EUR/USD knocks on 1.0860 but stays capped on Monday

- EUR/USD up a quarter of a percent in skinny market open.

- ECB President Lagarde reiterates inflation stance.

- Inflation prints due this week, US PCE to be key records point on Thursday.

EUR/USD saw a skinny open to a busy week on the industrial calendar as markets eased into Monday action. EUR/USD rose round a quarter of a percent on Monday as technicals dwell crimped ahead of a slew of price inflation and suppose figures due on every sides of the pond.

Tuesday kicks things off with US Durable Goods Orders, and Wednesday delivers EU Shopper Self assurance and US Substandard Domestic Product (GDP) figures midweek. Thursday sees the euro build develop its silly records entrance to the shopping and selling week with German Retail Sales and Shopper Mark Index (CPI) inflation. January’s US Private Consumption Expenditure (PCE) Mark Index is additionally due on Thursday.

Each day digest market movers: Aloof Monday shopping and selling sees EUR/USD pinned as investors await key records

- European Central Monetary institution (ECB) President Christine Lagarde well-known on Monday that inflation continues to ease toward ECB targets, stays committed to restrictive coverage measures for the time being.

- Read more: ECB President Lagarde says restrictive coverage stance acts as a safeguard in opposition to wage-price spiral.Germany’s Gfk Shopper Self assurance Be conscious for March due Tuesday, anticipated to recuperate to -29.0 from -29.7.

- US Durable Goods Orders in January are additionally due Tuesday, forecast to drawl no to -4.8% versus the previous 0.0%.

- Wednesday to hinge on US Q4 GDP, forecast to glean regular at 3.3% during the four quarters.

- Thursday’s German Retail Sales anticipated to a miniature bit recuperate to -1.5% for the twelve months ended January in comparison to the previous length’s -1.7%.

- German CPI for February forecast to ease to 2.7% YoY versus the previous 3.1%.

- US Core PCE Mark Index anticipated to print at 0.4% MoM in January versus the previous 0.2%.

Euro price this week

The desk under reveals the proportion swap of Euro (EUR) in opposition to listed indispensable currencies this week. Euro was the strongest in opposition to the Australian Buck.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.28% | -0.09% | 0.00% | 0.40% | 0.05% | 0.31% | -0.14% | |

| EUR | 0.28% | 0.18% | 0.28% | 0.67% | 0.31% | 0.57% | 0.13% | |

| GBP | 0.09% | -0.19% | 0.10% | 0.49% | 0.13% | 0.39% | -0.05% | |

| CAD | 0.00% | -0.28% | -0.10% | 0.41% | 0.03% | 0.30% | -0.15% | |

| AUD | -0.42% | -0.68% | -0.49% | -0.40% | -0.36% | -0.11% | -0.56% | |

| JPY | -0.08% | -0.32% | -0.08% | -0.04% | 0.38% | 0.28% | -0.18% | |

| NZD | -0.32% | -0.59% | -0.39% | -0.30% | 0.10% | -0.25% | -0.46% | |

| CHF | 0.14% | -0.13% | 0.05% | 0.15% | 0.55% | 0.18% | 0.44% |

The warmth scheme reveals percentage adjustments of indispensable currencies in opposition to every diversified. The sinful currency is picked from the left column, while the quote currency is picked from the discontinue row. For example, while you happen to heart of attention on the Euro from the left column and dart alongside the horizontal line to the Japanese Yen, the proportion swap displayed in the sector will signify EUR (sinful)/JPY (quote).

