The Halving Accept 22 situation: Will Riot Platforms War within the Face of Bitcoin’s Mountainous Shift?

The crypto panorama is bracing for a seismic shift with the upcoming 2024 Bitcoin halving, casting a shadow of uncertainty over mining enterprises similar to Riot Platforms.

Once valued at $3 billion, Riot now sits at a market cap of $2.1 billion. The looming halving occasion poses a necessary demand: Will it drive Riot to a destiny similar to Core Scientific’s death?

Hovering Alternate Charges

The Bitcoin halving, a mechanism cutting again Bitcoin mining rewards by half, is poised to alter the field’s economics enormously. It’s anticipated to double the moderate cost per Bitcoin, ranging between $30,000 to $60,000, or halve mining revenues.

Be taught extra: Bitcoin Halving Cycles and Investment Suggestions: What To Know

Basically primarily based totally on Looking out for Alpha, with the historical top of Bitcoin at $69,000, this shift may maybe per chance well per chance be catastrophic for tons of, including Riot, given its precarious cost structure.

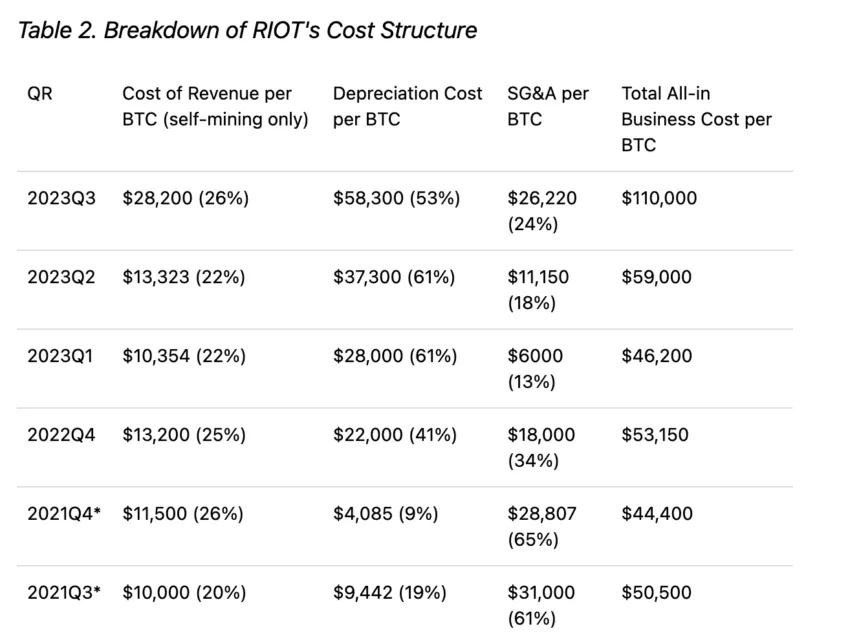

Riot’s most necessary prices encompass electricity, web hosting, depreciation of mining tools, sales, as well to sleek and administrative prices. Notably, tools depreciation is the bulk of those, a model residence to intensify.

Riot’s non eternal expansion, adding 26 exahashes per 2d (EH/s) price of tools at $416 million, and a prolonged-time length function of attaining 100 EH/s considerably elevate this cost. Put up-halving, this is able to per chance well imply a doubling of depreciation cost per Bitcoin.

A breakdown of Riot’s cost structure is illuminating. The corporate’s complete industry cost per Bitcoin has step by step elevated, reaching $110,000 in Q3 2023 from $44,400 in Q4 2021. This model and the halving occasion may maybe per chance well per chance doubtlessly triple Riot’s industry cost to an unsustainable $183,000 per Bitcoin.

Can Riot Continue to exist The Effects of Bitcoin Halving?

The difficulty turns into extra bearing on when brooding about Bitcoin’s market performance.

Looking out for Alpha additional explains that a bull market may maybe per chance well per chance look Bitcoin reaching $90,000. On the replacement hand, this falls making an try covering Riot’s soaring prices.

“We simplest query Bitcoin to hit $90,000 within the coming bull market (which will moderate $66,000 at some stage within the bull market length). Except Bitcoin surprises to the upside beyond $180,000, we construct now not query any distributable profits to [Riot’s] shareholders,” acknowledged Looking out for Alpha analyst.

The corporate faces a dire scenario: both proceed with shareholder dilution to fund operations or confront the reality of its industry mannequin’s unfeasibility.

This scenario eerily mirrors Core Scientific’s downfall, attributed now not fully to a bear market however to insurmountable mining prices. Core Scientific’s financial catastrophe submitting in December 2022, precipitated by falling Bitcoin prices, soaring electricity bills, and elevated network hash rates, serves as a cautionary memoir.

Riot’s stock model, trading at $10.47 on Wednesday and down 44% since its December top, reflects investor apprehension.

Be taught extra: Top 12 Crypto Companies to Gaze in 2024

With the put up-halving scenario per chance pushing depreciation prices per Bitcoin beyond even essentially the most optimistic Bitcoin model forecasts, Riot’s industry mannequin looks extra and extra precarious.

As the Bitcoin halving approaches, Riot stands at a necessary juncture. Will it navigate the turbulent waters of elevated prices and market volatility, or will it succumb, like Core Scientific, to the harsh realities of the evolving crypto-mining panorama?

Disclaimer

In adherence to the Believe Project pointers, BeInCrypto is committed to just, clear reporting. This information article objectives to present exact, timely information. On the replacement hand, readers are told to have a examine info independently and seek the suggestion of with a talented sooner than making any decisions per this suppose. Please fresh that our Phrases and Instances, Privateness Policy, and Disclaimers maintain been updated.