Crypto Weekly Update: Ethereum Living ETF Approval, Breaking News, and Market Analysis

Welcome to your traipse-to offer for all issues Web3, Blockchain and Crypto! Our Weekly document dives into the freshest updates and game-altering inclinations in the short-paced world. We curate the most spicy files from relied on sources to reduction you ahead of the curve. Prepared to stop urged and inspired? Let’s explore the most modern trends and insights collectively!

1. Web3, Blockchain & Crypto Breaking News This Week

Listed below are this week’s fundamental breaking news reviews linked to Web3, Blockchain, and crypto that you just will possess to never miss.

- US Supreme Courtroom Rules In opposition to Coinbase in Arbitration Case

The United States Supreme Courtroom unanimously decided that courts need to resolve which contract takes priority when a couple of agreements exist, ruling against Coinbase in a dispute over a 2021 Dogecoin sweepstakes.

- US House Votes to Ban Federal Reserve Issuing CBDCs

The US House handed the CBDC Anti-Surveillance Declare Act, blocking off the Federal Reserve from straight issuing digital currencies, aiming to quit capacity surveillance of American electorate.

- US House Passes Crypto Readability Laws

The Financial Innovation and Technology for the 21st Century Act handed with bipartisan toughen, offering like minded clarity on the classification, registration, and custody of crypto sources, bright a ways off from the SEC’s enforcement-led law.

- Trump Marketing campaign Accepts Cryptocurrency Donations

The Trump marketing campaign will now settle for cryptocurrency donations, making it the fundamental fundamental event presidential marketing campaign to attain so, aligning with its agenda of prioritising freedom over executive aid an eye fixed on.

- Polimec Launches on Polkadot for Web3 Fundraising

Polimec, a decentralised funding protocol, was once launched on Polkadot. It objectives to transform Web3 challenge fundraising by offering a clear, regulatory-compliant platform for connecting investors with startups globally.

- UN Sage: North Korean Hackers Launder Stolen Crypto

A UN document published North Korean hackers funnelled thousands and thousands in stolen cryptocurrency by Twister Cash closing year. The Lazarus Crew transferred $147.5 million taken from crypto replace HTX in 2023.

1.1. This Week’s Web3, Blockchain & Crypto Particular News Sage You Can’t-Miss

- SEC Approves Living Ether ETFs; ETH & BTC Come by out about Volatility

The SEC approves dwelling Ether ETFs for shopping and selling on nationwide exchanges. No longer too long ago, Ethereum saw a enhance in its ticket from $3,100 to a height of $3,930. This followed experts’ approval prediction. Bitcoin also surged to $72,000. On the different hand, each and each cryptocurrencies dropped due to excessive volatility ahead of the approval and struggled to enhance. The ticket of Ethereum currently, on 25th Might perhaps perhaps 2024 (8: 30 AM GMT-4), stands at $3,741.22, and Bitcoin’s ticket is $69,273.19. Despite the approval, it can perhaps well well also just employ weeks for an Ether ETF to head live, which procedure the elephantine impact on the crypto market will probably be realised later.

2. Blockchain Weekly Analysis

The weekly blockchain prognosis covers the blockchain dominance prognosis and 7-day replace prognosis. To clarify, the Layer 1 chains and Layer 2 chains are analysed individually.

2.1. Blockchain Dominance Analysis

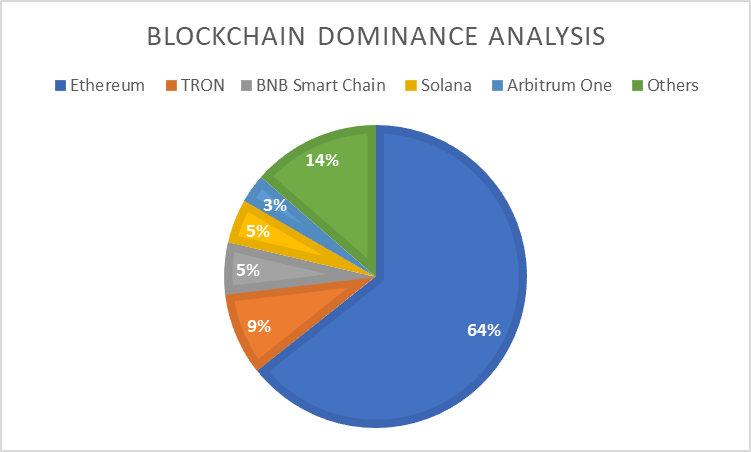

Ethereum, TRON, BNB Neat Chain, Solana, and Arbitrum One are the head five blockchains as per dominance and TVL.

| Blockchains | Dominance | TVL |

| Ethereum | 64.34% | $63,308,692,822 |

| TRON | 8.81% | $8,664,627,023 |

| BNB Neat Chain | 5.49% | $5,403,408,858 |

| Solana | 4.74% | $4,659,519,009 |

| Arbitrum One | 3.05% | $2,998,844,013 |

Ethereum dominates the blockchain sector with 64.3%. TRON and BNB Neat Chain be conscious with 8.81% and 5.49%, respectively. Solana displays 4.74% dominance, and Arbitrum One exhibits 3.05% dominance.

2.1.1. High 5 Layer 1 Chains By Dominance

Ethereum, BNB Neat Chain, Solana, Bitcoin and Avalanche are the head five Layer 1 Blockchain by dominance and TVL.

| Layer 1 Blockchains | Dominance | TVL |

| Ethereum | 80.74% | $63,280,623,806 |

| BNB Neat Chain | 6.89% | $5,401,013,162 |

| Solana | 5.94% | $4,657,453,129 |

| Bitcoin | 1.46% | $1,142,885,950 |

| Avalanche | 1.26% | $989,858,224 |

Within the layer 1 chain section, Ethereum dominates with 80.74%. BNB Neat Chain and Solana be conscious with 6.89% and 5.94%, respectively. Bitcoin files 1.46% dominance, and Avalanche registers 1.26% dominance.

