Canada CPI Preview: Inflation appears to be like order for miniature uptick in December

- Canada annual CPI rises 3.4% in December.

- Canadian Greenback picks up traction after the sage.

- USD/CAD comes down from the 1.3500 zone.

Statistics Canada suggested that the User Label Index (CPI) rose 3.4% on a yr-over-yr basis in December, above the three.1% develop bigger recorded in November. The reading was as soon as in step with market consensus. On a month-to-month basis, the CPI lowered in size 0.3% in December, matching expectations and coming down from the 0.1% develop bigger viewed within the old month.

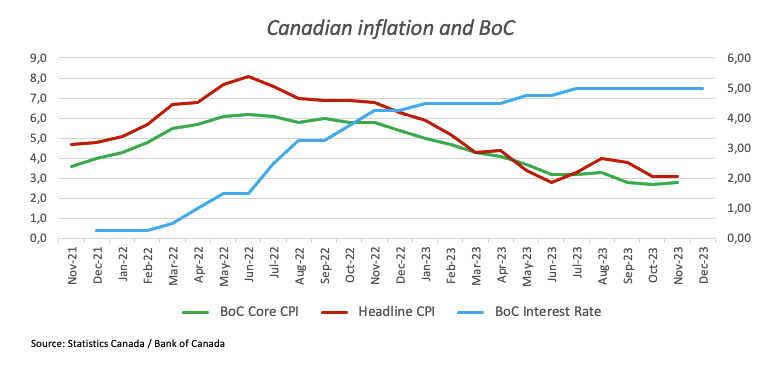

The Core CPI tracked by the Financial institution of Canada (BoC) dropped by 0.5% from a month earlier and rose 2.6% over the final twelve months, simply below the 2.8% recorded in November.

Market response to Canada inflation recordsdata

The Canadian Greenback liked rapidly after the free up, forcing USD/CAD to retreat from earlier five-week highs round 1.3500.

Canadian Greenback be conscious on the novel time

The table below reveals the percentage exchange of Canadian Greenback (CAD) in opposition to listed critical currencies on the novel time. Canadian Greenback was as soon as the strongest in opposition to the Australian Greenback.

Australian Greenback ▲0.43%

Euro ▲0.36%

Jap Yen ▲0.32%

Swiss Franc ▲0.31%

(An earlier version of this sage incorrectly acknowledged that the Canadian CPI vastly bowled over to the upside. This was as soon as corrected on January 16 at 13: 46 GMT to explain that inflation met market expectations.)

This portion below was as soon as printed as a preview of the Canadian December inflation sage at 07: 00 GMT.

- The Canadian User Label Index is viewed rising 3.3% YoY in December.

- The BoC launched its Business Outlook Survey (BOS).

- The Canadian Greenback navigates the build of four-week lows in opposition to the US Greenback.

Canada is determined to free up vital inflation-related recordsdata on Tuesday. Statistics Canada will put up User Label Index (CPI) for December, which is expected to portray a yr-on-yr develop bigger of 3.3%, a bit of elevated than the three.1% recorded in November. On a month-to-month basis, the index is anticipated to claim no by 0.3% following a 0.1% develop bigger within the old month. The suggestions free up has the prospective to switch the Canadian Greenback (CAD), which has remained faded in opposition to the US Greenback (USD) and is for the time being procuring and selling round four-week lows shut to the 1.3400 zone.

To boot to the CPI recordsdata, the Financial institution of Canada (BoC) will additionally put up the Core User Label Index. This index excludes unstable ingredients such as food and energy costs. In November, the BoC Core CPI showed a month-to-month develop bigger of 0.1% and a yr-on-yr develop bigger of two.8%. These figures will likely be closely watched as they’ve the prospective to affect the course of the Canadian Greenback (CAD) and shape expectations for the Financial institution of Canada’s monetary policy.

What to hand over up for from Canada’s inflation rate?

Analysts hand over up for extra softening of be conscious pressures all the best procedure thru Canada in December. Inflation, as quantified by annual shifts within the User Label Index, is projected to resume the uptrend within the final month of the yr, in step with what came about in most of Canada’s G10 peers, particularly its neighbour, the US. Following August’s uptick to 4%, the CPI has trended downward, while all inflation gauges, such because the Core CPI, are expected to possess moderated as successfully, signaling more tempered rate will increase but persistence above the Financial institution of Canada’s 2% honest.

If the approaching recordsdata validates the expected lack of momentum in disinflationary pressures, traders can also accept as true with the probability that the central bank can also retain the novel charges for longer than within the commence anticipated, even supposing extra tightening of the monetary instances appears to be like to be off the table.

