‘Eerily the same to 2022.’ Why this ragged strategist is ‘max bearish’ on U.S. shares

Credit final twelve months’s hero Nvidia

NVDA,

for giving Wall Road its easiest day to this level in a shaky delivery to 2024. Nonetheless gloom from Samsung is dampening the mood, with stock-market futures pointing to pullback.

In the undergo camp, JPMorgan’s chief world strategist Marko Kolanovic, says shares reside overbought and traders complacent no matter the partial early-twelve months reversal. While concern sources have began to “fully embrace” the premise central banks will ease as inflation falls, resilient enhance and persevered story profitability might per chance per chance per chance per chance cease up as contradictory for traders.

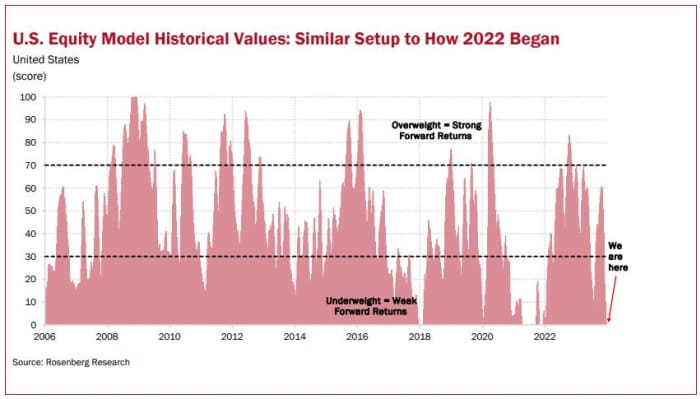

Also on that bearish aspect is our call of the day from David Rosenberg, a ragged strategist who says his company is now “maximum” bearish on U.S. shares, citing some troubling contemporary history.

“The setup for 2024 is having a worth eerily the same to how we entered 2022, with positioning, sentiment, and technicals all at crude readings – matching what we saw in December 2021 (and with worse fundamentals to

boot),” talked about the president of Toronto-primarily based Rosenberg Analysis and his crew that entails Marius Jongstra and Bhawana Chhabra, in a mark.

The S&P 500

SPX

finished 2022 with a 19% loss, its largest since 2008.

Here’s Rosenberg’s chart:

Rosenberg’s bearish views final twelve months integrated an early 2023 call for shares to lose 30% and a power recession forecast. Nonetheless he moreover predicted in September that the Nasdaq would inspect a main in December-January, which will most likely be on the honest note judging by the action this twelve months to this level.

So where to disguise for now? The strategist sees financials — due to kick off earnings this week — because the distinct prime take hold of for traders and among the many most cost-effective as a ways as valuations scoot. “Historical diagnosis shows this community to be a strong performer all the blueprint thru each and each the Fed discontinuance and disinflation classes,” he talked about.

“While recession dangers assemble loom over the field, traders can worth in opposition to the easier banks (neatly-capitalized) and insurance firms (right earnings enhance; better valuations) below the ground,” talked about Rosenberg.

And exterior of financials, the strategist says vitality, communication products and services and utilities all are tied for 2d place.

He moreover weighs in on bonds, announcing with markets pricing in about six Fed charge cuts, a chunk of the pivot call is already “within the associated price.” Other headwinds consist of the 10% form considered for the 10-twelve months Treasury since October. While no longer a promote advice, he says it’ll be time to “digest market strikes.”

“With entrance-cease T-bills peaceable paying [approximately] 5.25%, traders can think locking in these yields following the lunge-up we have now experienced to this level on the prolonged cease.”

Read: Veteran bond king Bill Unsuitable says 10-twelve months Treasury ‘over priced’

Rosenberg moreover talked about they became optimistic on commodities in December, with their model gain reaching its top since July 2022. Alternatively, vitality is no longer within the combo except for natural gas, as they get food/agricultural, with wheat, cotton, corn and soybeans at the stop.

The strategist talked about they rightly timed a bullish flip on gold final drop, but are fading that, citing investor crowding and overbought technicals.