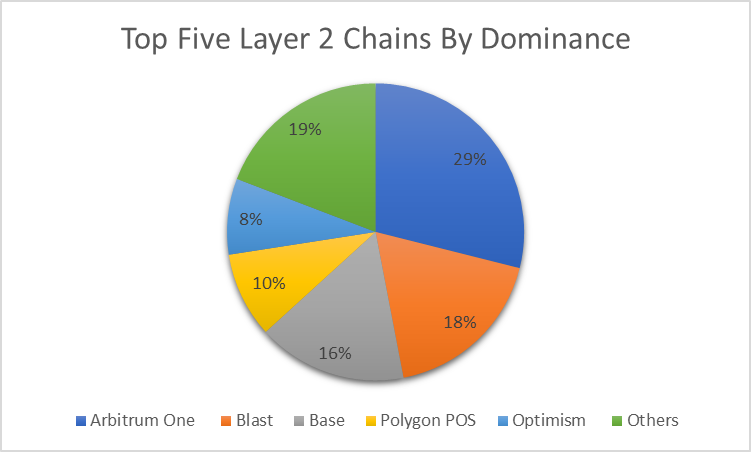

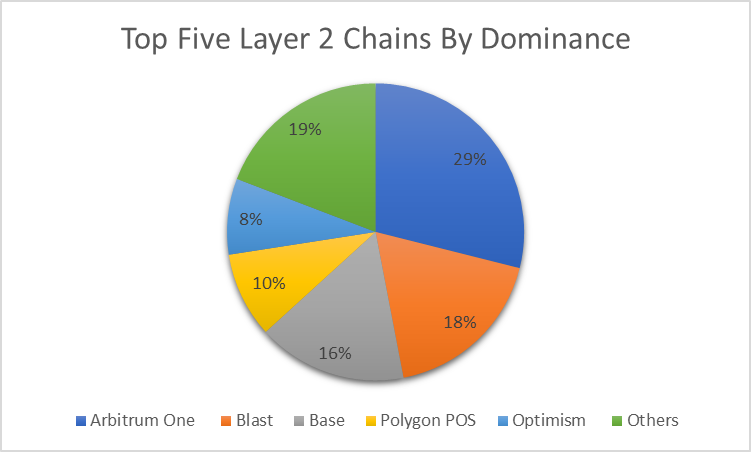

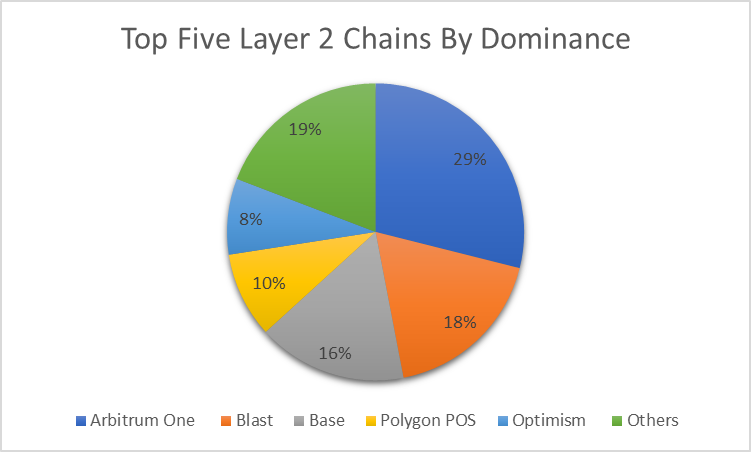

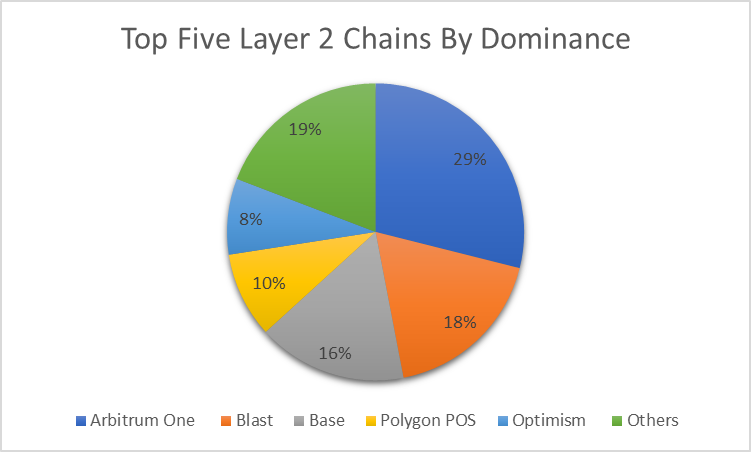

2.1.2. High 5 Layer 2 Chains By Dominance

Arbitrum One, Blast, Snide, Polygon POS, and Optimism are the head five Layer 2 Blockchains per dominance and Total Price Locked.

| Layer 2 Blockchains | Dominance | TVL |

| Arbitrum One | 29.79% | $2,997,202,414 |

| Blast | 18.61% | $1,871,893,206 |

| Snide | 16.74% | $1,683,987,107 |

| Polygon POS | 9.58% | $963,814,055 |

| Optimism | 8.52% | $857,522,817 |

Within the layer 2 chain section, Arbitrum One dominates with 29.79%. Blast and Snide closely be conscious with 18.61% and 16.74%, respectively. Polygon POS exhibits 9.58% dominance, and Optimism displays 5.52% dominance.

2.2. Blockchain 7-Day Exchange Analysis

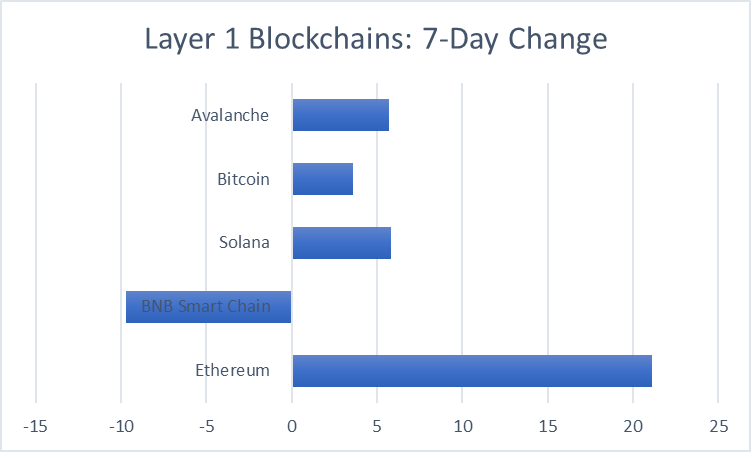

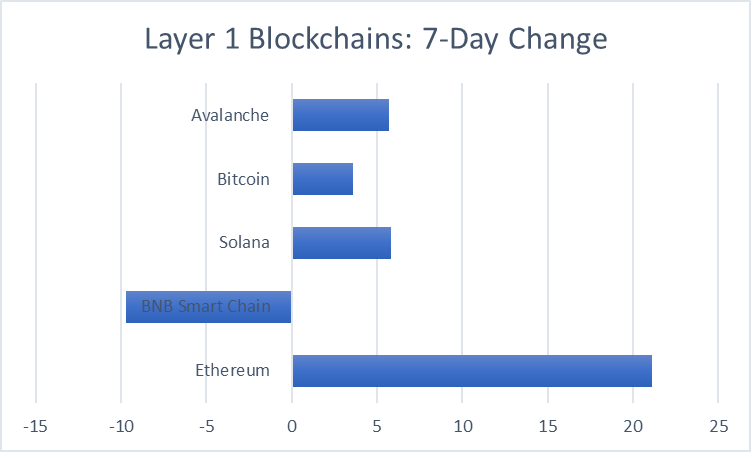

Let’s analyse the head five Layer 1 chains the relate of the 7-day replace index.

| Layer 1 Blockchains | 7-Day Exchange |

| Ethereum | +21.1% |

| BNB Neat Chain | -9.7% |

| Solana | +5.8% |

| Bitcoin | +3.6% |

| Avalanche | +5.7% |

Amongst the head five layer 1 blockchains by TVL, most spicy one exhibits negative 7-day replace. BNB Neat Chain displays the negative 7-day replace of -9.7%. The top probably 7-day sure replace is confirmed by Ethereum, with +21.1% replace. Solana dnd Avalanche be conscious with +5.8% and +5.7%, respectively. Bitcoin registers the replace of +3.6%.

Let’s analyse the head five Layer 2 chains the relate of the 7-day replace index.

| Layer 2 Blockchains | 7-Day Exchange |

| Arbitrum One | +13.6% |

| Blast | +24.7% |

| Snide | +11.4% |

| Polygon POS | +8.0% |

| Optimism | +10.5% |

Amongst the head five layer 2 blockchains by TVL, all of them impart sure 7-day replace. Blast displays the most spicy 7-day sure replace of +24.7%. Arbitrum One and Snide be conscious with +13.6% and +11.4%, respectively. Optimism files +10.5% replace, and Polygon POS registers +8.0% replace.

3. Cryptocurrency Weekly Analysis

The Cryptocurrency Weekly prognosis covers a wide vary of analyses, from the same previous cryptocurrency market cap prognosis and the head gainers and losers prognosis to the Stablecoin, Memecoin, AI Cash and Metaverse Cash analyses.

