‘The squeeze is on.’ Uranium prices hit current story and alternate watchers hit upon additional to head

Whereas stocks dither in the present 300 and sixty five days, a dramatic rally has been under approach in a single corner of the commodity market that alternate watchers inquire of to good retain going.

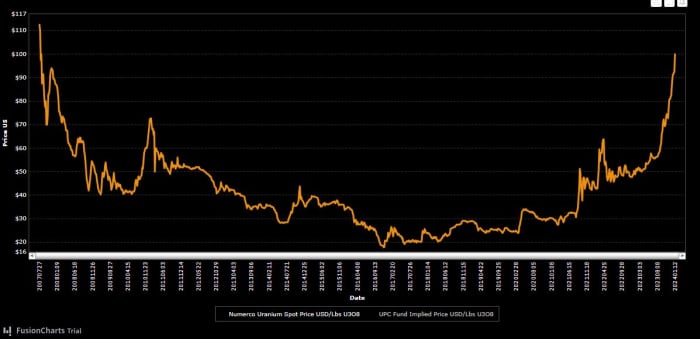

The home tag for uranium, significant for fueling nuclear reactors, climbed to good over $103/pound on Monday, a stage no longer considered since 2007, in step with a chart from Numerco, a U.Good satisfactory.-primarily based home tag for uranium. That follows a roughly 90% tag develop for the steel in 2023 in a market that has struggled to retain up with current quiz.

“The uranium market is undergoing a prime speculative funding trip with ETF’s preserving physical stocks persevering with to suck in stocks, thereby adding to the tightness being driven by the prospect of rising quiz in the impending years, and a trip of shopping of from utilities who have faith turn into slothful with hedging following years of low prices,” said Ole Hansen, head of commodity approach at Saxo Monetary institution.

Diagram tag for uranium ore concentrate, typically known as U3O8.

Numerco

Uranium prices at the starting up shot previous $100/pound final Friday after Kazakhstan’s issue uranium firm said it might well well perchance no longer meet production targets. NAC Kazatomprom, the arena’s ideal producer, said it used to be struggling to source sulfuric acid venerable in extracting the steel and seeing building delays at current deposit discovery websites. It used to be focusing on 2024 production volume at 90% of what permits allow.

That provides to production downgrades in 2023 from Canadian uranium miner Cameco

CCO,

and French miner Orano’s operation in Niger, equity analysts Chris Drew and Christopher LaFemina, said in a screen on Monday.

Of their behold, uranium prices are heading in the appropriate route to bust previous the June 2007 all-time excessive of $136/lb. “Furthermore, with length of time contracting volumes barely at replace ranges at a time when home pricing is thru US$100/lb, the setup for length of time pricing stays bullish,” said the analysts. “Necessary producers remain brief kilos.”

That tight market has been amplified by “ongoing” shopping from Sprott Bodily Uranium Have confidence

SRUUF

or SPUT, the arena’s ideal physical uranium fund, and Yellow Cake

YCA,

an funding automobile that makes bets on uranium, said the Jefferies analysts, who added: “The squeeze is on.”

Australian miners Paladin Energy

PDN,

Boss Energy

BOE,

and Deep Yellow Restricted

DYL,

remain their most traditional exposures, at the same time as the Jefferies analysts admit valuations remain “elevated.” Those miners jumped round 7%, 9% and 11%, respectively, on Monday, and have faith won 30% each and every for the 300 and sixty five days to this level.

Shares of Yellow Cake, up 15% to this level this 300 and sixty five days, rose 2.6% in London on Monday.

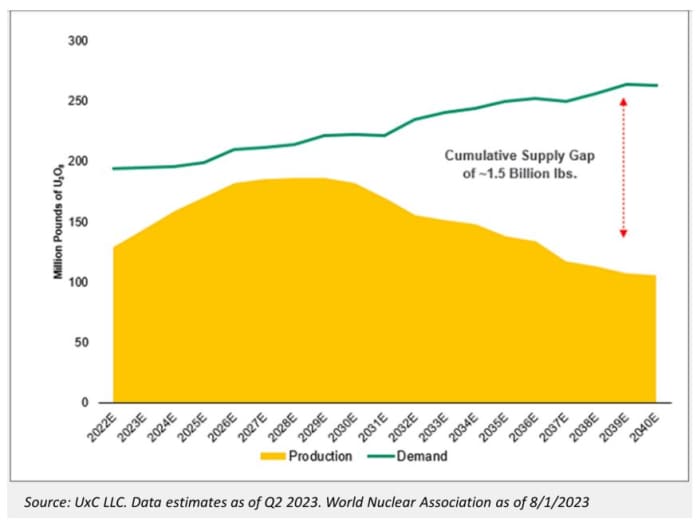

In an interview that printed final week with Macro Voices, Uranium Insider founder and e-newsletter editor Justin Huhn laid out the standard funding case for uranium throughout the below chart:

It reveals “proper anticipated mined kilos out of the bottom on an annual foundation when compared with the correct burn up rate of the arena nuclear reactor snappily. And it is likely you’ll well perchance hit upon that we generally remain at a deficit even with anticipated peak production toward the pause of the decade,” Huhn said.

Since an abundance of provide in the 1980s, uranium has been in shortfall, with two bull markets in that length and the mid 2000s. “The adaptation now is that there’s very tiny secondary provide to balance that shortfall of production,” he said.

Secondary provide refers to inventory held by governments and utilities, which stood at round 30 million kilos plus even right thru the “rip roaring bull market” of the mid 2000s, he said.

Rapid forward and good 15 million kilos of secondary provide exist this day, with anyone who can be selling that inventory no longer doing so, whereas the final 18 months has considered China aggressively shopping, he said.

So no matter the keep the uranium tag is, “pretty essential any mine on the earth can be earning money,” but a provide shortfall will persist and this is truly a protracted time sooner than tall current mines will come online, said Huhn.

One more stressor for the market is a looming ban on Russian fuel providers by the U.S., with the Senate good a vote away from pushing that thru. In the kill, Russia might well perchance retaliate with a ban on exports in home of settle for a segment out by 2028 in that laws. “An instantaneous ban would have faith extra serious consequences, seemingly squeezing prices right thru the nuclear fuel chain,” said Drew and LaFemina.