‘Retain the rational, sell the trash’ and eavesdrop on the 2 most major charts for 2024, says SocGen

Markets managed to employ in a considerably hotter-than-expected U.S. consumer inflation reading for December with out valuable drama.

Now extra attention can flip to the corporate earnings season, which slips into equipment on Friday, led by financials.

If company outcomes and forecasts are reasonably successfully-got by investors then the S&P 500 soon can also attain a brand original closing sage.

The benchmark on Thursday closed real 16 parts, or now not as much as 0.4%, off its earlier peak of 4796.56, map within the initiating of January 2022.

So, given no foremost earnings shocks, and if the market remains overjoyed with Federal Reserve payment-decrease projections, it is some distance clever to favor possibility resources, in protecting with Societe Generale.

Classic signals proceed to beef up, state the unpleasant-asset technique team at SocGen, led by head of U.S. fairness technique Manish Kabra. As an illustration jobless claims, one of the most key indicators of an imminent U.S. recession, are easy some distance from alarming stages

But be warned, he adds, the sources of volatility are map to lengthen within the 2d and third quarters.

There are two major causes for this, says the French bank in a expose printed before Thursday’s free up of the U.S. consumer tag index document.

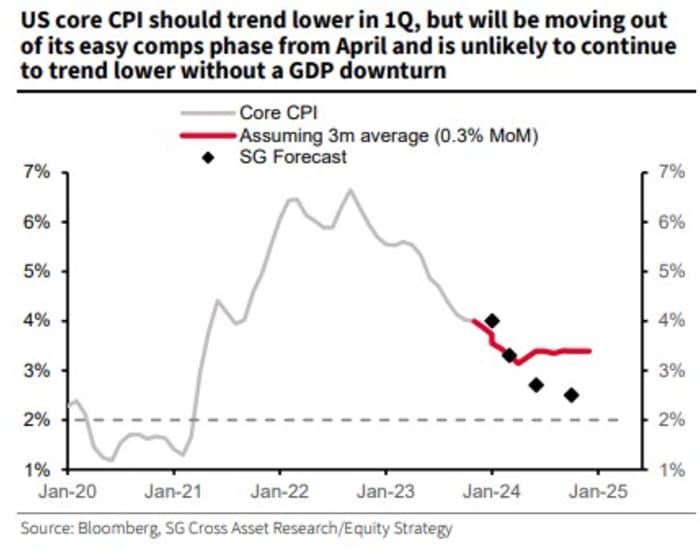

First, U.S. disinflation, which has been the major driver of the payment decrease hopes, can also stall as “CPI strikes out of its ‘easy comps’ phase in April,” says SocGen. “Within the absence of recession it is some distance doubtlessly to now not proceed to fashion decrease, so bond market volatility will doubtlessly upward push.”

Offer: SocGen.

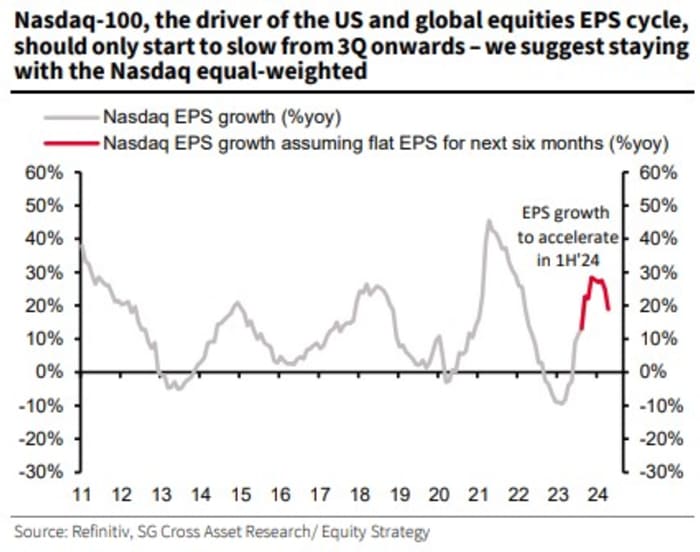

2nd, the Nasdaq-100

NDX,

which with its heavy weighting of mega tech stocks, has been the major driver of U.S. equities’ earnings per half cycle, will additionally face more difficult EPS comparisons after the 2d quarter, “and is therefore seemingly to expose a slower tempo of mumble from 3Q onwards,” says SocGen.

Offer: SocGen.

Importantly, Kabra and colleagues test a steady landing for the U.S. financial system now not turning within the slashing of borrowing charges that investors appear to be making a wager on.

“Non-recession Fed payment cuts are changes and now not the launch of the reducing cycle that the market is discounting,” the SocGen team emphasize.

Traders, therefore, can also easy spend the present “every thing rally [to] aid the rational, sell the trash,” equivalent to extremely leveraged resources adore excessive-yield credit rating and extremely-indebted U.S. diminutive caps, SocGen concludes.

The Russell 2000 Minute-Cap index

RUT,

whereby about 40% of companies are unprofitable, is up 12.8% over the remaining three months. The ARK Innovation ETF

ARKK,

is up 20.8% over the identical interval.