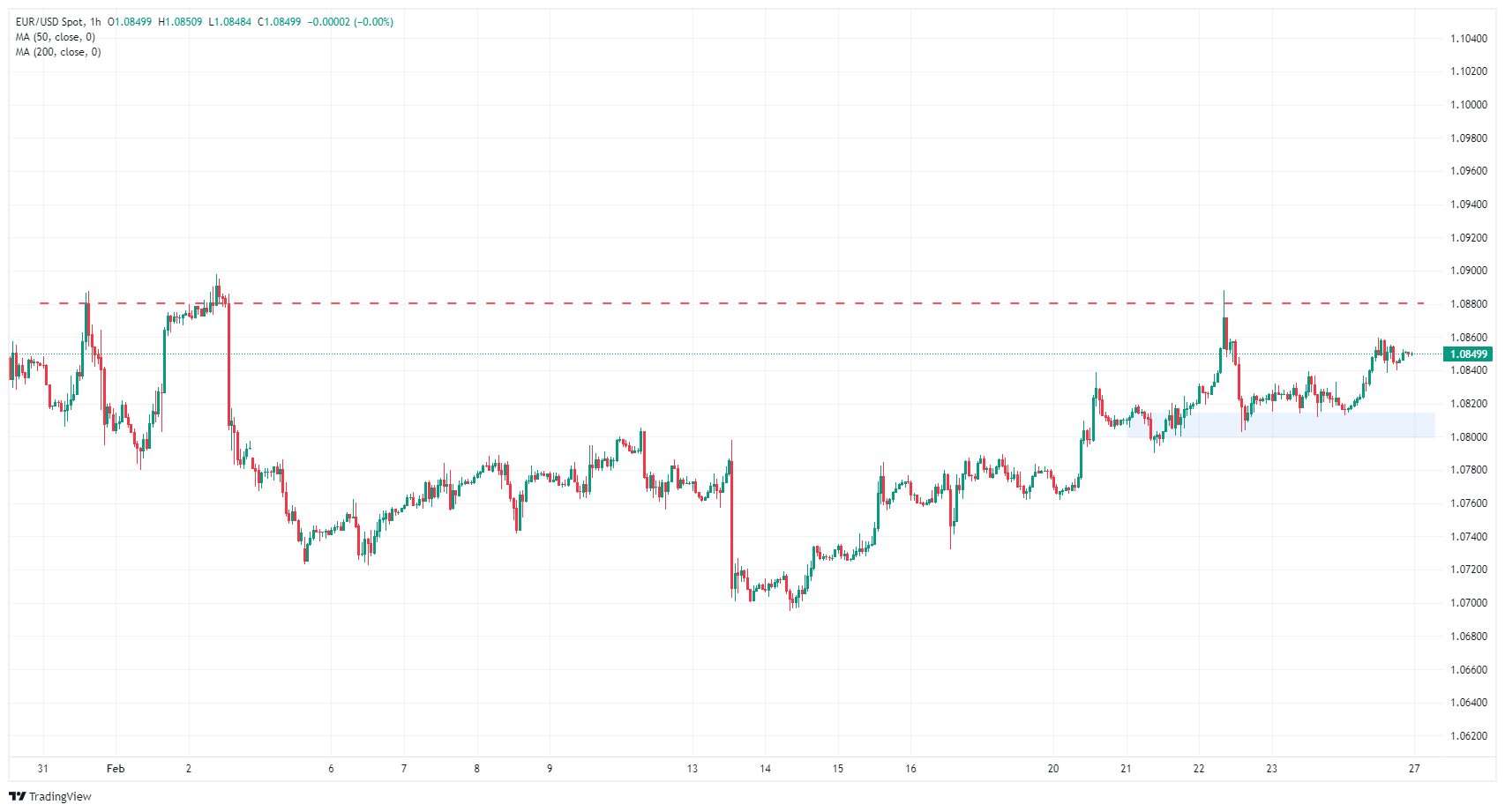

Technical diagnosis: EUR/USD pinned under 1.0860 in skinny Monday churn

EUR/USD stays capped under 1.0860 on Monday, but shut to-length of time bigger lows are keeping the pair bolstered into the high dwell. A heavy supply zone from 1.0800 to 1.0820 stays on the intraday charts, and 1.0880 represents the shut to-length of time technical ceiling.

In spite of a skinny bullish buildout that sees very miniature topside momentum, EUR/USD has closed in the fairway for eight consecutive shopping and selling days and is on tempo to chalk in a ninth. Of the last 14 shopping and selling days, finest two gain managed to shut in the red.

