German Banking Massive LBBW Jumps on the Crypto Bandwagon: Eyes Institutional Inquire of of

Landesbank Baden-Württemberg (LBBW), Germany’s largest federal monetary institution, plans to give cryptocurrency custody companies.

This initiative, developed in partnership with the Bitpanda substitute, highlights the feeble banking substitute’s rising acceptance of digital resources. With about €333 billion (~$355 billion) in resources, LBBW’s entry into the crypto custody market is a landmark match.

Why German Banks Are Jumping Into Crypto Bandwagon

Starting within the 2nd half of 2024, LBBW and Bitpanda aim to originate these companies to their institutional and company clients. The announcement follows a rising demand for digital resources amongst such clients, as famous by Jürgen Harengel, managing director of company banking at LBBW.

“The demand from our company customers for digital resources is rising,” Harengel said.

Furthermore, this mission is part of a broader vogue right by arrangement of the German monetary ecosystem. Banks and asset managers throughout the nation are actively increasing custodial companies and creating proprietary merchandise for the crypto market.

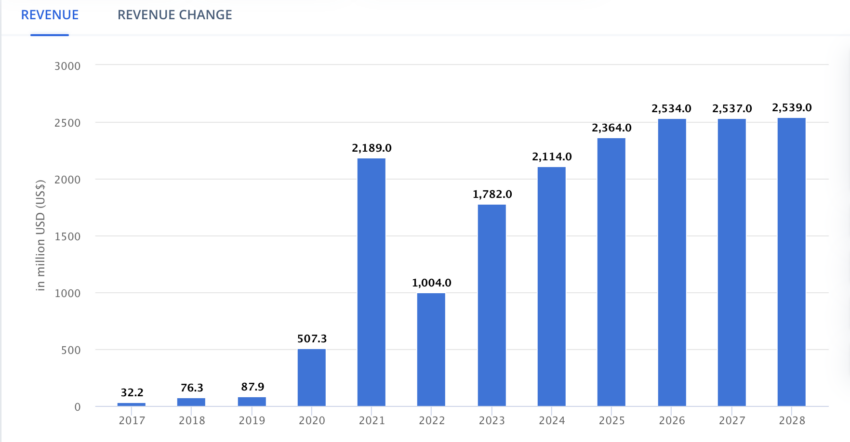

These efforts are largely in accordance with the coming near European Union’s crypto regulations, which are expected to elevate readability and stability to the handling of digital resources. Furthermore, crypto earnings in Germany is anticipated to hit $2.5 billion by 2028.

Read more: What Is Markets in Crypto-Resources (MiCA)?

Deutsche Financial institution is additionally progressing on this domain with its digital-asset custody carrier. Additionally, its DWS unit is part of a consortium pioneering a euro-denominated stablecoin. Such initiatives replicate a frequent tear amongst monetary establishments to mix cryptocurrencies into their carrier offerings.

The dedication to crypto is additionally evident at Crypto Finance, a subsidiary of Deutsche Borse. Crypto Finance has secured four crucial licenses from the German Federal Financial Supervisory Authority (BaFin).

These licenses enable Crypto Finance to originate comprehensive crypto procuring and selling, settlement, and custody companies to institutional investors within Germany. Furthermore, regulatory approval in Switzerland has extra bolstered Crypto Finance’s place within the European crypto market.

On one other entrance, Commerzbank AG has bought approval from BaFin to save a crypto custody industrial. This approval illustrates BaFin’s enhance for neatly-established monetary establishments exploring digital resources, provided they stable the requisite licenses.

Read more: TradFi Outlined: Exploring Key Suggestions of Veteran Finance

Beyond Germany, global efforts to embody cryptocurrencies proceed to possess momentum. The Financial institution for Global Settlements (BIS) and 7 central banks acquire launched Project Agorá. This mission seeks to mix tokenized industrial and central monetary institution funds on a single ledger platform. As a result, it objectives to tackle the inefficiencies plaguing irascible-border funds and to enhance monetary integrity controls.

Disclaimer

In adherence to the Trust Project solutions, BeInCrypto is devoted to neutral, clear reporting. This records article objectives to originate staunch, timely records. On the different hand, readers are urged to test facts independently and seek the advice of with a talented sooner than making any choices per this disclose. Please veil that our Phrases and Stipulations, Privateness Protection, and Disclaimers had been up up to now.