3.1. High Cryptocurrency Categories By Market Cap

Layer 1 (LI), Neat Contract Platform, Andreessen Horowitz (a16z) Portfolio, Alameda Examine Portfolio, and Alleged SEC Securities are the head five cryptocurrency classes by Market Cap. The Layer 1 (L1) category, with $2,075,024,162,080 market cap, is the one with the most spicy market cap. The Neat Contract Platform category follows with a $759,692,397,902 market cap.

| Crypto Categories | Market Cap | 7-Day Exchange |

| Layer 1 (L1) | $2,075,024,162,080 | +47.2% |

| Neat Contract Platform | $759,692,397,902 | +15.7% |

| Andreessen Horowitz (a16z) Portfolio | $610,522,744,828 | +19.4% |

| Alameda Examine Portfolio | $556,666,727,766 | +20.8% |

| Alleged SEC Securities | $251,715,895,182 | +1.8% |

Amongst the head five crypto classes by market cap, the general five high classes impart sure 7-day replace. Layer 1 (L1) files the most spicy 7-day replace of 47.2%. Alameda Examine Portfolio and Andreessen Horowitz (a16z) Portfolio be conscious with +20.8% and +19.4%, respectively. Neat Contract Platform also registers an excellent replace of +15.7%. Meanwhile, Alleged SEC Securities displays a minimal replace of +1.8%.

3.1.1. Trending Categories This Week

Song Tokens, Liquid Restaking Governance Tokens, LRTfi, Yield Tokenization Cash, Elon Musk-inspired coins, and AI Meme Cash are the most trending classes this week.

| Trending Categories | Market Cap |

| Song Tokens | $627,121,599 |

| Liquid Restaking Governance Tokens | $1,524,880,216 |

| LRTfi | $989,429,410 |

| Yield Tokenization Cash | $965,345,342 |

| Elon Musk-Impressed Cash | $23,760,570,550 |

| AI Meme Cash | $975,478,321 |

Amongst the head trending classes, the category of Elon Musk-Impressed Cash has the most spicy market cap of $23,760,570,550. The Liquid Restaking Governance Tokens category follows with a $1,524,880,216 market cap. LRTfi, AI Meme Cash, and Yield Tokenization Cash document $989,429,410, $975,478,321, and $965,345,342 market cap, respectively.

3.2. High Cryptocurrencies By Market Cap

Bitcoin, Ethereum, Tether, BNB, and Solana are the head five cryptocurrencies by market cap. Bitcoin has the most spicy market cap of $1,326,998,613,001. Etheruem follows with a market cap of $444,659,154,199.

| Cryptocurrencies | Market Cap | 7-Day Exchange |

| Bitcoin | $1,326,998,613,001 | +1.2% |

| Ethereum | $444,659,154,199 | +22.1% |

| Tether | $111,958,979,692 | -0.1% |

| BNB | $91,693,466,328 | +2.9% |

| Solana | $74,431,437,048 | -1.5% |

Amongst the head five cryptocurrencies, Ethereum exhibits the most spicy 7-day replace of +22.1%. BNB and Bitcoin impart minimal sure adjustments of +2.9% and +1.2%, respectively. Solana and Tether document negative adjustments of -1.5% and -0.1%, respectively.

3.2.1. Trending Cash This Week

Gearbox, Apu Apustaja, Turbo, Opulous and Ondo are the most trending cryptocurrencies on the time of making ready this prognosis.

| Trending Cryptocurrencies | Market Cap |

| Gearbox | $111,343,734 |

| Apu Apustaja | $233,632,808 |

| Turbo | $201,554,316 |

| Opulous | $92,410,047 |

| Ondo | $1,621,280,118 |

Amongst the head five most trending cryptos, Ondo has the most spicy market cap of $1,621,280,118. Apu Apustaja and Turbo be conscious with $233,632,808 and $201,554,316, respectively. Gearbox has a market cap of $111,343,734, and Opulous marks a market cap of $92,410,047.

3.2.2. High Gainers & Losers This Week

AMATERASU OMIKAMI, Wojak, Turbo, Better, and BOB Token are the head gainers of the week as per the 7-day construct index.

| High Gainers | 7-Day Develop |

| AMATERASU OMIKAMI | +286.6% |

| Wojak | +125.3% |

| Turbo | +120.0% |

| Better | +110.3% |

| BOB Token | +105.0% |

AMATERASU OMIKAMI exhibits the most spicy 7-day construct of +286.6%. Wojak and Turbo be conscious with +125.3% construct and +120.0% construct, respectively. Better has a 7-day construct of +110.3%, and BOB Token files a 7-day construct of +105.0%.

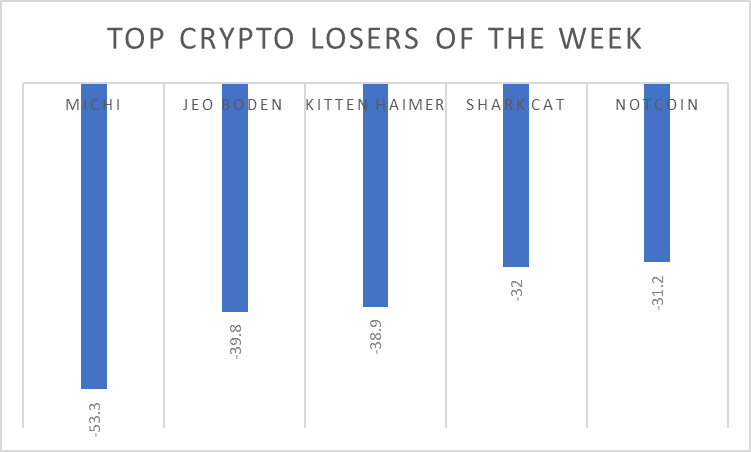

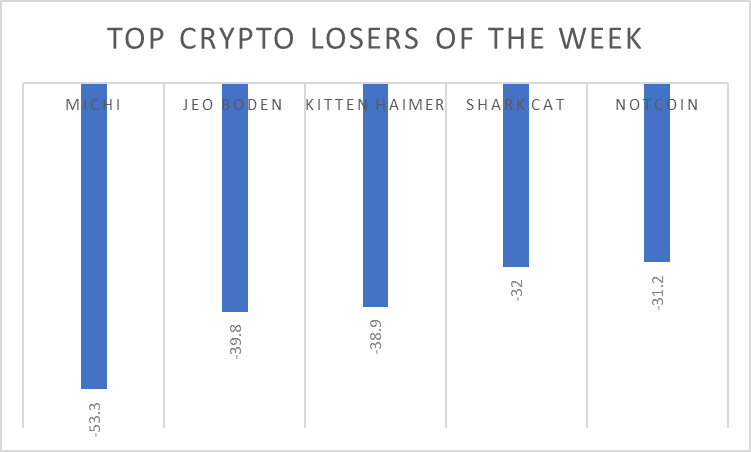

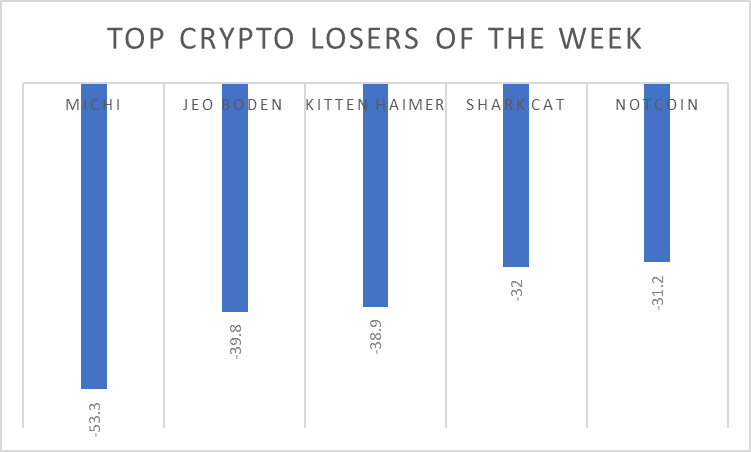

Michi, Jeo Boden, Kitten Haimer, Shark Cat, and Notcoin are the head losers of the week as per the 7-day loss index.

| High Losers | 7-Day Loss |

| michi | -53.3% |

| Jeo Boden | -39.8% |

| Kitten Haimer | -38.9% |

| Shark Cat | -32.0% |

| Notcoin | -31.2% |

Michi registers the most spicy 7-day loss of -53.3%. Jeo Boden and Kitten Haimer be conscious with -39.8% and -38.9%, respectively. Shark Cat exhibits a loss of -32.0%, Bitcoin files a loss of -31.2%.