Markets

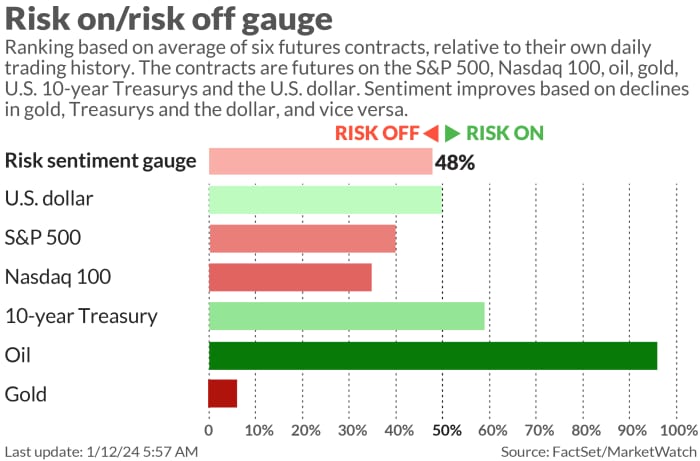

U.S. inventory-index futures

ES00,

NQ00,

are decrease after some bank outcomes dissatisfied, whereas benchmark Treasury yields

BX:TMUBMUSD10Y

secure real below 4%. The dollar

DXY

is a contact higher, whereas oil prices

CL.1,

rally and gold

GC00,

trades real panicked of $2,050 an oz…

| Key asset performance | Final | 5d | 1m | YTD | 1y |

| S&P 500 | 4,780.24 | 1.95% | 1.29% | 0.22% | 20.01% |

| Nasdaq Composite | 14,970.19 | 3.17% | 1.41% | -0.27% | 36.08% |

| 10 one year Treasury | 3.978 | -6.80 | 6.39 | 9.68 | 47.24 |

| Gold | 2,044.90 | -0.38% | 0.55% | -1.30% | 6.34% |

| Oil | 74.77 | 1.11% | 4.17% | 4.82% | -6.61% |

| Files: MarketWatch. Treasury yields exchange expressed in foundation parts | |||||

For extra market updates plus actionable exchange ideas for stocks, choices and crypto, subscribe to MarketDiem by Investor’s Alternate Each day.

The buzz

U.S. wholesale prices fell 0.1% in December, for the third month in a row of factory gate deflation, files released Friday confirmed.

The fourth quarter 2023 corporate earnings season has kicked into equipment Friday morning, with some enormous banks to the fore. And it’s been a mixed accumulate if premarket reactions are any files, with JPMorgan Lunge shares

JPM,

and Citigroup shares

C,

up about 2%, but Bank of The United States

BAC,

off about 3% and Wells Fargo

WFC,

down 1.3%.

UnitedHealth’s shares

UNH,

are down nearly 5% after its outcomes weren’t so successfully got by investors, nor secure been Delta Airlines’

DAL,

off about 6% on mature forecasts.

Brent crude

BRN00,

moved encourage above $80 a barrel after the U.S. and allies struck encourage at Yemen’s Houthi following the militia’s attacks on shipping within the Red Sea.

Tesla shares

TSLA,

are down extra than 2% in premarket trading after reports the EV maker had decrease the cost of two automobiles in China.

BlackRock

BLK,

struck a cash-and-inventory deal to dangle International Infrastructure Companions.

Burberry

BRBY,

shares fell nearly 9% after the rage home decrease its steerage, pronouncing world luxurious quiz persisted to boring in the end of December’s key trading interval.

Minneapolis Fed President Neel Kashkari is because of keep up a correspondence at 10 a.m.

Taiwan will secure an election on Saturday which will demonstrate needed to U.S./China family.

U.S. markets shall be closed on Monday for Martin Luther King, Jr day.

Only of the web

Hunt for serious minerals draws world powers to Saudi Arabia.

Why the $6 trillion pile of cash in money-market funds isn’t heading to the inventory market.

The chart

Japan’s Nikkei 225 inventory index

JP:NIK

on Friday hit its top likely stage since February 1990. But things are taking a peer stretched. The benchmark’s 14-day relative energy index (base line), a gauge of momentum, moved to 75, successfully above the overbought threshold of 70. Even supposing, as we saw remaining one year, it’ll plod higher.

Offer: Factset

High tickers

Right here secure been doubtlessly the most active inventory-market tickers on MarketWatch as of 6 a.m. Jap.

| Ticker | Security title |

|

TSLA, |

Tesla |

|

NVDA, |

Nvidia |

|

INFY, |

Infosys |

|

MARA, |

Marathon Digital |

|

NIO, |

NIO |

|

AAPL, |

Apple |

|

GME, |

GameStop |

|

AMC, |

AMC Entertainment |

|

AMZN, |

Amazon.com |

|

COIN, |

Coinbase International |

Random reads

Within the meantime, within the Amazon, valley of two,000 one year-extinct cities stumbled on.

Fancy dressing up? Reckon you’re blue-blooded? Crave bananas? There’s a job for you.

Must Know starts early and is updated till the opening bell, but join here to secure it delivered as soon as to your electronic mail box. The emailed version shall be despatched out at about 7: 30 a.m. Jap.