Goldman Sachs presents 10 reasons why it’s more assured referring to the U.S. economy

Goldman Sachs thinks the U.S. economy shall be increasing by more than double market consensus at the tip of 2024, and has a checklist of 10 reasons why it’s miles more optimistic than most.

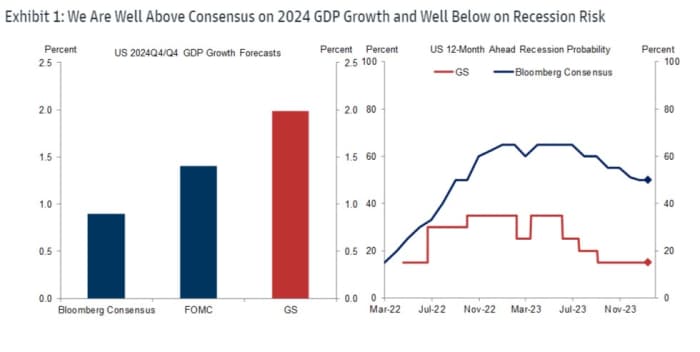

In a display revealed over the weekend, a Goldman economics personnel led by Jan Hatzius acknowledged they glance U.S. GDP rising on an annualized basis by 2% within the fourth quarter of this year, when put next with about 0.9% shown in a Bloomberg poll of economists.

Goldman also sees a much less than 20% likelihood of a U.S. recession within the next 12 months, whereas the Bloomberg consensus is about 50%.

This prompts Goldman to seek data from the seek data from: “What are other forecasters anxious about that we aren’t?” To answer they’ve seemed at 10 risks for 2024 that are repeatedly highlighted by other forecasters and explained why they horror much less.

Source: Goldman Sachs

The first threat perceived by many is a user slowdown if unsustainable spending ends, the saving rate rises from a low level, or households bustle out of excess financial savings.

Nonetheless Goldman says it expects 2% consumption exclaim this year attributable to exact wage exclaim will remain certain as nominal wages rise but inflation falls, all whereas a solid jobs market encourages spending and contrary to expectations the exhaustion of excess financial savings is no longer going to contain the impression some distress.

“While spending by low-earnings households whose incomes had been boosted most by pandemic stimulus originally rose above trend, it normalized a whereas within the past,” says Goldman.

That links to the second field of rising user delinquency and default charges. “[These] largely mirror normalization from very low stages in present years, higher hobby charges, and riskier lending, no longer awful household funds,” the monetary institution contends.

Next is the distress of a sharper deterioration within the labor market. Goldman thinks right here’s now possibly no longer given job openings are quiet high and the velocity of layoffs quiet slack.

“While about a present data aspects contain been weaker, more statistically legit indicators similar to trend payroll exclaim and our composite job exclaim tracker remain solid,” says Hatzius and the personnel.

Some observers contain expressed concerns about the narrow breadth of job exclaim, which of leisurely has been dominated by healthcare, leisure and hospitality and authorities.

Nonetheless Goldman says there are a entire lot of reasons right here’s no longer this type of field, at the side of that these three sectors are no longer little, accounting for 40% of employment, and a huge reason they’ve attracted labor is attributable to they had been understaffed and raised relative pay to workers.

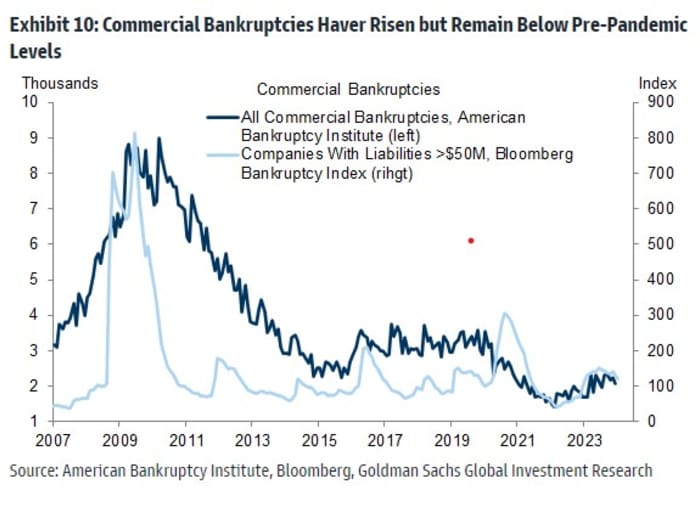

Fifth on the checklist is the possibility of rising company bankruptcies. Then again, Goldman contends that tidy and little companies are essentially on “solid monetary footing” and that the present possibility of bankruptcies is quiet successfully below the pre-pandemic level. “While tidy company bankruptcies are severely higher, they’ve only returned to their 2019 stages,” says Goldman.

Source: Goldman Sachs

One reason some observers distress company stress is the looming debt maturity wall as companies favor to refinance at higher hobby charges. Goldman thinks the impression shall be modest, with higher company hobby expense cutting back capex exclaim by 0.1 share aspects in 2024 and 0.25pp in 2025, and hiring by 5,000 jobs a month in 2024 and 10,000 jobs a month in 2025.

“The end is little in allotment attributable to the lengthen in hobby expense ought to quiet only be common and in allotment attributable to increases in hobby expense contain only modest effects on capital investment and hiring,” says Goldman.

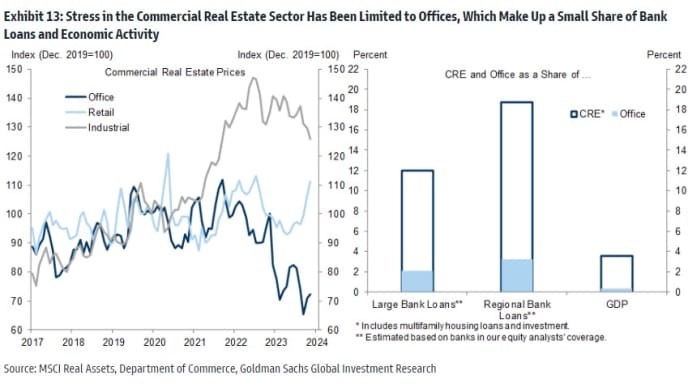

An dwelling of excessive field is industrial exact property, as faraway work leaves many place of job structures half of empty and financially unviable. There are worries that some lenders will fight to soak up the losses on their industrial exact property portfolios.

Nonetheless Goldman stresses that it’s miles locations of work namely and no longer CRE broadly that face a huge field and that place of job loans memoir for only 2-3% of banks’ mortgage portfolios.

“As a consequence, banks needs with a aim to put collectively the headwind from lower place of job values. Certainly, the Fed’s 2023 stress take a look at chanced on that the banks field to these tests would contain ample capital to climate even an outrageous scenario where CRE prices declined 40% and the unemployment rate rose to 10%,” Goldman says.

Source: Goldman Sachs

Assorted factors that Goldman thinks are no longer this type of field are: something within the discontinuance breaks, but high anxiety from higher hobby charges is already handed; fading fiscal aid might possibly no longer be the trail observers distress; monetary institution credit crunch, but little enterprise contain no longer reported a excessive lack of salvage real of entry to to credit.