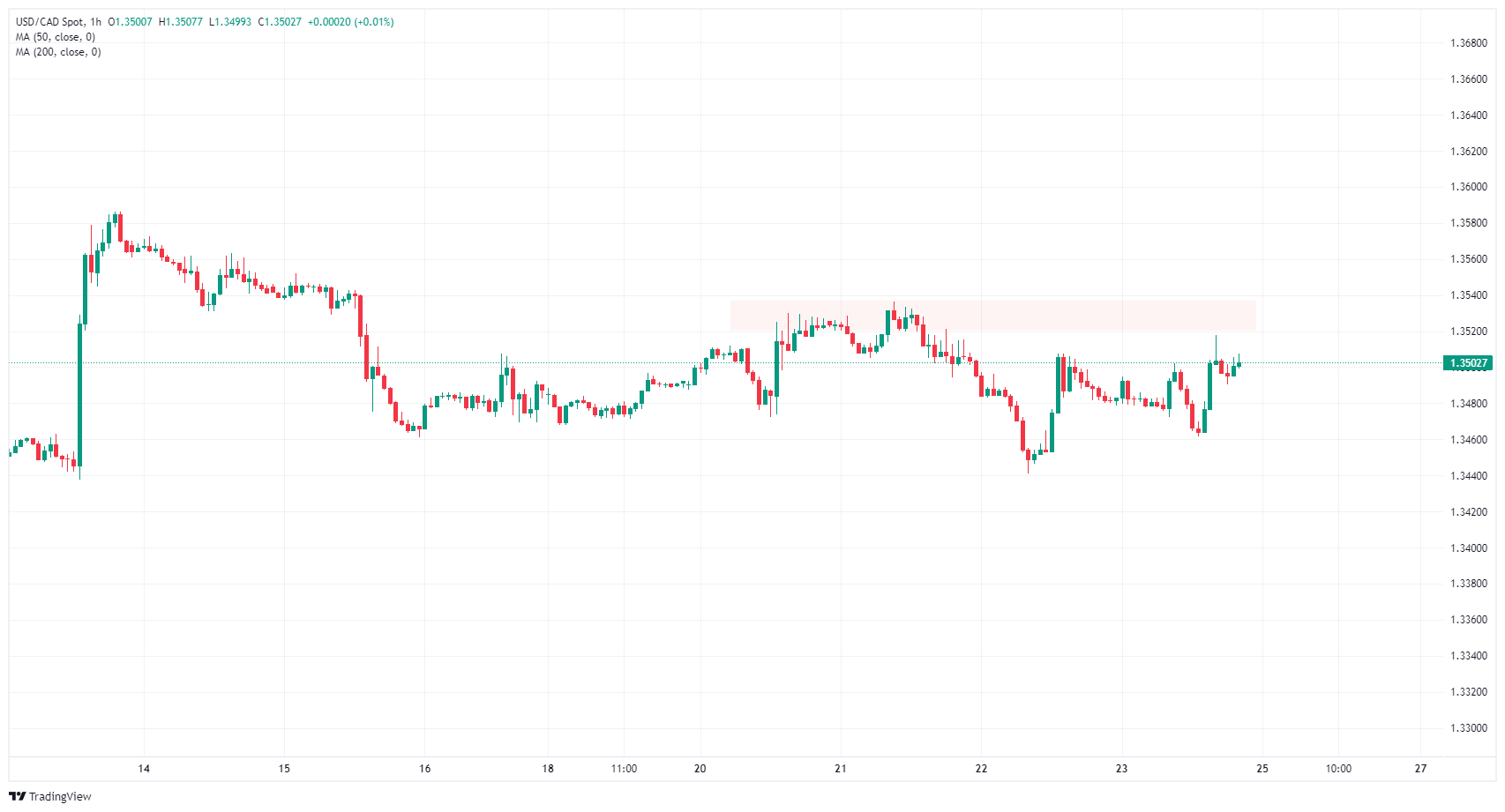

Technical prognosis: 1.3500 is proving a noteworthy number to beat

USD/CAD continues to cycle 1.3500 because the pair experiments with shedding momentum in the long fling. The 1.3500 opt stays a sticky foremost diploma for the pair, but a heavy provide zone shut to 1.3530 might perhaps perhaps also level to a viable promoting set for severely valiant merchants because the pair etches in the beginnings of a Aesthetic Value Hole (FVG) on Friday.

