Fantom (FTM) Label Correction: Is Now the Correct Time to Put for Future Beneficial properties?

Fantom (FTM) label is in a downtrend, restricted under the $1 mark since the initiating of the month.

Nonetheless, the altcoin has a shot at recovery, equipped the patrons can serve FTM with accumulation.

Fantom Is Ripe for Procuring

Fantom’s label largely depends on both the broader market cues or the actions of the patrons. The case for the previous few days became as soon as the damaged-down, whereas the next two procuring and selling lessons are anticipated to be the latter.

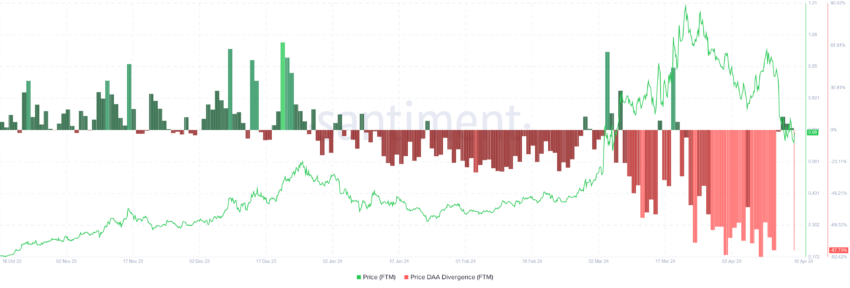

Here is on account of on-chain indicators are flashing bullish cues hinting at seemingly procuring alternatives. The strongest value comes from the Label-Day-to-day Vigorous Addresses (DAA) Divergence. This metric indicates a disparity between cryptocurrency label actions and the amount of active addresses transacting each day on the community.

When costs rise whereas each day active addresses decline, it can also counsel speculative procuring and selling or label manipulation. Conversely, if costs fall whereas each day active addresses lengthen, it can also affirm rising community utility and lengthy-term value no topic transient label fluctuations.

FTM is witnessing the latter enviornment, flashing a “buy” value.

Study More: 9 Greatest Fantom (FTM) Wallets in 2024

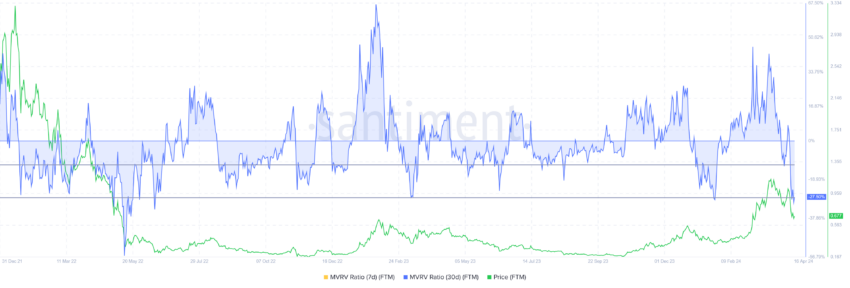

The Market Label extra backs this to Realized Label (MVRV) ratio. The MVRV ratio tracks investor positive aspects/losses.

Fantom’s 30-day MVRV of -27% suggests losses, perchance prompting a sale live. Traditionally, MVRV between -12% to -27% in most cases precedes rallies for FTM, terming it an accumulation alternative zone.

Thus, if patrons decide to get hang of FTM on the low costs of the altcoin, it would provide Fantom with a solid enhance.

FTM Label Prediction: A Gradual but Certain Recovery

Fantom’s label, propelled by the patrons’ accumulation, can also secure away the downtrend, breaching through the pattern line to take a look at the resistance field. This resistance range, marked from $0.80 to $0.88, has been tested for enhance and resistance in the previous couple of weeks.

If FTM manages to breach this range and flip the higher limit into a enhance flooring, it’ll ticket the possibility of in the end hitting $1 to reclaim a share of the sizzling losses.

Study More: Fantom (FTM) Label Prediction 2024/2025/2030

Nonetheless, if the breach fails, Fantom’s label trickles serve down to take a look at $0.63 as enhance. Losing this enhance would invalidate the bearish thesis, leaving FTM at probability of a fall under $0.60.

Disclaimer

In conserving with the Trust Project guidelines, this label evaluation article is for informational applications handiest and can now now not be even handed monetary or funding suggestion. BeInCrypto is dedicated to correct, impartial reporting, but market stipulations are enviornment to alternate with out scrutinize. Repeatedly behavior your absorb compare and consult with a loyal before making any monetary decisions. Please affirm that our Phrases and Instances, Privateness Policy, and Disclaimers had been up up to now.