The markets

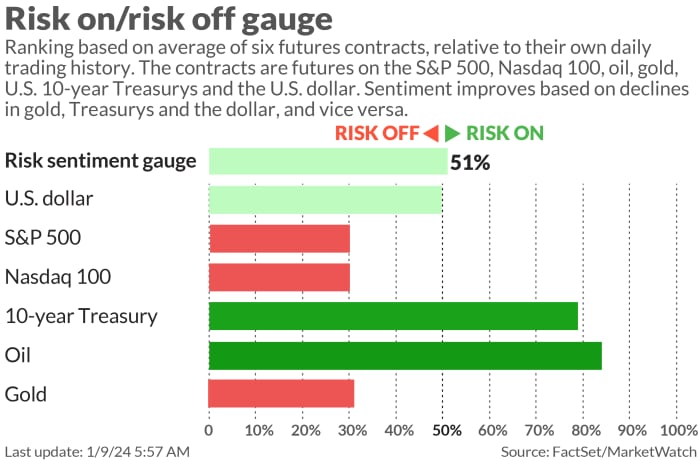

Stock futures

ES00,

COMP

are extending losses, led by tech, as Treasury yields

BX:TMUBMUSD10Y

bound up. In other locations, oil

CL.1,

is up with regards to 3% and gold

GC00,

is moreover animated up. The Nikkei 225 index

JP:NIK

hit a contemporary 33-twelve months high, in a combined day for Asia.

| Key asset efficiency | Final | 5d | 1m | YTD | 1y |

| S&P 500 | 4,763.54 | -0.13% | 3.05% | -0.13% | 22.39% |

| Nasdaq Composite | 14,843.77 | -1.12% | 2.85% | -1.12% | 39.57% |

| 10 twelve months Treasury | 4.045 | 10.86 | -15.89 | 16.37 | 42.39 |

| Gold | 2,037.90 | -1.64% | 2.02% | -1.64% | 8.61% |

| Oil | 71.23 | -0.14% | -0.24% | -0.14% | -4.86% |

| Files: MarketWatch. Treasury yields commerce expressed in foundation points | |||||

The buzz

Juniper Networks stock

JNPR,

is up 22% after The Wall Road Journal reported insensible Monday that Hewlett Packard Endeavor

HPE,

is in evolved talks to prefer the tech community for $13 billion.

Match Neighborhood

MTCH,

is rallying on a file activist investor Elliott Administration wants adjustments.

Samsung Electronics

005930,

forecast plunging fourth-quarter income.

Netflix

NFLX,

shares were minimize to withhold by Citigroup, whose analysts cited worries over income and spending, but saved a $500 tag purpose. The stock is down 2%.

Urban Outfitters stock

URBN,

is up 5% after the retailer reported a 10% upward thrust in annual gross sales over the holidays.

Deutsche Monetary institution upgraded JPMorgan Slump

JPM,

to pick out out from withhold and minimize Wells Fargo

WFC,

to withhold from pick, earlier than earnings from banks and others on Friday.

United Airlines

UAL,

found unfastened bolts and “installation points” upon inspecting some Boeing

BA,

737 Max 9 planes following final week’s midflight blowout. Boeing shares are off a little in premarket, after shedding 8% on Monday.

Files confirmed the U.S. alternate deficit shrank in November. Fed Vice Chair for Supervision, Michael Barr will talk at 12 noon. Fed governor Michelle Bowman talked about she now thinks inflation might per chance per chance per chance per chance ease with out more charge hikes.

France has named its youngest and first overtly homosexual prime minister, Gabriel Attal.

Exclusively of the online

South Korea outlaws its dog meat alternate in landmark regulations

Lithuania’s first unicorn: The Vinted phenomenon

Earth final twelve months flirted with globally agreed upon warming limits

High tickers

These were the stop-searched tickers on MarketWatch as of 6 a.m.:

| Ticker | Safety name |

|

TSLA, |

Tesla |

|

NVDA, |

Nvidia |

|

BA, |

Boeing |

|

AAPL, |

Apple |

|

AMC, |

AMC Leisure |

|

NIO, |

Nio |

|

GME, |

GameStop |

|

MARA, |

Marathon Digital |

|

AMZN, |

Amazon.com |

|

AMD, |

Evolved Micro Devices |

Random reads

Indonesia sends rare singing minute apes serve to the wild

At final, the precise reason urine is yellow.

Need to Know starts early and is updated unless the gap bell, but worth in here to receive it delivered once to your email field. The emailed version will most likely be despatched out at about 7: 30 a.m. Japanese.