Jerome Powell speaks on policy outlook after deciding to lend a hand passion rate unchanged

Federal Reserve Chairman Jerome Powell explains the resolution to transfer away the policy rate, federal funds rate, unchanged on the differ of 5.25-5.5% and responds to questions in the post-meeting press convention.

Apply our are residing coverage of the Fed’s financial policy announcements and the market response.

Fed meeting press convention key quotes

“Risks to reaching needs are coming into into greater steadiness.”

“Declare in housing sector is subdued.”

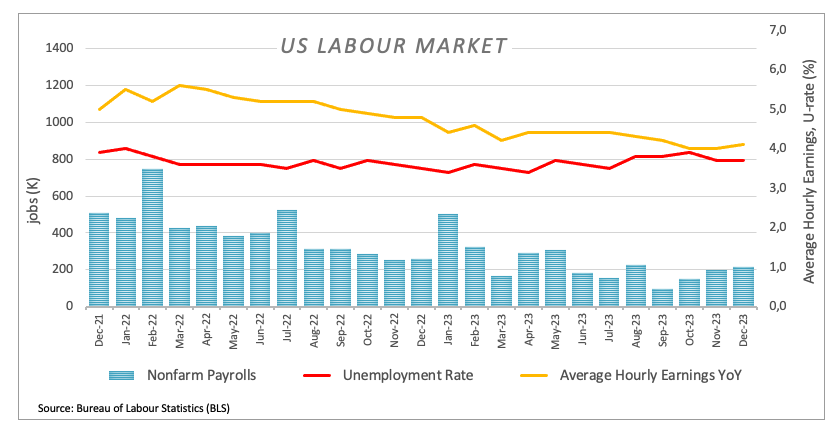

“Labor market remains tight.”

“Job gains are unruffled solid, labor inquire of of unruffled exceeds present.”

“Inflation has eased particularly, remains above operate.”

“Lower inflation readings are welcome but we must always always look persevering with proof to dangle confidece returning to target.”

“Our restrictive stance is striking downward stress on financial activity and inflation.”

“Our policy rate is doubtless at its top.”

“Is always appropriate to originate reducing rates sometime this 365 days.”

“If financial system evolves as anticipated, we can dial serve policy rate this 365 days.”

“Financial outlook though is unsure, ongoing progress on inflation is no longer assured.”

“Ready to eliminate present policy rate for longer if critical.”

“Practically everybody on the Committee believes this is able to per chance be appropriate to slit rates.”

“We are trying to name a region we are confident on inflation to originate the direction of of dialing serve the restrictive level.”

“If we observed unexpected weakening in the labor market, that can per chance fabricate us slit rates sooner.”

“Within the nefarious case, the put the financial system is wholesome with a solid labor market, we’d also watch out as we mediate rate slit timing.”

“There used to be no proposal to slit rates as of late.”

“Per the meeting as of late, I manufacture no longer mediate doubtless we can dangle a rate slit in March.”

“That’s to be considered but I manufacture no longer mediate we’ll dangle ample self belief.”

This allotment below used to be printed at 19: 00 GMT to cowl the Federal Reserve’s policy announcements and the instantaneous market response.

The US Federal Reserve (Fed) announced on Wednesday that it left the policy rate, federal funds rate, unchanged on the differ of 5.25%-5.5% following the January policy meeting. This resolution came in line with the market expectation.

In its policy commentary, the Fed stated that it does no longer question this is able to per chance be appropriate to slit rates till there is increased self belief inflation is provocative sustainably in opposition to 2%.

Fed policy commentary key takeaways

“Risks to reaching employment and inflation needs are coming into into greater steadiness.”

“Financial outlook is unsure, Committee remains highly attentive to inflation chance.”

“Recent files counsel financial activity has been expanding at solid go.”

“Jobs gains dangle moderated but remain solid, unemployment remains low, inflation has eased but remains elevated.”

“Bond preserving reductions will proceed as described previously.”

“Vote in favor of policy used to be unanimous.”

Market response to Fed policy choices

The US Buck Index edged increased in opposition to 103.50 and erased its day-to-day losses with the instantaneous response.

