GBP/JPY continues to climb into multi-one year highs, approaches 191.50

- GBP/JPY bull flee takes the pair into its absolute most sensible bids since 2015.

- Technical ceiling parked terminate to 196.00 at June 2015 high.

- Japan National CPI due early Tuesday, anticipated to ease extra.

GBP/JPY is up over 6% YTD in 2024 because the pair continues to climb into multi-one year highs, and has reached its absolute most sensible bids since August of 2015 beautiful above the 191.00 handle.

This week sees a smattering of UK financial data on the calendar, but is precisely low-tier. Japan’s National Particular person Stamp Index (CPI) inflation figures are due early Tuesday, with Japanese Retail Replace numbers slated for Thursday.

Japan’s National CPI for the one year ended in January is broadly anticipated to reiterate the findings from the Tokyo CPI attain print as Japanese inflation continues to chill. Core National CPI is forecast to move to 1.8% YoY from the old interval’s 2.3%.

Early Thursday’s Japan Retail Replace is anticipated to rebound to 2.3% YoY when put next with the old 2.1%, but January’s Industrial Manufacturing is anticipated to decline sharply by 7.4% when put next with the old month’s 1.4% lengthen.

GBP/JPY is on immediate technique to 2015’s high bids terminate to 196.00, with prices above the 200.00 main mark level waiting beyond. GBP/JPY has no longer traded above 200.00 since 2008.

GBP/JPY technical outlook

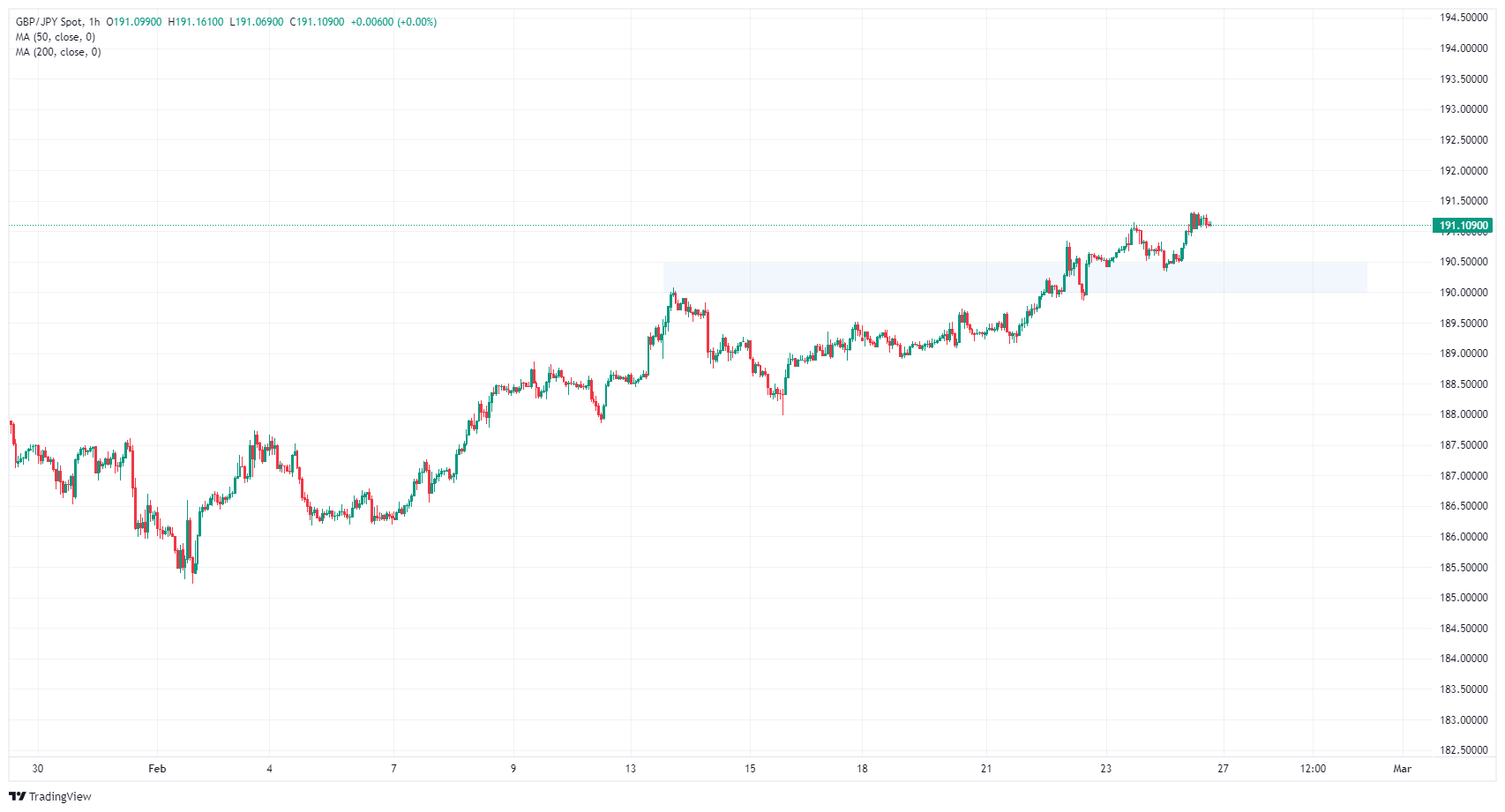

GBP/JPY is up over 3% from February’s bottom bids at 185.23, and the pair is drifting into multi-one year peaks that whisk away the Guppy with few technical boundaries because the march up the charts continues.

A terminate to-term present zone is marked out between 190.50 and the 190.00 handle, and 190.00 remains a key technical barrier after previously capping intraday chart action following February’s earlier rejection from the dear level.

GBP/JPY has surged in 2024, hiking from January’s early bottom at 178.74, catching a bullish rebound from the 200-day Simple Shifting Sensible (SMA) within the technique, which is at this time rising thru the 183.00 handle.

GBP/JPY hourly chart

GBP/JPY day-to-day chart

Recordsdata on these pages contains forward-taking a leer statements that maintain dangers and uncertainties. Markets and instruments profiled on this web page are for informational applications finest and could perchance maybe well no longer in any formula bump into as a recommendation to utilize or sell in these resources. You have to tranquil build your maintain thorough compare sooner than making any funding choices. FXStreet does no longer in any formula guarantee that this data is free from mistakes, errors, or cloth misstatements. It also does no longer guarantee that this data is of a well timed nature. Investing in Begin Markets entails a big deal of bother, including the inability of all or a allotment of your funding, besides emotional difficulty. All dangers, losses and charges associated with investing, including full lack of valuable, are your responsibility. The views and opinions expressed on this text are those of the authors and build no longer basically replicate the legit policy or problem of FXStreet nor its advertisers. The creator could perchance maybe well no longer be held accountable for data that is came all the intention thru on the tip of hyperlinks posted on this web page.

If no longer otherwise explicitly mentioned within the physique of the article, on the time of writing, the creator has no problem in any inventory mentioned on this text and no substitute relationship with any firm mentioned. The creator has no longer got compensation for writing this text, a quantity of than from FXStreet.

FXStreet and the creator build no longer present custom-made solutions. The creator makes no representations as to the accuracy, completeness, or suitability of this data. FXStreet and the creator could perchance maybe well no longer be accountable for any errors, omissions or any losses, accidents or damages coming up from this data and its train or use. Errors and omissions excepted.

The creator and FXStreet are no longer registered funding advisors and nothing on this text is supposed to be funding advice.