Tether’s Bitcoin pockets swells to 66,400 BTC, tallying up unrealized positive aspects of over $1B

Tether has vastly elevated its Bitcoin holdings, now comprising more than 66,000 BTC, with an estimated price exceeding $2.8 billion.

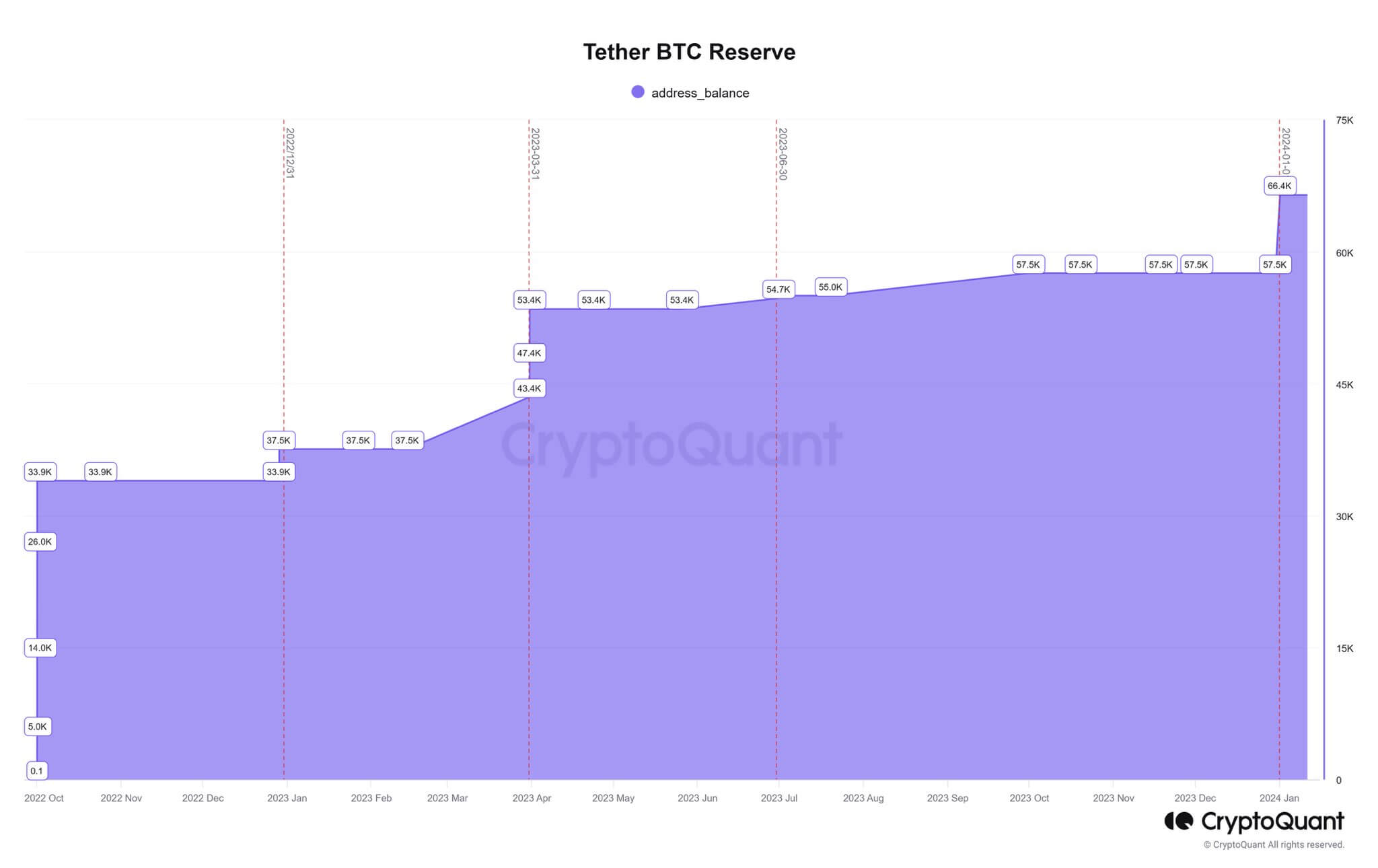

Based mostly fully on data shared by CryptoQuant founder Ki Young Ju, Tether’s BTC holdings surged to 66,400 from the 57,500 recorded in the starting up of the twelve months—indicating an acquisition of approximately 8,900 BTC in the final quarter of 2023.

This strategic switch aligns with Tether’s thought to allocate as much as 15% of its realized investment earnings in direction of procuring BTC for its stablecoin reserves.

An address, “bc1qjasf9z3h7w3jspkhtgatgpyvvzgpa2wwd2lr0eh5tx44reyn2k7sfc27a4,” doubtlessly belonging to Tether, is the 11th-largest Bitcoin holder, based fully on Bitinfocharts data. 21.co Evaluate Analyst Tom Wan came all through the same address final twelve months. The pockets currently boasts an unrealized profit of $1.1 billion.

Regardless of the important lengthen in its Bitcoin holdings, Tether has now not formally disclosed its BTC address and has yet to answer inquiries from CryptoSlate as of press time.

BTC mining investments

As well to, the stablecoin issuer is engaged in strategic investments in BTC mining.

Closing November, the firm committed to invest approximately $500 million in BTC mining actions over six months. CEO Paolo Ardoino expressed the firm’s ambition to elevate its half of the final computing vitality on the Bitcoin community to 1%.

The firm is actively pursuing the institution of mining amenities in Uruguay, Paraguay, and El Salvador, each boasting a massive skill ranging from 40 to 70 megawatts.

USDT’s rising offer

Over the past twelve months, Tether’s USDT stablecoin has experienced a significant surge, witnessing a sturdy 38% lengthen in its market capitalization from $66 billion to a ambitious $91 billion in 2023.

This obvious momentum has endured into the brand new twelve months, with the stablecoin’s market capitalization reaching $95.08 billion as of press time.

The broad development has triggered concerns interior the neighborhood referring to Tether’s skill to meet redemption calls for with enough reserves.

Addressing these worries, Cantor Fitzgerald CEO Howard Lutnick emphatically reassured the neighborhood that Tether diligently upholds the precious reserve necessities for its stablecoins.