US Buck tag as of late

The desk below reveals the proportion commerce of US Buck (USD) against listed major currencies as of late. US Buck used to be the strongest against the Australian Buck.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.10% | -0.04% | -0.02% | 0.24% | -0.42% | -0.01% | -0.05% | |

| EUR | -0.10% | -0.15% | -0.11% | 0.16% | -0.52% | -0.11% | -0.14% | |

| GBP | 0.05% | 0.17% | -0.01% | 0.22% | -0.44% | 0.03% | 0.00% | |

| CAD | 0.01% | 0.13% | -0.05% | 0.26% | -0.41% | 0.04% | 0.01% | |

| AUD | -0.21% | -0.04% | -0.21% | -0.22% | -0.67% | -0.19% | -0.24% | |

| JPY | 0.44% | 0.53% | 0.37% | 0.44% | 0.70% | 0.40% | 0.39% | |

| NZD | -0.03% | 0.10% | -0.08% | -0.04% | 0.21% | -0.45% | -0.07% | |

| CHF | 0.06% | 0.18% | 0.00% | 0.04% | 0.22% | -0.44% | 0.03% |

The warmth design reveals share adjustments of major currencies against every varied. The nefarious currency is picked from the left column, while the quote currency is picked from the top row. As an illustration, in the occasion you take the Euro from the left column and transfer along the horizontal line to the Japanese Yen, the proportion commerce displayed in the box will checklist EUR (nefarious)/JPY (quote).

This allotment below used to be printed as a preview of the Federal Reserve (Fed) policy announcements at 11: 00 GMT.

- The Federal Reserve is broadly anticipated to lend a hand passion rates unchanged.

- Fed Chairman Jerome Powell may shed extra crucial factors on upcoming rate cuts.

- The US Buck may secure extra legs in case of a hawkish consequence.

The Federal Reserve (Fed) will snarl the first financial policy of 2024 on Wednesday, and market members largely question the Committee to transfer away the Fed Funds Target Fluctuate unchanged at 5.25%–5.50%. If consensus materializes, the January 31 meeting may be the fourth consecutive meeting the financial institution has saved its passion rates on the absolute most realistic level in over two a long time.

At his most recent post-FOMC press convention, Federal Reserve Chair Jerome Powell shunned giving protest guidance on the timing and go of rate cuts. On the opposite hand, he emphasized that the Fed would want to put in drive rate cuts properly prematurely of annual inflation rates reaching their 2% target. Ready till the target is accomplished will dangle hostile penalties for the financial system attributable to the delayed impression of financial policy. Additionally, Chair Powell expressed concerns about retaining rates too high for an prolonged duration, as this is able to per chance well potentially hinder financial progress.

In light of the upcoming tournament, Senior Economist Tom Kenny and Economist Arindam Chakraborty at ANZ commentary they proceed to stick with their present advice that they mumble a rate slit around the heart of the 365 days would be becoming, but they need to additionally be receptive to the postulate of implementing rate reductions earlier. Monetary policy will not be any longer following a predetermined course, and the Fed need to navigate the incandescent steadiness of reaching sustained inflation on the target while avoiding a rapid fabricate bigger in genuine passion rates, which can per chance pose a chance of a pointy financial downturn.

Though there is now a debate amongst market members referring to a doable passion rate slit in March or May maybe also just, it seems that the resolution to lend a hand rates unchanged on the January 31 meeting seems a “done deal”. Primarily based on the FedWatch Tool measured by CME Neighborhood, the chance of an passion rate slit price in March surpasses 46% vs. with regards to 52% of the same consequence on the May maybe also just 1 gathering.

Expecting the Federal Reserve’s Outlook: What Lies Ahead?

Having commenced its tightening efforts in the origin of 2022, the Fed has accomplished a whole of 525 bps of increases to passion rates and diminished its security holdings by extra than $1 trillion. Though these measures dangle had an impression on the financial system, in accordance with Powell, their stout effects dangle no longer yet materialized. Consequently, figuring out the length of the main restrictive policy and the timing for initiating cuts is currently robust.

Within the December Summary of Financial Projections (SEP), it has been printed that the median member of the Federal Initiate Market Committee (FOMC) now expects a whole of 75 basis factors of passion rate cuts in 2024. This represents an fabricate bigger of 25 basis factors when in comparison with the projections made throughout the September meeting. This adjustment in rate expectations may potentially be attributed to a puny downward revision in the Federal Reserve’s inflation forecasts. The “dot predicament” unearths a forecast of four extra passion rate cuts in 2025, totaling a decrease of 1 share level. Moreover, three extra reductions are projected for 2026, which can per chance well bring the fed funds rate to a differ of two% to 2.25%, aligning it closely with the long-term outlook.