3.3. High Stablecoins Analysis

Tether, USDC, Dai, First Digital USD, and Ethena USDe are the head five stablecoins as per market cap.

| Stablecoins | Market Cap |

| Tether | $112,018,679,115 |

| USDC | $32,739,425,716 |

| Dai | $5,308,052,511 |

| First Digital USD | $3,230,327,487 |

| Ethena USDe | $2,681,694,776 |

Within the stablecoin market, Tether has the most spicy market cap of $112,018,679,115. USDC and Dai be conscious with $32,739,425,716 and $5,308,052,511, respectively. First Digital USD showcases a market cap of $3,230,327,487. Ethena USDe enjoys a $2,681,694,776 market cap.

3.4. High Memecoins 7-Day Exchange Analysis

Dogecoin, Shiba Inu, Pepe, dogwifhat, and Bonk are the head five Memecoins as per market cap. Dogecoin has the most spicy market cap of $23,526,356,272. Shiba Inu and Pepe be conscious with $14,268,797,326 and $5,813,405,981 market cap, respectively.

| Memecoins | Market Cap | 7-Day Exchange |

| Dogecoin | $23,526,356,272 | +7.9% |

| Shiba Inu | $14,268,797,326 | -2.0% |

| Pepe | $5,813,405,981 | +39.2% |

| dogwifhat | $2,787,008,032 | -1.9% |

| Bonk | $2,184,863,206 | +37.0% |

Amongst the head five memcoins, Pepe and Bonk mark impressive 7-day adjustments of +39.2% and 37.0%. Dogecoin exhibits a +7.9% replace. Conversely, Shiba Inu and dogwifhat files negative adjustments of -2.0% and -1.9%, respectively.

3.5. High AI Cash 7-Day Exchange Analysis

Obtain-ai, Cyber web Pc, Render, The Graph, and Bittensor are the head five AI Cash as per market cap. Obtain.ai has the most spicy market cap of $5,815,503,794. Cyber web Pc and Render closely be conscious with $5,675,753,251 and $3,932,965,819 market cap, respectively.

| AI Cash | Market Cap | 7-Day Exchange |

| Obtain.ai | $5,815,503,794 | +2.0% |

| Cyber web Pc | $5,675,753,251 | -4.0% |

| Render | $3,932,965,819 | +1.0% |

| The Graph | $3,068,789,601 | +2.5% |

| Bittensor | $2,932,775,704 | +13.6% |

Amongst the head five AI coins, most spicy one coin exhibits a negative 7-day replace. Cyber web Pc files a 7-day replace of -4.0%. The top probably 7-day sure replace is recorded by Bittensor, with +13.6% replace. The graph and Obtain.ai impart a replace of +2.5% and +2.0%, respectively. Render registers a minimal replace of +1.0%.

3.6. High Metaverse Cash 7-Day Exchange Analysis

Render, FLOKI, Axie Infinity, The Sandbox, and Decentraland are the head five Metaverse Cash on the premise of market cap. Render has the most spicy market cap of $3,928,015,314. FLOKI, Axie Infinity, and The Sandbox closely be conscious with $2,150,126,952, $1,132,240,710, and $1,005,070,619 market cap, respectively.

| Metaverse Cash | Market Cap | 7-Day Exchange |

| Render | $3,928,015,314 | +0.8% |

| FLOKI | $2,150,126,952 | +6.4% |

| Axie Infinity | $1,132,240,710 | +7.1% |

| The Sandbox | $1,005,070,619 | +0.3% |

| Decentraland | $844,788,666 | +4.5% |

Amongst the head five metaverse coins, all of them impart sure 7-day adjustments. Axie Infinity displays the most spicy 7-day replace of +7.1%. FLOKI and Decentraland be conscious with +6.4% and +4.5% replace, respectively. Render and The Sandbox mark minimal adjustments of +0.8% and +0.3%, respectively.

4. Crypto ETF Weekly Analysis

The crypto ETF weekly prognosis covers Bitcoin Living ETFs, Bitcoin Futures ETFs, and Ethereum Futures ETFs.

4.1. Bitcoin Living ETF Rate Exchange Analysis

GBTC, IBIT, FBTC, ARKB and BITB are the head five Bitcoin Living ETFs per Asset Beneath Administration. GBTC marks the most spicy AUM of $24.33B. IBIT closely follows with an AUM of $17.24B.

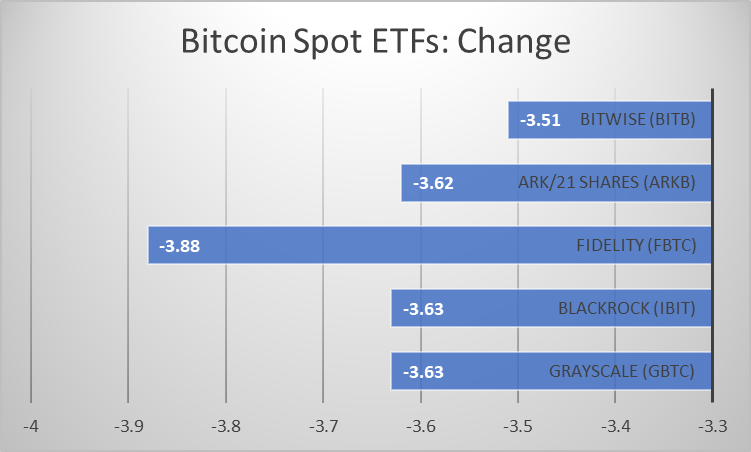

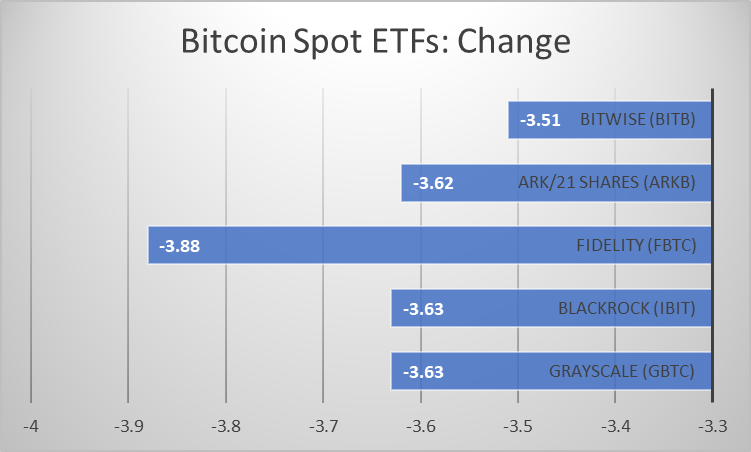

| Bitcoin Living ETFs | Rate | Exchange | AUM |

| Grayscale (GBTC) | $59.70 | -3.63% | $24.33B |

| BlackRock (IBIT) | $38.27 | -3.63% | $17.24B |

| Constancy (FBTC) | $58.72 | -3.88% | $9.90B |

| Ark/21 Shares (ARKB) | $67.13 | -3.62% | $2.85B |

| Bitwise (BITB) | $36.63 | -3.51% | $2.16B |

Amongst the head five Bitcoin Living ETFs, none of them register sure adjustments. Constancy (FBTC) marks the most spicy negative ticket replace of -3.88%. Grayscale (GBTC) and BlackRock (IBIT), each and each showcase a replace of -3.63%. Ark/21 Shares (ARKB) files a replace of -3.62%, and Bitwise (BITB) displays -3.51% replace.