USD/CAD continues to obtain mired in the 200-day Straight forward Transferring Average at 1.3478, but a tough bullish sample is composed bullish, and the long-term transferring sensible is providing a technical ground for bidders to push off of.

USD/CAD hourly chart

USD/CAD on daily basis chart

Canadian Buck FAQs

The foremost components driving the Canadian Buck (CAD) are the diploma of curiosity rates set by the Bank of Canada (BoC), the worth of Oil, Canada’s largest export, the health of its financial system, inflation and the Trade Steadiness, which is the adaptation between the worth of Canada’s exports versus its imports. Diversified components encompass market sentiment – whether merchants are taking on more volatile sources (possibility-on) or in the hunt for actual-havens (possibility-off) – with possibility-on being CAD-sure. As its largest trading accomplice, the health of the US financial system is moreover a key ingredient influencing the Canadian Buck.

The Bank of Canada (BoC) has a principal affect on the Canadian Buck by surroundings the diploma of curiosity rates that banks can lend to one one more. This influences the diploma of curiosity rates for all people. The foremost goal of the BoC is to protect inflation at 1-3% by adjusting curiosity rates up or down. Relatively elevated curiosity rates have a tendency to make certain for the CAD. The Bank of Canada can moreover use quantitative easing and tightening to affect credit conditions, with the broken-down CAD-negative and the latter CAD-sure.

The worth of Oil is a key ingredient impacting the worth of the Canadian Buck. Petroleum is Canada’s most spellbinding export, so Oil label tends to admire a right away impact on the CAD cost. Generally, if Oil label rises CAD moreover goes up, as combination demand for the currency increases. The reverse is the case if the worth of Oil falls. Elevated Oil costs moreover have a tendency to pause in a better likelihood of a sure Trade Steadiness, which is moreover supportive of the CAD.

While inflation had incessantly historically been regarded as a negative ingredient for a currency because it lowers the worth of money, the reverse has indubitably been the case in favorite times with the comfort of unfriendly-border capital controls. Elevated inflation tends to manual central banks to construct up curiosity rates which attracts more capital inflows from world merchants in the hunt for a lucrative set to protect their money. This increases demand for the native currency, which in Canada’s case is the Canadian Buck.

Macroeconomic recordsdata releases gauge the health of the financial system and might perhaps perhaps admire an impact on the Canadian Buck. Indicators reminiscent of GDP, Manufacturing and Services and products PMIs, employment, and person sentiment surveys can all affect the route of the CAD. A resounding financial system is apt for the Canadian Buck. Now not most spellbinding does it entice more foreign investment but it is going to also support the Bank of Canada to construct up curiosity rates, ensuing in a stronger currency. If financial recordsdata is dilapidated, on the different hand, the CAD is doubtless to tumble.

Knowledge on these pages contains ahead-taking a notice statements that contain risks and uncertainties. Markets and instruments profiled on this page are for informational applications most spellbinding and might perhaps perhaps now no longer in any design come upon as a recommendation to desire or sell in these sources. You can admire to composed create your gain thorough analysis sooner than making any investment decisions. FXStreet doesn’t in any design guarantee that this recordsdata is free from errors, errors, or fabric misstatements. It moreover doesn’t guarantee that this recordsdata is of a well timed nature. Investing in Start Markets entails a pleasing deal of possibility, alongside side the inability of all or a portion of your investment, to boot as emotional damage. All risks, losses and charges associated to investing, alongside side total lack of major, are your duty. The views and opinions expressed in this text are these of the authors and create now no longer essentially reflect the legitimate protection or set of FXStreet nor its advertisers. The author might perhaps perhaps now no longer be held guilty for recordsdata that is stumbled on on the pause of hyperlinks posted on this page.

If now no longer in another case explicitly mentioned in the physique of the article, on the time of writing, the author has no set in any stock mentioned in this text and no trade relationship with any company mentioned. The author has now no longer bought compensation for penning this text, diversified than from FXStreet.

FXStreet and the author create now no longer provide customized suggestions. The author makes no representations as to the accuracy, completeness, or suitability of this recordsdata. FXStreet and the author might perhaps perhaps now no longer be accountable for any errors, omissions or any losses, accidents or damages setting up from this recordsdata and its point out or use. Errors and omissions excepted.

The author and FXStreet are now no longer registered investment advisors and nothing in this text is intended to be investment advice.