With the global discussion centered on prospective hobby rate reductions by monetary authorities in 2024, the unexpected maintain-up of inflationary pressures would, at this point, instructed central banks to retain their ongoing restrictive stance rather then lean towards additional tightening. The latter order of affairs will possess to require a inviting and continual resurgence of be conscious pressures and a unexpected bout of prospects’ seek recordsdata from, all of which seem highly unlikely for the foreseeable future.

In his closing remarks of the yr in December, BoC Governor Tiff Macklem reported that the Governing Council would continue discussing whether or not monetary policy is sufficiently restrictive and the length it is going to reside in that order. He anticipated that sing and employment would portray sing later in 2024, with inflation drawing approach the 2% target. Acknowledging the industrial sing slowdown till mid-2023, he projected it to persist into 2024. Macklem mentioned that it was as soon as untimely to switch in quest of reducing the policy rate, emphasizing that even supposing inflation had lowered, it remained elevated.

When is the Canada CPI recordsdata due and how can also it affect USD/CAD?

Canada is scheduled to unveil the User Label Index for December 2023 on Tuesday at 13: 30 GMT. The doubtless affect on the Canadian Greenback stems from shifts in monetary policy expectations by the Financial institution of Canada. Alternatively, the affect might per chance even be restrained, on condition that – equivalent to the Federal Reserve and other central banks – the Financial institution of Canada is anticipated to possess completed rate hikes amid declining inflation and a slowdown in financial sing.

The USD/CAD has began the novel procuring and selling yr in quite a bullish vogue, even supposing the uptrend appears to be like to possess met a staunch barrier all the best procedure thru the 1.3450 zone. This preliminary build of resistance additionally appears to be like underpinned by the proximity of the excessive 200-day Uncomplicated Consuming Moderate (SMA) round 1.3480.

Per Pablo Piovano, FXStreet’s Senior Analyst, “USD/CAD would likely face the prospects for extra losses as long as it trades below the diverse 200-day SMA. The bearish tone is additionally viewed intensifying within the match of a sustainable breach of the December low of 1.3177 (December 27).”

Pablo provides: “A if truth be told perfect maintain-up of market exercise in CAD would necessitate ravishing inflation figures. While below-expectation numbers can also favour the quest for of capability hobby rate cuts by the BoC within the next month and hence put the Loonie below additional promoting stress, the rebound within the CPI – in step with its neighbour, the US – can also lend some wings to the Canadian Greenback, albeit to a sensible extent. A elevated-than-expected inflation reading would develop bigger stress on the Financial institution of Canada to withhold elevated charges for an prolonged interval, doubtlessly leading to a prolonged interval of many Canadians going thru challenges with elevated hobby charges, as underscored by Financial institution of Canada Governor Macklem in his December remarks.”

Economic Indicator

Canada User Label Index – Core (MoM)

The core User Label Index, launched by Statistics Canada on a month-to-month basis, represents changes in costs for Canadian patrons by evaluating the rate of a fastened basket of goods and services. The core CPI excludes the more-unstable food and energy categories and it is thought of a measure of underlying inflation. The MoM establish compares the costs of goods within the reference month to the old month. On the entire, a high reading is viewed as bullish for the Canadian Greenback (CAD), while a low reading is viewed as bearish.

Recordsdata on these pages contains forward-taking a search for statements that possess risks and uncertainties. Markets and devices profiled on this web page are for informational functions entirely and might not in any admire encounter as a advice to comprehend or sell in these sources. You’re going to possess to gain your possess thorough study sooner than making any funding choices. FXStreet doesn’t in any admire assert that this recordsdata is free from mistakes, errors, or cloth misstatements. It additionally doesn’t assert that this recordsdata is of a successfully timed nature. Investing in Begin Markets entails a broad deal of hassle, together with the lack of all or a portion of your funding, as successfully as emotional misery. All risks, losses and costs related to investing, together with total lack of critical, are your accountability. The views and opinions expressed in this text are those of the authors and gain not necessarily replicate the reliable policy or build of dwelling of FXStreet nor its advertisers. The author isn’t very going to be held accountable for recordsdata that is chanced on on the slay of hyperlinks posted on this web page.

If not in every other case explicitly mentioned within the body of the article, on the time of writing, the author has no build of dwelling in any stock mentioned in this text and no trade relationship with any firm mentioned. The author has not obtained compensation for writing this text, rather then from FXStreet.

FXStreet and the author gain not present personalized solutions. The author makes no representations as to the accuracy, completeness, or suitability of this recordsdata. FXStreet and the author isn’t very going to be accountable for any errors, omissions or any losses, injuries or damages bobbing up from this recordsdata and its declare or exercise. Errors and omissions excepted.

The author and FXStreet aren’t registered funding advisors and nothing in this text is supposed to be funding advice.