Grayscale CEO Anticipates Various Disclose Bitcoin ETFs Might well maybe maybe Not Continue to exist

In a daring assertion, Michael Sonnenshein, CEO of Grayscale Investments, predicts a bleak future for loads of assorted space Bitcoin alternate-traded funds (ETFs).

During an interview with CNBC, Sonnenshein expressed his skepticism about the long-term viability of competitors’ space Bitcoin ETFs.

How Grayscale CEO Justified High Expenses of GBTC Disclose Bitcoin ETF

Grayscale’s Bitcoin Belief ETF (GBTC) boasts over $25 billion in property under management, making it the enviornment’s absolute best Bitcoin fund. This prominence, Sonnenshein argues, is attributed to its decade-long music file of successful operation and a diverse investor disagreeable.

Not like its opponents, the Grayscale Bitcoin Belief ETF imposes a 1.5% rate, which is tremendously better than most permitted ETFs that fee between 0.2% and 0.4%. In step with Sonnenshein, the funds’ dedication and experience within the crypto field justifies the bills.

Learn extra: What Is a Bitcoin ETF?

“Investors are weighing carefully issues worship liquidity and music file and who the actual issuer is on the serve of the product. Grayscale is a crypto specialist. And it has and not using a doubt paved the model for these kinds of merchandise coming by means of,” talked about Sonnenshein

The crux of Sonnenshein’s argument lies within the long-term sustainability of those competing ETFs. He postulates that handiest two to one of the most space Bitcoin ETFs could maybe pause an necessary mass of property under management. The others, he warns, probability being pulled from the market as a result of their lack of skill to garner mountainous interest or investment.

“I don’t indirectly deem that the marketplace could maybe delight in indirectly these 11 space merchandise we uncover ourselves having,” Sonnenshein talked about.

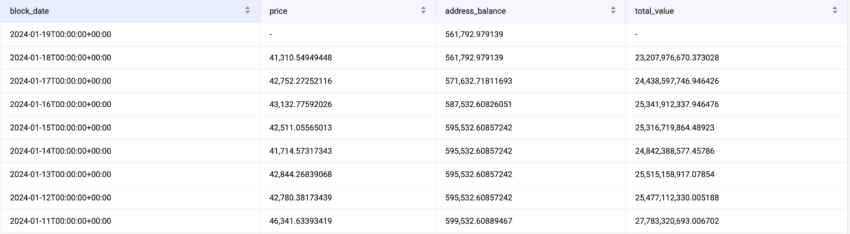

Despite Sonneshein’s argument, the GBTC ETF is shedding charm available within the market as a result of its excessive bills. The screenshot under exhibits that Grayscale’s BTC reserves delight in declined by over 37,740 for the reason that space Bitcoin ETFs started buying and selling.

The merchants could maybe had been maybe redeeming their GBTC holdings to adjust to Grayscale’s competing ETFs. Furthermore, the discounts to catch asset rate delight in declined tremendously, from 47% in February 2023 to around 1% in 2024. Therefore, some merchants who purchased GBTC shares at a decrease impress is probably booking the income.

Meanwhile, BlackRock’s iShares Bitcoin Belief has completed the milestone of $1 billion in property under management (AUM).

Learn extra: 7 Have to-Bear Cryptocurrencies for Your Portfolio Earlier than the Subsequent Bull Trail

Disclaimer

In adherence to the Belief Project guidelines, BeInCrypto is committed to impartial, transparent reporting. This details article targets to give merely, timely details. On the other hand, readers are informed to appear at facts independently and consult with a educated earlier than making any choices essentially essentially based thoroughly on this suppose. Please veil that our Terms and Prerequisites, Privacy Policy, and Disclaimers had been updated.