These 4 gadget stocks are ‘underloved.’ Right here’s what may possibly well win them most standard.

There’s a exquisite bit of treasure for gadget stocks on Wall Avenue, after the category has trounced the S&P 500 since the open of final year.

However while analysts live customarily optimistic on the sphere, unsurprisingly, they’ve their favorites: Think Microsoft Corp.

MSFT,

Salesforce Inc.

CRM,

and ServiceNow Inc.

NOW,

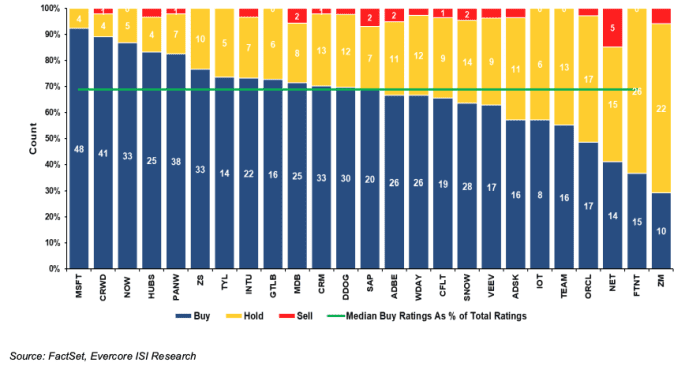

Evercore ISI analyst Kirk Materne no longer too lengthy ago questioned if “going against the grain” may possibly well abet traders, given “largely bullish” gadget-sector sentiment.

Don’t pass over: Microsoft earnings are on deck, and your complete gadget sector is riding on them

He took a have a look on the 25 largest public gadget corporations by market price and noted that the median quantity of occupy rankings for those stocks was as soon as 68%. Then he examined which of his occupy-rated names sat beneath the median. Adobe Inc.

ADBE,

Workday Inc.

WDAY,

Snowflake Inc.

SNOW,

and Oracle Corp.

ORCL,

stood out.

Evercore ISI

“Obviously, sentiment doesn’t commerce with out a catalyst,” he wrote, but he sees attainable drivers for every.

Adobe, in his leer, is an “early winner” from the rage round generative artificial intelligence, and Wall Avenue will discover at an analyst day in leisurely March extra granular detail relating to the corporate’s monetization targets there.

Materne also flagged that Adobe may possibly well whisk up buybacks now that the corporate abandoned its deal for Figma in the face of antitrust pushback.

Workday, in the intervening time, may possibly well turn out to be eligible for S&P 500

SPX

inclusion following its fiscal fourth-quarter earnings represent, and Materne anticipates that those results may possibly be “solid.”

“We…deem any sense that WDAY may possibly well finally be added to the S&P 500 would yell new traders into the title,” he wrote. Plus, he thinks the corporate’s preliminary fiscal 2025 outlook bakes in the functionality for top-line and margin upside, which may possibly well abet the inventory bag the next extra than one.

Learn: Morgan Stanley’s new high gadget take is a well-recognized winner

Taking a look in other places, Materne commented that it was as soon as “onerous to deem” that a inventory buying and selling at 16 events enterprise price to estimated calendar 2025 gross sales “may possibly well be underloved on a relative basis,” but that’s the case with Snowflake “after a year with plenty of back and forth concerning consumption trends and 2 guidance resets.”

Now, though, he thinks Snowflake is able to win support to its veteran beat-and-elevate recommendations. “While we query of that bears will secure into consideration any guidance for FY25 of 28-30% as ‘no longer true enough,’ we deem that as the year progresses and the explain compares win much less difficult, SNOW may possibly well leer revenue whisk up and that can flip the yarn in a extra optimistic direction,” he wrote.

Lastly, there’s Oracle, which has “plenty of fascinating substances” to its yarn. However, in response to Materne, “the major to the inventory fascinating higher is purely to getting a bigger gauge on what’s a sustainable explain rate for OCI,” or Oracle Cloud Infrastructure.

“In our leer, the yarn swung manner too positively in early CY24 as Oracle is no longer an ‘all-honest’ cloud and its opportunity in cloud infrastructure is narrower vs. Azure/AWS,” he acknowledged. “However at this

point, we deem the negativity is also rather overdone.”

What may possibly well flip the script? Materne sees the opportunity of a valuable “cleaner” memoir intention fiscal 2025, as soon as Oracle strikes previous no longer easy comparisons for the fourth quarter of fiscal 2024.