BlackRock’s space Bitcoin ETF surpasses $10B in AUM, quicker than any a number of to this point

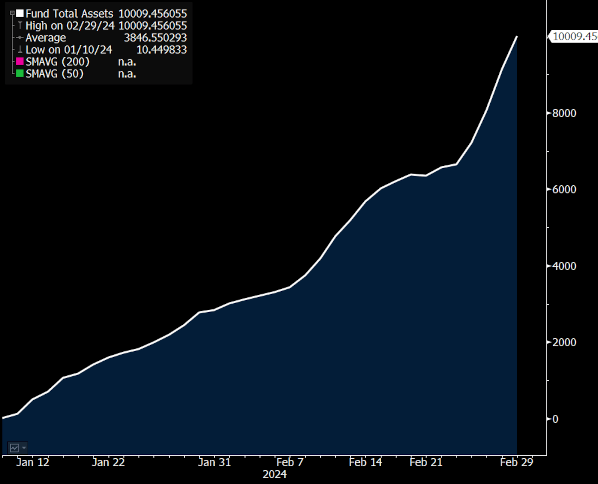

BlackRock’s iShares Bitcoin Have faith (IBIT) now has bigger than $10 billion in sources beneath administration (AUM), in accordance with data from CoinGlass.

Bloomberg ETF analyst Eric Balchunas notable that IBIT is one in every of proper 152 alternate-traded funds (ETFs) which have reached the $10 billion mark. At the second, roughly 3,400 ETFs exist in entire.

He noticed that IBIT is the fastest to reach $10 billion in AUM. The fund started trading decrease than two months ago on Jan. 11, that system that it reached its most modern stage in decrease than two months. ETF.com individually notable that the first gold ETF didn’t reach $10 billion in AUM for 2 years.

The competing Grayscale Bitcoin Have faith (GBTC) reports a greater AUM, with $27 billion in sources beneath administration. On the opposite hand, GBTC originated as an investment fund in 2013 earlier than it used to be transformed to an ETF this year, and unlike BlackRock’s IBIT, it didn’t start with zero sources.

The third finest space Bitcoin ETF, the Constancy Wise Origin Bitcoin Fund (FBTC), now holds $6.5 billion in sources beneath administration. All ten present space Bitcoin ETFs have $48.2 billion in AUM blended.

Causes for IBIT’s mutter

Balchunas implied that IBIT’s rising AUM is thanks to inflows. He urged that ETFs most regularly battle to enact the first $10 billion in AUM because that cost must create from inflows, whereas the second $10 billion is less complicated to enact thanks to market appreciation.

IBIT surpassed the $10 billion mark on March 1. Around that time, the ETF reported $7.7 billion in inflows since open, including $603 million in inflows on Feb. 29. According to Balchunas, this makes IBIT the ETF with the third-longest speed of inflows.

Rising Bitcoin prices would possibly possibly presumably well be an additional contributor to IBIT’s mutter. As of March 4, Bitcoin is worth $67,200. Its designate is up 25.3% over the last week and up 51.0% over two months.

Furthermore, definite monetary establishments, including Monetary institution of The US’s Merrill Lynch and Wells Fargo, have reportedly begun to give earn admission to to BlackRock’s Bitcoin ETF and competing alternate-traded funds. This construction would possibly possibly presumably well have contributed to contemporary mutter.