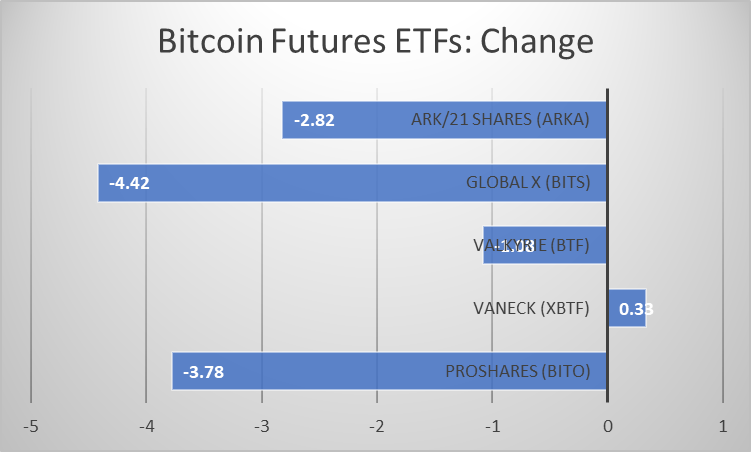

4.2. Bitcoin Futures ETF Rate Exchange Analysis

BITO, XBTF, BTF, BITS, and ARKA are the head five Bitcoin Futures ETFs as per Asset Beneath Administration. BITO has the most spicy AUM of $598.78M. XBTF follows with $42.41M AUM.

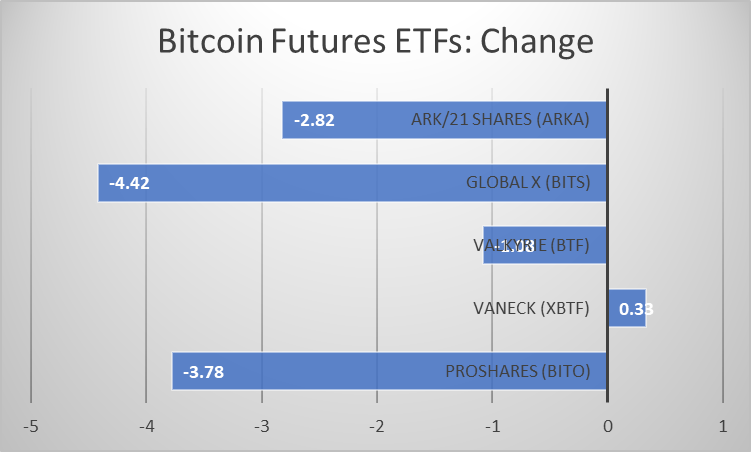

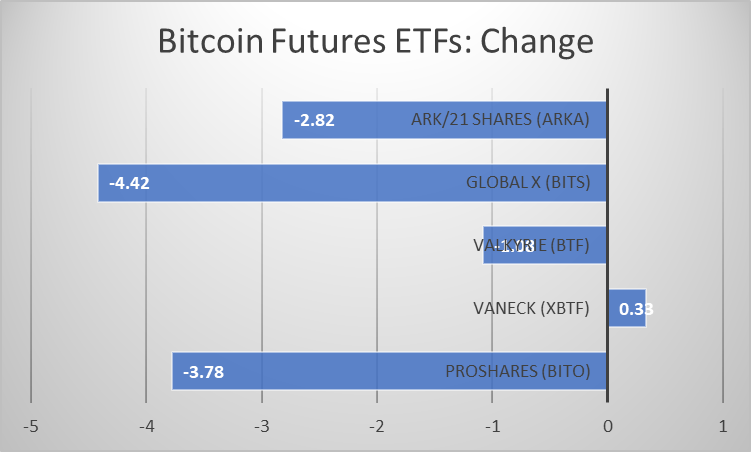

| Bitcoin Futures ETFs | Rate | Exchange | AUM |

| ProShares (BITO) | $27.20 | -3.78% | $598.78M |

| VanEck (XBTF) | $39.22 | +0.33% | $42.41M |

| Valkyrie (BTF) | $21.08 | -1.08% | $38.20M |

| World X (BITS) | $66.20 | -4.42% | $26.10M |

| Ark/21 Shares (ARKA) | $64.66 | -2.82% | $8.01M |

Amongst the head five Bitcoin Futures ETFs, most spicy VanEck (XBTF) displays a sure replace; it files a replace of +0.33%. The top probably negative ticket replace is confirmed by World X (BITS), with -4.42%. ProShares (BITO) follows closely with a -3.78% replace. Ark/21 Shares (ARKA) and Valkyrie (BTF) register negative adjustments of -2.82% and -1.08%, respectively.