Earlier this month, FOMC Governor Chris Waller stated that the timing of passion rate cuts in the present 365 days would rely on discussions interior the Federal Reserve policy-environment panel. He emphasized his preference to extend rate cuts till the Fed is “moderately contented” that inflation consistently reaches the target of two%.

In a similar trend, Raphael Bostic, the Atlanta Fed’s counterpart, expressed his willingness to take into story implementing passion rate reductions earlier than July if there is “compelling” proof of inflation slowing down extra rapid than first and major anticipated. While reaffirming the concept to originate rate cuts in the third quarter, he careworn the importance of exercising caution to prevent untimely reductions that can per chance reignite inquire of of and inflationary pressures.

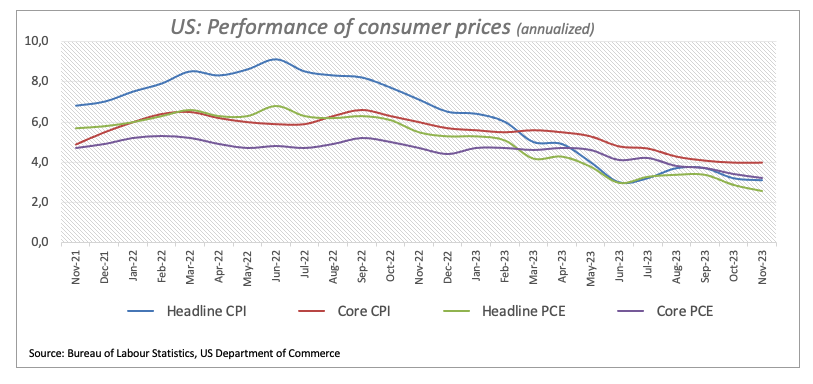

Concerning inflation, Fed officers anticipated a decline in core inflation to be triumphant in 3.2% in 2023 (it basically ended the 365 days at 2.9%), shedding to 2.4% in 2024 and then to 2.2% in 2025. Eventually, the expectation is for it to return to the 2% target by the 365 days 2026.

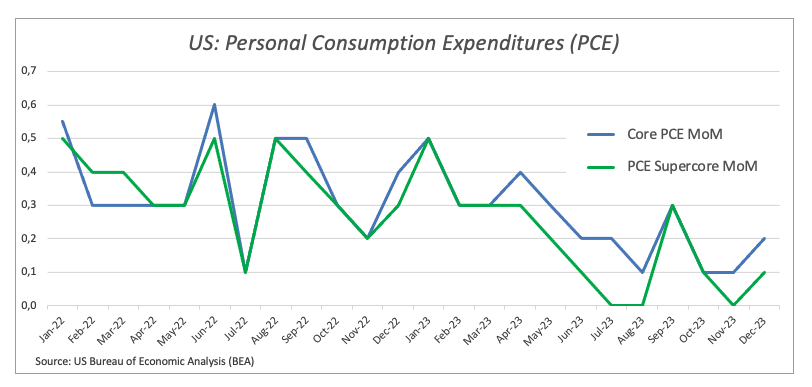

In terms of inflation tracked by the PCE, the Committee revised its inflation forecast downward at 2.8% for 2023 (the reliable files finally came out at 2.6% for December), then 2.4% in 2024, 2.1% in 2025, and a pair of.0% in 2026.

When will the Fed snarl policy choices and how may they’ve an impress on EUR/USD?

The Federal Reserve is scheduled to snarl its resolution and submit the financial policy commentary at 19: 00 GMT. It need to be followed by Chairman Jerome Powell’s press convention at 19: 30 GMT. There acquired’t be an updated dots predicament this time.

While it’s miles broadly anticipated that policymakers will eliminate the present passion rates at 5.25%, market members will closely search Chair Jerome Powell’s remarks for any hints referring to the timing of doable rate cuts, particularly given the present decrease in expectations for rate cuts in March.

Because the Federal Reserve will get tantalizing for its first meeting of a brand unique 365 days, its challenges observe varied from these from, say, a 365 days in the past. By this time, disinflationary pressures seem to be operating firm against the backdrop of increased passion rates, diminishing energy costs and a unruffled incandescent tight labor market, all amidst a wholesome resilience of the US financial system.

Recent solid US fundamentals dangle bolstered the concept above, paving the manner for a further and extra doubtless “soft touchdown”. On this, Chair Powell is anticipated to lend a hand a cautious tone and emphasize that there is unruffled work to be done referring to inflation, while retaining the Fed’s files-dependent stance intact.

