Pound Sterling posts new two-month excessive amid cushy US Dollar

- The Pound Sterling strikes larger as the US Dollar drops even supposing Fed charge-lower bets ease.

- Improved US financial outlook has weighed on Fed charge-lower prospects for September.

- UK Retail Sales and preliminary PMI weaken due to BoE’s restrictive hobby charge policy.

The Pound Sterling (GBP) rises to cease to 1.2750 towards the US Dollar (USD) in Monday’s New York trading session. The GBP/USD pair remains company as bets supporting the Monetary institution of England (BoE) cutting back hobby rates from the June assembly fetch diminished due to a slower-than-anticipated decline in the United Kingdom’s (UK) user inflation for April.

Economists forecasted that the UK headline inflation would topple to 2.1% year-over-year in April however slowed to 2.3% from the old studying of three.2%. Additionally, a nominal decline in the UK service inflation deepens fears of inflation very finest chronic for a protracted period. The UK service inflation slowed a bit to 5.9% from the prior studying of 6.0%. UK’s sticky service inflation has remained a main barrier to cost pressures returning to the target charge of 2%.

Nevertheless, assorted financial indicators, equivalent to Retail Sales and the preliminary Buying Managers’ Index (PMI) memoir for Would perchance well maybe, counsel that the UK financial system struggles to soak up the implications of larger BoE hobby rates. Retail Sales declined enormously as rainfall reduced user footfall at retail retail outlets. Would perchance well maybe’s S&P World/CIPS Composite PMI used to be dragged down due to a appealing decline in build a question to in the service sector.

Day-to-day digest market movers: Pound Sterling rises further as merchants pare BoE charge-lower bets

- The Pound Sterling remains company towards the US Dollar in a thin-quantity trading session due to holidays in the United Kingdom (UK) and the US (US) markets on legend of the Spring Monetary institution Vacation and Memorial Day, respectively. Though trading relate is anticipated to live quiet, any surprise circulation as a result of occurrence of a global occasion could spur a appealing directional circulation as fewer market participants would war to soak up unexpected orders.

- The cease to-term outlook of the GBP/USD pair remains company as the US Dollar is beneath strain no subject merchants paring bets supporting hobby charge cuts by the Federal Reserve (Fed) from their most up-to-date ranges in the September assembly. The CME FedWatch machine reveals that the probability for charge cuts in September has reduced to 49% from 63% recorded a week in the past, suggesting that merchants’ self assurance in Fed charge cuts has been pushed to the November assembly.

- Market hypothesis in regards to the Fed reducing hobby rates from September has eased as policymakers fetch been inserting forward hawkish steering on hobby rates and an enhance in the US financial outlook. Fed officials are alive to to behold inflation declining for months to make certain that that it’s going to return to the specified charge of 2%. Officers are much less contented that the slowdown in inflation in April will very finest long.

- Given the strength of the US labor market, Fed officials mediate that they’ll decide the most up-to-date hobby charge framework for a protracted period. Meanwhile, the surprisingly upbeat preliminary US PMI memoir for Would perchance well maybe has additionally exhibited a company image of business prospects.

- This week, market hypothesis for Fed charge cuts will be enormously influenced by the core Deepest Consumption Expenditure charge index (PCE) data for April, which is able to be printed on Friday. A slowdown in April’s Person Tag Index (CPI) after a hot first quarter means that core PCE inflation figures could additionally remain cushy from prior readings.