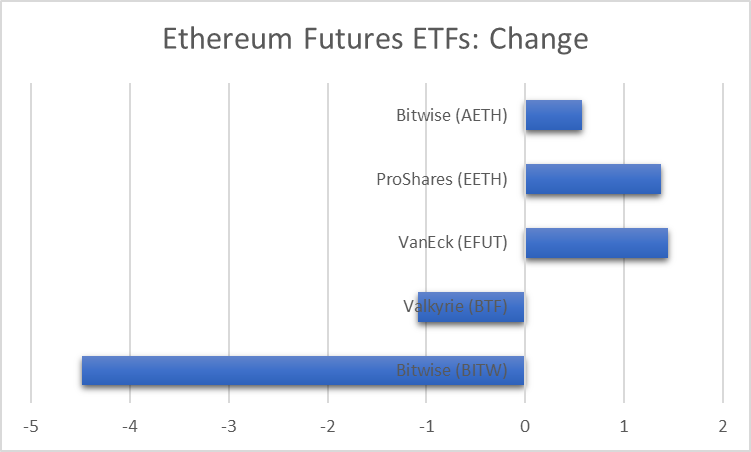

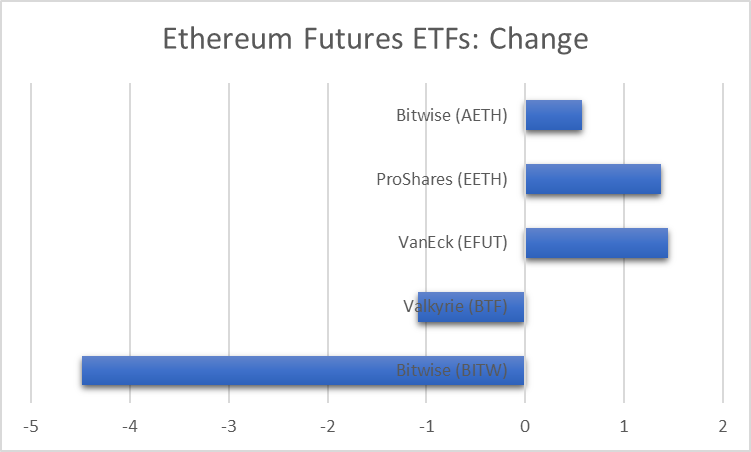

4.3. Ethereum Futures ETF Rate Exchange Analysis

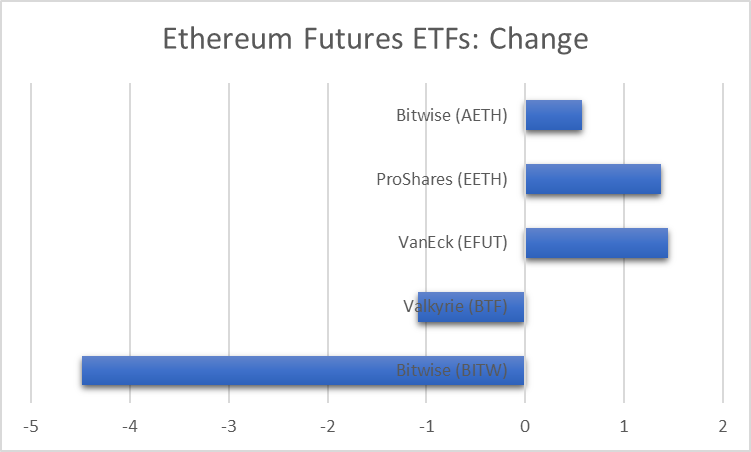

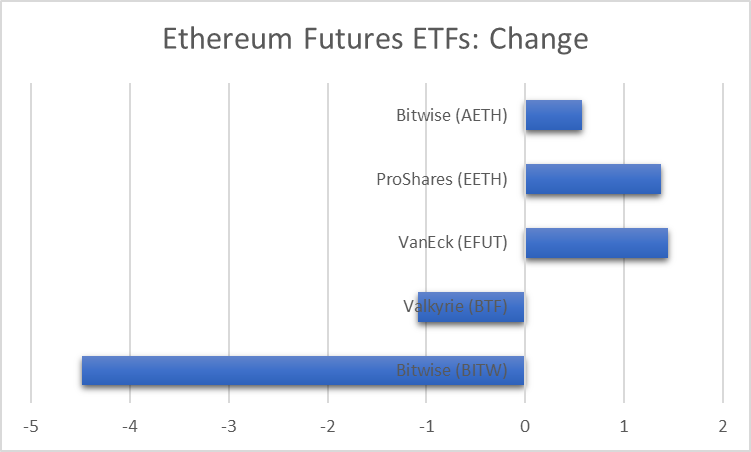

BITW, BTF, EFUT, EETH, and AETH are the head five Ethereum Futures ETFs per Asset Beneath Administration. BITW has the most spicy AUM of $478.00M. BTF follows with $25.93M AUM.

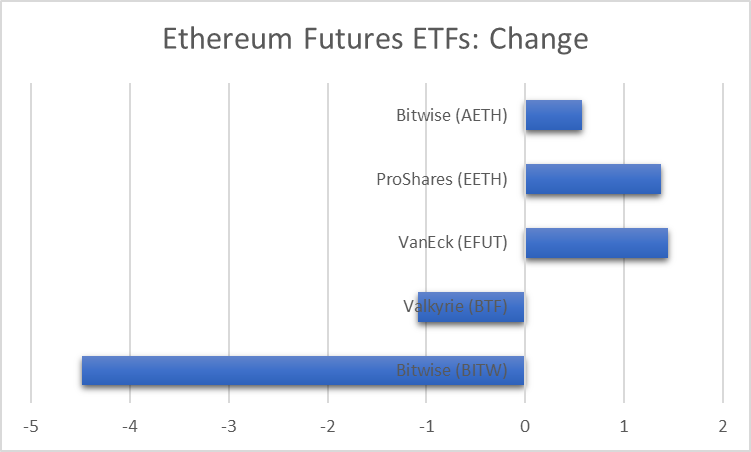

| Ethereum Futures ETFs | Rate | Exchange | AUM |

| Bitwise (BITW) | $36.22 | -4.48% | $478.00M |

| Valkyrie (BTF) | $21.08 | -1.08% | $25.93M |

| VanEck (EFUT) | $29.46 | +1.45% | $7.84M |

| ProShares (EETH) | $82.16 | +1.37% | $6.43M |

| Bitwise (AETH) | $49.51 | +0.57% | $585.75K |

Amongst the head five Ethereum futures ETFs, no decrease than three document sure ticket adjustments, despite the truth that comfortable. When VanEck (EFUT) and ProShares (EETH) impart impressive adjustments of +1.45% and +1.37%, respectively, Bitwise (AETH) displays a cozy sure replace of +0.57%. Conversely, Bitwise (BITW) registers an unimpressive replace of -4.48%, and Valkyrie (BTF) marks a cozy negative replace of -1.08%.

5. DeFi Protocols Weekly Analysis

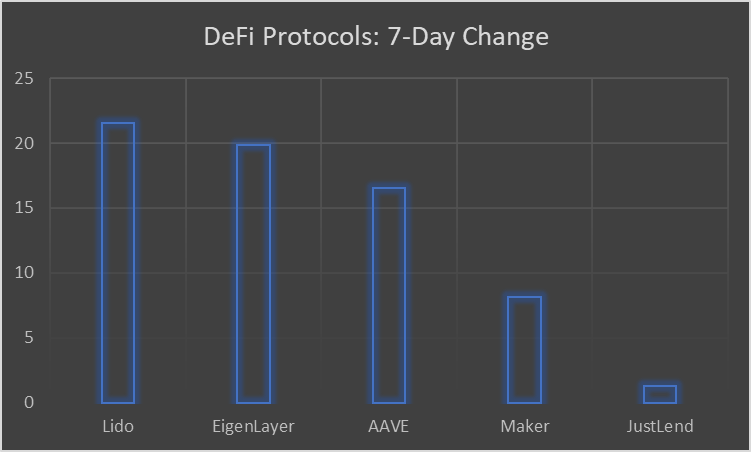

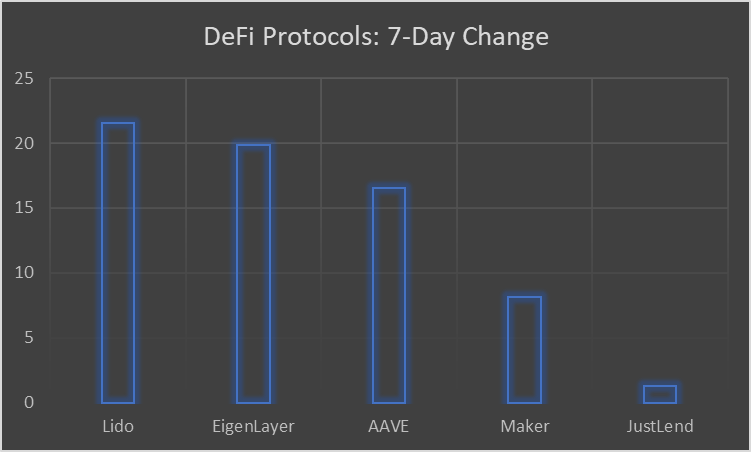

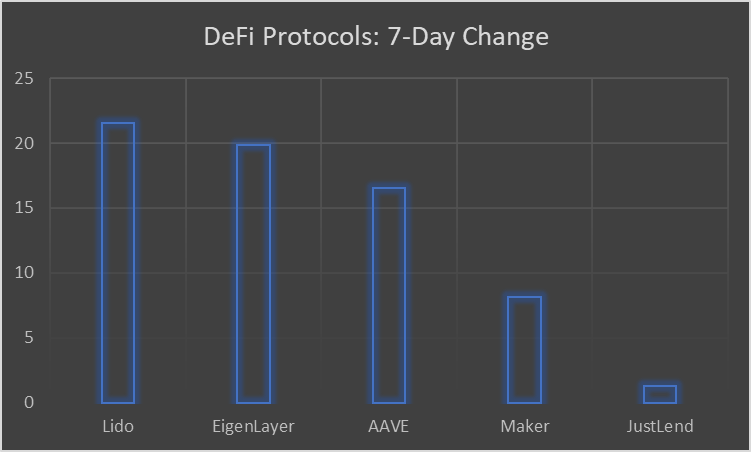

Lido, EigenLayer, AAVE, Maker and JustLend are the head five DeFi protocols as per Total Price Locked. Lido marks the most spicy TVL of $34.568B. EigenLayer and AAVE be conscious with $18.189B and $12.727B, respectively.