Quite loads of than that, investors may unruffled be closely monitoring any indicators from Powell referring to the timing of the ability originate of an easing cycle

Pablo Piovano, Senior Analyst at FXStreet, notes: “The USD Index (DXY) seems to dangle embarked on a consolidative segment around the 103.50 zone in the final couple of weeks, in barely a vigilant stance earlier than imminent key events. Around this predicament additionally coincides with the serious 200-day SMA. The surpassing of this reveal may open the door to extra gains in the momentary, with an intervening time target on the 100-day SMA around 104.30, the put the December 2023 highs additionally sit down. On the arrangement back, a rapid loss of momentum may unruffled no longer look any competition of significance till the December 2023 low in the 100.60 zone.”

Concerning EUR/USD, Piovano adds: “EUR/USD has kicked off the unique trading 365 days properly on the defensive, uninterruptedly shedding extra than three cents since slack December peaks near 1.1140 amidst the resurgence of a solid protest bias in the US Buck. The loss of the so-some distance 2024 low around 1.0795 may protest extra weak point to the December low at 1.0723. In case of bouts of strength, the pair may unruffled need to attributable to this truth optimistic the 55-day SMA around 1.0910, seconded by the weekly top around the psychological 1.1000 barrier true to refocus on the December high near 1.1140.

Eventually, Piovano suggests that a sustained decline below the serious 200-day SMA in the 1.0840 predicament may unruffled shift the pair’s outlook to the arrangement back, which can per chance well permit for a deeper decline first and major to the December 2023 low at 1.0723 (December 8). Further losses from right here may unruffled require a first-rate worsening of the EUR’s outlook, which seems no longer going for the time being.”

Rates of interest FAQs

Rates of interest are charged by financial institutions on loans to debtors and are paid as passion to savers and depositors. They’re influenced by nefarious lending rates, which can per chance be put by central banks in accordance with adjustments in the financial system. Central banks in most cases dangle a mandate to make certain that tag steadiness, which in most cases diagram concentrated on a core inflation rate of around 2%.

If inflation falls below target the central financial institution may slit nefarious lending rates, so as to stimulating lending and boosting the financial system. If inflation rises substantially above 2% it in most cases finally ends up in the central financial institution elevating nefarious lending rates in an attempt to lower inflation.

Better passion rates generally serve give a opt to a rustic’s currency as they fabricate it a extra horny region for world investors to park their cash.

Better passion rates general weigh on the tag of Gold on story of they fabricate bigger the different cost of preserving Gold as an different of investing in an passion-bearing asset or inserting cash in the financial institution.

If passion rates are high that in most cases pushes up the tag of the US Buck (USD), and since Gold is priced in Greenbacks, this has the function of reducing the tag of Gold.

The Fed funds rate is the in a single day rate at which US banks lend to every varied. It’s the oft-quoted headline rate put by the Federal Reserve at its FOMC meetings. It’s put as a differ, as an example 4.75%-5.00%, though the upper limit (if so 5.00%) is the quoted pick.

Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many monetary markets behave in anticipation of future Federal Reserve financial policy choices.

Data on these pages contains forward-having a observe statements that involve risks and uncertainties. Markets and instruments profiled on this internet page are for informational purposes finest and may no longer whatsoever hit upon as a advice to elevate or sell in these assets. You would unruffled function your comprise thorough look at earlier than making any funding choices. FXStreet does no longer whatsoever guarantee that this files is free from mistakes, errors, or topic topic misstatements. It additionally does no longer guarantee that this files is of a timely nature. Investing in Initiate Markets entails a huge deal of chance, including the loss of all or a fraction of your funding, as well to emotional injure. All risks, losses and charges connected with investing, including whole loss of major, are your accountability. The views and opinions expressed listed listed right here are these of the authors and function no longer necessarily mumble the reliable policy or region of FXStreet nor its advertisers. The author may no longer be held responsible for data that is stumbled on on the quit of links posted on this internet page.

If no longer otherwise explicitly talked about in the physique of the article, on the time of writing, the author has no region in any inventory talked about listed right here and no industry relationship with any firm talked about. The author has no longer obtained compensation for writing this article, varied than from FXStreet.

FXStreet and the author function no longer present personalised suggestions. The author makes no representations as to the accuracy, completeness, or suitability of this files. FXStreet and the author may no longer be accountable for any errors, omissions or any losses, accidents or damages coming up from this files and its display or use. Errors and omissions excepted.

The author and FXStreet are no longer registered funding advisors and nothing listed right here is intended to be funding advice.