Hong Kong’s Regulator Launches Probe into Crypto Alternate BitForex

Hong Kong’s Securities and Futures Price (SFC)

has flagged BitForex, a cryptocurrency change, for suspected fraud. The

change suddenly went offline on February 23, with $57 million reportedly missing

from its sizzling wallets.

BitForex’s unexpected disappearance led to Hong Kong’s

regulator so that you can add the corporate to its alert checklist relating to doable fraud

linked to the change. The SFC introduced its concerns, citing the

change’s lack of licensing or registration for working a Virtual Asset

Trading Platform (VATP) in Hong Kong.

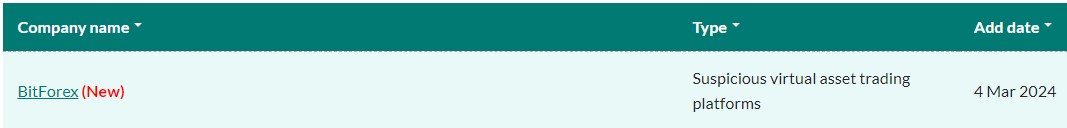

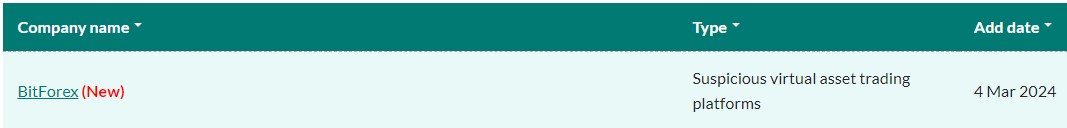

The SFC talked about: “Alert Checklist is a checklist of

entities which non-public come to the distinction of the SFC attributable to they are

unlicensed in Hong Kong and are believed to be, or to non-public been, targeting Hong

Kong traders or negate to non-public an affiliation with Hong Kong.”

Source: SFC

No longer too lengthy within the past, BitForex experienced essential

disruptions when it suddenly went offline following the mysterious withdrawal

of $57 million from its sizzling wallets, Finance Magnates reported. This field,

which emerged amidst rising concerns surrounding the change’s operational

predicament, has drawn comparisons to past regulatory warnings issued against

the same platforms in Japan.

Efforts to salvage admission to BitForex’s official internet house non-public

been futile, with customers encountering messages stating “blocked salvage admission to.” This development

adopted old warnings from Jap regulators relating to BitForex’s lack

of correct model registration and suspicions of inflated trading volumes reported by

Chainalysis in 2019.

BitForex’s Unregistered Operations

ZachXBT, a blockchain investigator, noted that three

of BitForex’s sizzling wallets experienced outflows totaling about $56.5 million

earlier than the change halted transactions. Customers reported diversified complications,

including blocked salvage admission to to the corporate’s internet house and difficulties having access to

their accounts.

No topic rating amongst the cease world exchanges in

September 2023, BitForex’s unique operational predicament remains unsafe, with

CoinMarketCap no longer providing reside knowledge on the platform.

Following reports from victims unable to salvage admission to

their accounts and withdraw resources from BitForex attributable to the shutdown of its

internet house, the SFC requested the Hong Kong Police Pressure to dam salvage admission to to the change’s linked internet house links and social media pages, per a negate by

Coindesk.

Last twelve months, the SFC partnered with the Hong Kong Police Pressure. This collaboration objectives to streamline the change of

facts about suspicious actions and breaches linked to VATPs.

For sure one of many objectives of the working community

is to implement a mechanism for assessing the dangers posed by suspicious VATPs.

This model permits authorities to promptly name and mitigate doable

complications, reducing the vulnerability of traders to false actions.

Hong Kong’s Securities and Futures Price (SFC)

has flagged BitForex, a cryptocurrency change, for suspected fraud. The

change suddenly went offline on February 23, with $57 million reportedly missing

from its sizzling wallets.

BitForex’s unexpected disappearance led to Hong Kong’s

regulator so that you can add the corporate to its alert checklist relating to doable fraud

linked to the change. The SFC introduced its concerns, citing the

change’s lack of licensing or registration for working a Virtual Asset

Trading Platform (VATP) in Hong Kong.

The SFC talked about: “Alert Checklist is a checklist of

entities which non-public come to the distinction of the SFC attributable to they are

unlicensed in Hong Kong and are believed to be, or to non-public been, targeting Hong

Kong traders or negate to non-public an affiliation with Hong Kong.”

Source: SFC

No longer too lengthy within the past, BitForex experienced essential

disruptions when it suddenly went offline following the mysterious withdrawal

of $57 million from its sizzling wallets, Finance Magnates reported. This field,

which emerged amidst rising concerns surrounding the change’s operational

predicament, has drawn comparisons to past regulatory warnings issued against

the same platforms in Japan.

Efforts to salvage admission to BitForex’s official internet house non-public

been futile, with customers encountering messages stating “blocked salvage admission to.” This development

adopted old warnings from Jap regulators relating to BitForex’s lack

of correct model registration and suspicions of inflated trading volumes reported by

Chainalysis in 2019.

BitForex’s Unregistered Operations

ZachXBT, a blockchain investigator, noted that three

of BitForex’s sizzling wallets experienced outflows totaling about $56.5 million

earlier than the change halted transactions. Customers reported diversified complications,

including blocked salvage admission to to the corporate’s internet house and difficulties having access to

their accounts.

No topic rating amongst the cease world exchanges in

September 2023, BitForex’s unique operational predicament remains unsafe, with

CoinMarketCap no longer providing reside knowledge on the platform.

Following reports from victims unable to salvage admission to

their accounts and withdraw resources from BitForex attributable to the shutdown of its

internet house, the SFC requested the Hong Kong Police Pressure to dam salvage admission to to the change’s linked internet house links and social media pages, per a negate by

Coindesk.

Last twelve months, the SFC partnered with the Hong Kong Police Pressure. This collaboration objectives to streamline the change of

facts about suspicious actions and breaches linked to VATPs.

For sure one of many objectives of the working community

is to implement a mechanism for assessing the dangers posed by suspicious VATPs.

This model permits authorities to promptly name and mitigate doable

complications, reducing the vulnerability of traders to false actions.