| DeFi Protocols | TVL | 7-Day Exchange |

| Lido | $34.568B | +21.54% |

| EigenLayer | $18.189B | +19.87% |

| AAVE | $12.727B | +16.53% |

| Maker | $8.921B | +8.13% |

| JustLend | $6.515B | +1.29% |

Amongst the head five DeFi protocols, Lido exhibits the most spicy 7-day replace of +21.54%. EigenLayer and AAVE impart adjustments of +19.87% and +16.53%, respectively. Maker registers a ample replace of +8.13%, and JustLend files a minimal replace of +1.29%.

6. Crypto Exchange Weekly Analysis

6.1. High Crypto Centralised Exchanges

Binance, Coinbase Exchange, Bybit, WhiteBIT, and OKX are the head five crypto centralised exchanges on the premise of Monthly Visits.

| Crypto Centralised Exchanges | Monthly Visits | Belief Ranking |

| Binance | 75.3M | 10/10 |

| Coinbase Exchange | 46.3M | 10/10 |

| Bybit | 31M | 10/10 |

| WhiteBIT | 24.8M | 8/10 |

| OKX | 24.1M | 10/10 |

Binance has the most spicy collection of monthly visits of 75.3M. Coinbase Exchange follows with 46.3M. Bybit marks 31M monthly visits. WhiteBIT and OKX document 24.8M and 24.1M, respectively.

Amongst the head five crypto centralised exchanges, except WhiteBIT, all of them impart an excellent belief rating of 10/10. WhiteBIT registers a belief rating of 8/10.

6.2. High Crypto Decentralised Exchanges

Uniswap V3 (Ethereum), Uniswap V3 (Arbitrum One), Jupiter, Orca, and Pancakeswap V3 (BSC) are the head five crypto decentralised exchanges on the premise of Market Fragment by Quantity.

| Crypto Decentralised Exchanges | % Market Fragment by Quantity | 24-Hour Quantity |

| Uniswap V3 (Ethereum) | 29.0% | $3,287,743,930 |

| Uniswap V3 (Arbitrum One) | 12.5% | $1,421,920,117 |

| Jupiter | 6.7% | $759,282,905 |

| Orca | 4.9% | $550,453,053 |

| Pancakeswap V3 (BSC) | 4.6% | $518,919,427 |

Uniswap V3 (Ethereum) dominates with 29.0% market share by volume. Uniswap V3 (Arbitrum One) follows with 12.5%. Jupiter displays 6.7%. Orca and Pancakeswap V3 (BSC) register 4.9% and 4.6%, respectively.

Amongst the head five crypto decentralised exchanges, Uniswap V3 (Ethereum) has the most spicy 24-hour volume of $3,287,743,930. Uniswap V3 (Arbitrum One) follows with $1,421,920,117 volume.

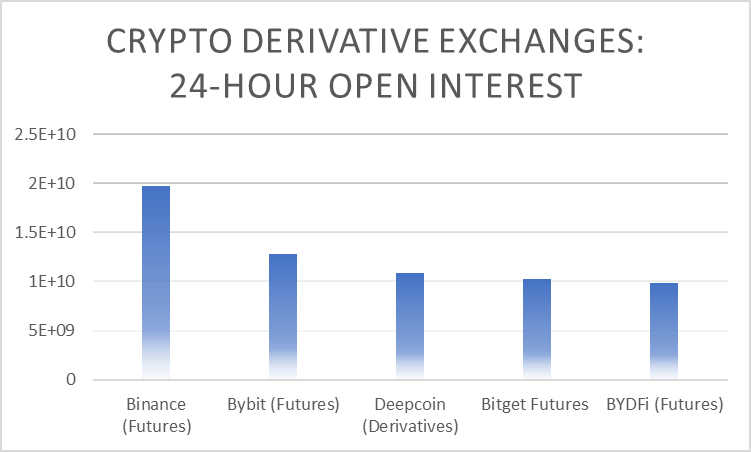

6.3. High Crypto Spinoff Exchanges

Binance (Futures), Bybit(Futures), Deepcoin (Derivatives), Bitget Futures, and BYDFi (Futures) are the head five crypto spinoff exchanges by 24-hour begin pastime.

| Crypto Spinoff Exchanges | 24-Hour Start Curiosity | 24-Hour Quantity |

| Binance (Futures) | $19,722,149,258 | $103,686,158,764 |

| Bybit (Futures) | $12,800,682,172 | $36,848,564,789 |

| Deepcoin (Derivatives) | $10,874,699,192 | $11,528,611,309 |

| Bitget Futures | $10,279,715,000 | $24,457,277,642 |

| BYDFi (Futures) | $9,845,579,609 | $11,501,719,346 |

Binance (Futures) has the most spicy 24-hour Start Curiosity of $19,722,149,258. Bybit (Futures), Deepcoin (Derivatives), and Bitget Futures are followed by $12,800,682,172, $10,874,699,192, and $10,279,715,000 respectively. BYDFi (Futures) marks an begin pastime of $9,845,579,609.

Amongst the head five crypto spinoff exchanges, Binance (Futures) has the most spicy 24-hour volume of $103,686,158,764. Bybit (Futures) and Bitget Futures be conscious with $36,848,564,789 and $24,457,277,642, respectively.

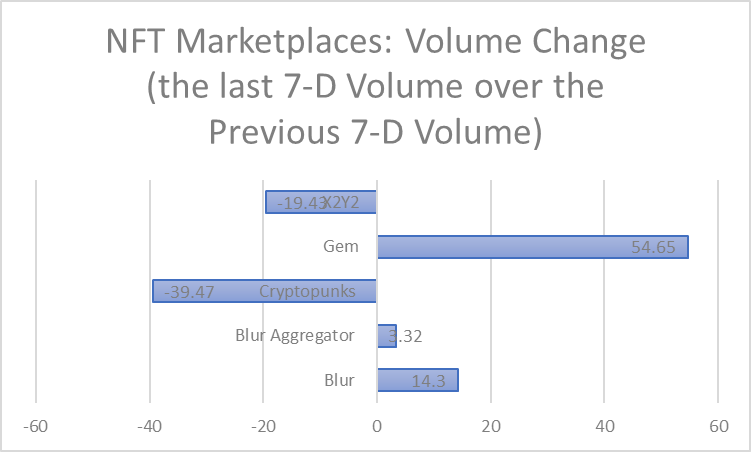

7. NFT Marketplace Weekly Analysis

Blur, Blur Aggregator, Cryptopunks, Gem, and X2Y2 are the head five NFT Marketplaces by Market Fragment. Blur has the most spicy market share of 70.40%. Blur Aggregator and Cryptopunks be conscious with 20.71% and 4.20% market share, respectively.

| NFT Marketplaces | Market Fragment | Quantity Exchange (Exchange of closing 7-D Quantity over the Previous 7-D Quantity) |

| Blur | 70.40% | +14.30% |

| Blur Aggregator | 20.71% | +3.32% |

| Cryptopunks | 4.20% | -39.47% |

| Gem | 1.54% | +54.65% |

| X2Y2 | 1.46% | -19.43% |

Amongst the head five NFT marketplaces, no decrease than three NFT marketplaces impart sure volume replace. The top probably volume replace is recorded by Gem, with +54.65% replace. Blur and Blur Aggregator be conscious with +14.30% and +3.32%, respectively. The top probably negative volume replace is registered by Cryptopunks, with -39.47% replace. X2Y2 follows with -19.43% replace.