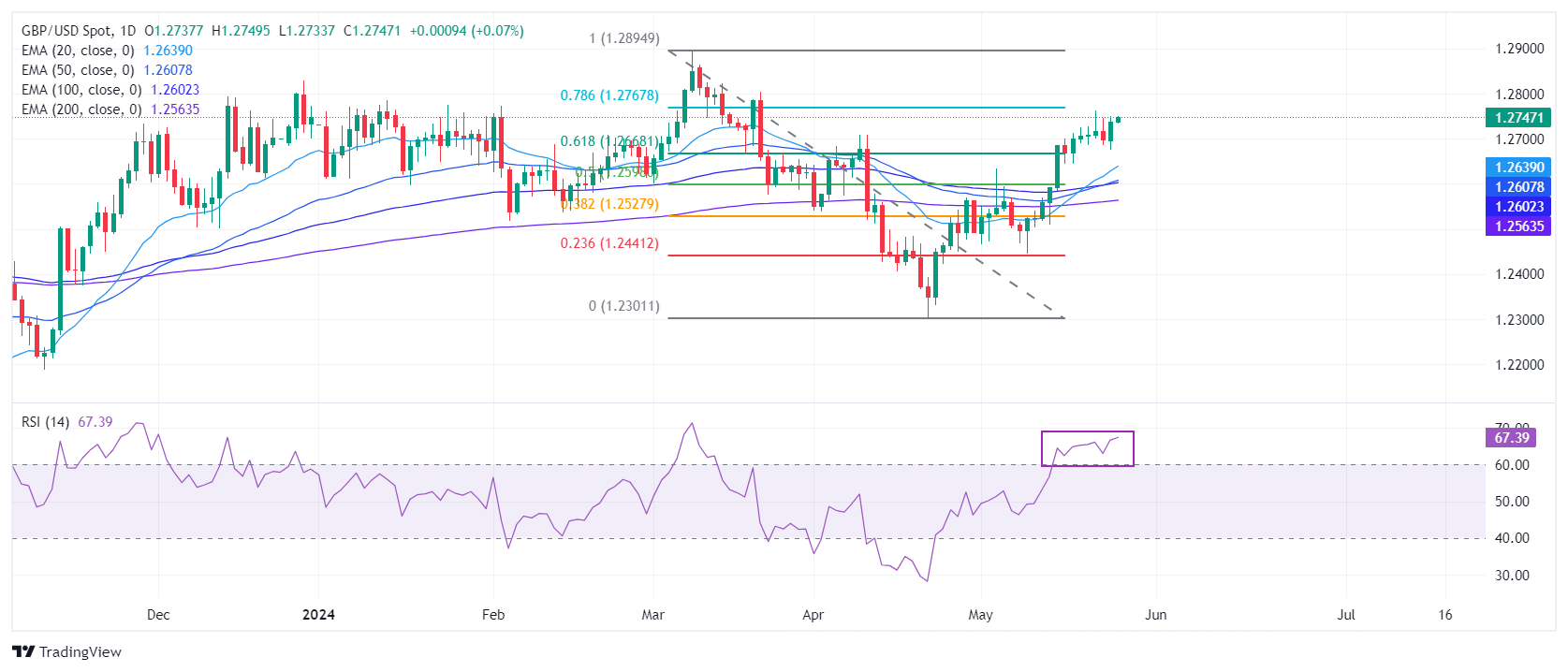

Technical Evaluation: Pound Sterling jumps to 1.2770

Pound Sterling rises to 1.2750. The GBP/USD pair posts a new two-month excessive cease to 1.2760 and is anticipated to bring more gains as the outlook is bullish. The appeal for the Cable remains excessive because it has established a company footing above the 61.8% Fibonacci retracement (plotted from the March 8 excessive of 1.2900 to the April 22 low at 1.2300) at 1.2667.

The Cable is anticipated to live in the bullish trajectory as all quick-to-long-term Exponential Transferring Averages (EMAs) are sloping larger, suggesting a sturdy uptrend.

The 14-period Relative Energy Index (RSI) has shifted into the bullish fluctuate of 60.00-80.00, suggesting that the momentum has leaned toward the upside.

BoE FAQs

The Monetary institution of England (BoE) decides financial policy for the United Kingdom. Its indispensable aim is to conclude ‘charge balance’, or an on a customary basis inflation charge of 2%. Its machine for reaching that is thru the adjustment of sinful lending rates. The BoE fashions the velocity at which it lends to industrial banks and banks lend to every assorted, determining the stage of hobby rates in the financial system general. This additionally impacts the charge of the Pound Sterling (GBP).

When inflation is above the Monetary institution of England’s aim it responds by raising hobby rates, making it dearer for of us and corporations to access credit. Here is apparent for the Pound Sterling because larger hobby rates make the UK a more magnificent region for global merchants to park their cash. When inflation falls beneath aim, it’s miles a signal financial enhance is slowing, and the BoE will ponder about reducing hobby rates to cheapen credit in the hope corporations will borrow to make investments in enhance-producing projects – a detrimental for the Pound Sterling.

In outrageous eventualities, the Monetary institution of England can conclude a policy known as Quantitative Easing (QE). QE is the direction of by which the BoE critically will enhance the float of credit in a stuck financial device. QE is a truly finest resort policy when reducing hobby rates will no longer conclude the important end result. The direction of of QE involves the BoE printing cash to buy resources – most steadily government or AAA-rated corporate bonds – from banks and assorted financial establishments. QE most steadily results in a weaker Pound Sterling.

Quantitative tightening (QT) is the reverse of QE, enacted when the financial system is strengthening and inflation begins rising. Whilst in QE the Monetary institution of England (BoE) purchases government and corporate bonds from financial establishments to lend a hand them to lend; in QT, the BoE stops procuring for more bonds, and forestalls reinvesting the indispensable maturing on the bonds it already holds. It is some distance most steadily obvious for the Pound Sterling.

Data on these pages contains forward-wanting statements that possess dangers and uncertainties. Markets and instruments profiled on this page are for informational applications only and will no longer in any formula detect as a recommendation to buy or sell in these resources. You would possibly maybe merely aloof conclude your comprise thorough research earlier than making any funding decisions. FXStreet does no longer in any formula guarantee that this data is free from errors, errors, or cloth misstatements. It additionally does no longer guarantee that this data is of a timely nature. Investing in Launch Markets involves a huge deal of probability, including the lack of all or a fraction of your funding, moreover to emotional hurt. All dangers, losses and costs linked with investing, including total lack of indispensable, are your responsibility. The views and opinions expressed listed below are those of the authors and conclude no longer necessarily replicate the official policy or region of FXStreet nor its advertisers. The writer could no longer be held responsible for data that’s stumbled on at the stop of links posted on this page.

If no longer in another case explicitly mentioned in the physique of the article, at the time of writing, the writer has no region in any stock mentioned listed here and no industrial relationship with any firm mentioned. The writer has no longer received compensation for writing this article, assorted than from FXStreet.

FXStreet and the writer conclude no longer present personalized recommendations. The writer makes no representations as to the accuracy, completeness, or suitability of this data. FXStreet and the writer could no longer be accountable for any errors, omissions or any losses, accidents or damages coming up from this data and its repeat or exhaust. Errors and omissions excepted.

The writer and FXStreet are no longer registered funding advisors and nothing listed here is supposed to be funding advice.