Vital technical strain is squeezing the pair into the midrange at the 200-day Straightforward Shifting Moderate (SMA) shut to 1.0830. EUR/USD is up a scant 1.3% from February’s low bids shut to 1.0695.

EUR/USD hourly chart

EUR/USD day-to-day chart

Euro FAQs

The Euro is the currency for the 20 European Union worldwide locations that belong to the Eurozone. It is the second most heavily traded currency on the earth in the again of the US Buck. In 2022, it accounted for 31% of all a long way off places alternate transactions, with a median day-to-day turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair on the earth, accounting for an estimated 30% off all transactions, adopted by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Monetary institution (ECB) in Frankfurt, Germany, is the reserve monetary institution for the Eurozone. The ECB items hobby rates and manages monetary coverage.

The ECB’s major mandate is to lend a hand price balance, meaning either controlling inflation or stimulating suppose. Its major instrument is the elevating or reducing of hobby rates. Reasonably high hobby rates – or the expectation of larger rates – will in general profit the Euro and vice versa.

The ECB Governing Council makes monetary coverage choices at meetings held eight cases a twelve months. Choices are made by heads of the Eurozone national banks and 6 everlasting participants, including the President of the ECB, Christine Lagarde.

Eurozone inflation records, measured by the Harmonized Index of Shopper Costs (HICP), is a a must-gain econometric for the Euro. If inflation rises more than anticipated, especially if above the ECB’s 2% target, it obliges the ECB to favor hobby rates to command it again under withhold an eye on.

Reasonably high hobby rates in comparison to its counterparts will in general profit the Euro, as it makes the build of living more honest as a build of living for world investors to park their money.

Recordsdata releases gauge the well being of the financial system and can affect on the Euro. Indicators just like GDP, Manufacturing and Services PMIs, employment, and particular person sentiment surveys can all affect the course of the single currency.

A real financial system is gorgeous for the Euro. No longer finest does it entice more a long way off places investment but it with out a doubt might maybe per chance also abet the ECB to build up hobby rates, which is exciting to straight strengthen the Euro. In another case, if financial records is historic, the Euro is possible to plunge.

Economic records for the four largest economies in the euro build (Germany, France, Italy and Spain) are especially necessary, as they yarn for 75% of the Eurozone’s financial system.

One more necessary records release for the Euro is the Trade Steadiness. This indicator measures the variation between what a nation earns from its exports and what it spends on imports over a given length.

If a nation produces extremely wanted exports then its currency will affect in price purely from the additional demand of constituted of a long way off places investors wanting for to glean these items. Therefore, a clear discover Trade Steadiness strengthens a currency and vice versa for a awful balance.

Data on these pages contains forward-taking a see statements that contain risks and uncertainties. Markets and devices profiled on this page are for informational purposes finest and might maybe per chance now not in any design detect as a recommendation to glean or sell in these sources. You need to pause your personal thorough analysis sooner than making any investment choices. FXStreet would now not in any design guarantee that this files is free from errors, errors, or discipline topic misstatements. It additionally would now not guarantee that this files is of a timely nature. Investing in Beginning Markets entails a gargantuan deal of risk, including the loss of all or a a part of your investment, as well as emotional hurt. All risks, losses and costs connected to investing, including total loss of predominant, are your responsibility. The views and opinions expressed in this text are these of the authors and pause now not basically replicate the first rate coverage or build of living of FXStreet nor its advertisers. The author might maybe per chance now not be held accountable for files that is came upon at the dwell of links posted on this page.

If now not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no build of living in any stock mentioned in this text and no industry relationship with any firm mentioned. The author has now not obtained compensation for writing this text, diversified than from FXStreet.

FXStreet and the author pause now not present customized suggestions. The author makes no representations as to the accuracy, completeness, or suitability of this files. FXStreet and the author might maybe per chance now not be accountable for any errors, omissions or any losses, accidents or damages coming up from this files and its expose or utilize. Errors and omissions excepted.

The author and FXStreet need to now not registered investment advisors and nothing in this text is meant to be investment advice.