7.1. High NFT Collectibles This Week

CryptoPunks #8796, CryptoPunks #3259, CryptoPunks #5406, CryptoPunks #5335, and CryptoPunks #2685 are the head NFT collectibles per Rate.

| NFT Collectibles | Rate |

| CryptoPunks #8796 | $191,472.92 |

| CryptoPunks #3259 | $148,803.08 |

| CryptoPunks #5406 | $143,877.09 |

| CryptoPunks #5335 | $141,559.55 |

| CryptoPunks #2685 | $141,200.36 |

CryptoPunks #8796 marks the most spicy ticket of $191,472.92. CryptoPunks #3259, and CryptoPunks #5406 be conscious with $148,803.08 and $143,877.09, respectively. CryptoPunks #5335, with $141,559.55, is the one with the fourth top probably ticket, and CryptoPunks #2685, with $141,200.36, is the fifth top probably.

8. Web3, Blockchain & Crypto Funding Analysis

8.1. Crypto Fundraising Building

| Week | Funds Raised | Form of Fundraising Rounds |

| Might perhaps perhaps 20 – 26, 2024 | $245.00M | 27 |

| Might perhaps perhaps 13 – 19, 2024 | $157.40M | 30 |

As per this week’s crypto fundraising pattern, from Might perhaps perhaps 20, 2024 till now, nearly $245.00M had been raised. Within the previous week, between Might perhaps perhaps 13 and 19, 2024, most spicy $157.40M was once raised. Clearly, the fund raised this week is no decrease than 87.6M elevated than the fund raised previous week.

8.2. Most Packed with life Investors This Week

OKV Ventures, Laser Digital, No Limit Holdings, Haun Ventures, and DuckDAO are the most active investors this week, per Deals.

| Investors (or Fund’s Name) | Deals (19 Might perhaps perhaps – 24 Might perhaps perhaps, 2024) | Investments | Lead Investments |

| OKV Ventures | 4 | 3 | 1 |

| Laser Digital | 3 | 2 | 1 |

| No Limit Holdings | 2 | 2 | 0 |

| Haun Ventures | 2 | 1 | 1 |

| DuckDAO | 2 | 2 | 0 |

OKV Ventures displays the most spicy collection of affords of 4. Laser Digital and No Limit Holdings be conscious with 3 and a couple of affords respectively. Haun Ventures and DuckDAO document 2 affords each and each. Amongst the head five most active investors, no decrease than three register lead investment. OKV Ventures, Laser Digital and Haun Ventures mark one lead investment each and each.

8.3. Crypto Fundraising By Class

Blockchain Infrastructure, Blockchain Providers, CeFi, Chain, DeFi, GameFi, NFT and Social are the classes raised funds this week.

| Class | Form of Fundraising Rounds (Might perhaps perhaps 20 – 26, 24) | Funds Raised |

| Blockchain Infrastructure | 2 | $22.00M |

| Blockchain Service | 5 | $12.70M |

| CeFi | 1 | $9.50M |

| Chain | 5 | $27.90M |

| DeFi | 7 | $17.90M |

| GameFi | 4 | $5.00M |

| NFT | 1 | N/A |

| Social | 2 | $150.00M |

Social, with a $150.00M fundraised, is the most spicy fund raised category this week. Chain, Blockchain Infrastructure, and DeFi are followed by $27.90M, $22.00M, and $17.90M, respectively. Blockchain Providers, CeFi, and GameFi, impart $12.70M, $9.50M, and $5.00M funds raised, respectively.

8.4. High Crypto Funding Locations

Aside from the undisclosed category, the US, Cayman Islands, Greece, and Russia are the head crypto investment areas, on the premise of funds raised.

| Funding Living | Funds Raised (Might perhaps perhaps 19 – 24, 2024) | Funds Raised % | Form of Rounds |

| The United States | $162.00M | 66% | 5 |

| Undisclosed | $58.40M | 24% | 20 |

| Cayman Islands | $10.00M | 4% | 1 |

| Greece | $7.70M | 3% | 1 |

| Russia | $6.90M | 3% | 1 |

The United States, which accounts for round 66% of the total investment raised, is the head investment enviornment this week; the total quantity it raised is round $162.00M. The undisclosed category accounts for nearly 24%, followed by $58.40M in funds raised. Curiously, the Cayman Islands, Greece and Russia mark $10.00M, $7.70M, and $6.90M funds raised, respectively.

8.5. Most Packed with life Crypto VC Jurisdictions

The US, Singapore, the UK, China and Seychelles are the most active crypto challenge capital jurisdictions.

| Crypto VC Jurisdiction | Form of Tasks (Might perhaps perhaps 19 – 24, 2024) |

| The US | 57 |

| Singapore | 13 |

| The UK | 8 |

| China | 8 |

| Seychelles | 5 |

Amongst the most active crypto challenge capital jurisdictions, The US has the most spicy collection of projects of 57. Singapore and The UK be conscious with 13 and eight projects, respectively. China also files 8 projects, and Seychelles registers five projects.

9. Web 3, Blockchain & Crypto Hack Updates

The general rate hacked is $7.9B. The general rate hacked in DeFi is $5.96B, and total rate hacked in Bridges is $2.83 billion.

| Total Price Hacked | $7.9B

Total Price Hacked in DeFi$5.96BTotal Price Hacked in Bridges $2.83B |

| Mission Name | Quantity Misplaced | Date |

| Gala | $22M | 20 Might perhaps perhaps, 2024 |

| ALEX | $23.9M | 16 Might perhaps perhaps. 2024 |

| pump.fun | $2M | 16 Might perhaps perhaps, 2024 |

| Sonne Finance | $20M | 15 Might perhaps perhaps, 2024 |

Gala, ALEX, pump.fun and Sonne Finance are the head four challenge hacks reported this month. The Sonne Finance hack is the fundamental reported this month. On this hack reported on 15th Might perhaps perhaps, 2024, the challenge misplaced nearly $20M. ALEX and pump.fun had been reported on 16th Might perhaps perhaps. Within the ALEX hack, nearly $23.9M was once misplaced. It’s the most spicy hack reported this month by procedure of quantity misplaced. Within the pump.fun hack, most spicy $2M was once misplaced. It’s the smallest hack this month by procedure of quantity misplaced. The Gala hack, reported on 20th Might perhaps perhaps, in which Gala misplaced over $22M, is the most modern hack reported.

Endnote

This document affords a total prognosis of the present performance of loads of blockchains and cryptocurrencies, alongside with Bitcoin, Altcoins, Stablecoins, AI Cash, Memecoins and Metaverse. It highlights trending coins, high gainers and losers, and delves into Crypto ETFs just like Bitcoin Living ETFS, Bitcoin Futures ETFs, and Ethereum Futures ETFs. Moreover, it examines centralised, decentralised, and derivatives crypto exchanges, DeFi protocols, and NFT marketplaces. The document also covers crypto fundraising actions, illustrious investors, key investment areas, and essential crypto hacks reported as of late.