Bitcoin ETF Makes Waves: Volumes Surge $10 Billion 3 Days

Bitcoin Self-discipline Substitute-Traded Funds (ETFs) ranking once extra garnered the dignity of crypto fans and investors because the merchandise ranking witnessed a whopping $10 billion in total buying and selling volume within the first three days of buying and selling.

Bitcoin Self-discipline ETF Sees Important Uptick In Day 3 Shopping and selling

The enchancment used to be published by Bloomberg Intelligence analyst James Seyffart on the social media platform X (previously Twitter). The knowledge shared by the analyst demonstrates a company desire for exposure to digital resources via regulated financial markets.

Seyffart’s X put up delves in on the information from the “Bitcoin ETF Cointucky Derby.” Per the analyst, “ETFs traded almost $10 billion in total all the plan in which via the last 3 days.”

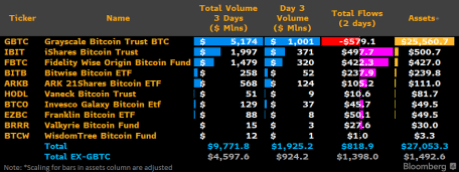

The analyst also equipped a digital direct of the information to extra account for on the huge buying and selling volume. With a total volume of over $5 billion, Grayscale Bitcoin Belief (GBTC) stands out because the stop performer amongst the primary financial corporations.

Meanwhile, iShares Bitcoin Belief (IBIT) and Fidelity Wise Initiating Bitcoin Fund (FBTC) reach next in line. The information shows that the financial corporations witnessed an total buying and selling volume of $1.997 billion and $1.479 billion, respectively.

ARK’s 21Shares ETF (ARKB) and Bitwise Bitcoin ETF (BTTB) followed behind with an unlimited total buying and selling volume of $568 million and $258 million, respectively. This spike in buying and selling volume signifies that every institutional and individual investors are increasing extra relaxed utilizing susceptible funding engines to alternate BTC.

Even though Grayscale’s Bitcoin fund continues to construct the highest total buying and selling volume, the fund has viewed valuable withdrawals from investors searching for to diminish their exposure.

There ranking been withdrawals totaling extra than $579 million since Grayscale started buying and selling on January 11. Currently, Grayscale is serene regarded as the “Liquidity King” of the Bitcoin web 22 situation ETFs.

Nevertheless, Bloomberg analyst Eric Balchunas anticipates that Blackrock would possibly maybe maybe maybe oversee Grayscale to claim the title. “IBIT conserving consequence in be one maybe to overtake GBTC as Liquidity King,” he talked about.

3-Day Shopping and selling Surpassed 500 ETFs In 2023

Following the direct, Eric Balchunas has equipped a context for the huge surge of these merchandise. The analyst did so by comparing the buying and selling volume of BTC ETFs to the total ETFs that had been launched in 2023.

“Let me place into context how insane $10b in volume is within the first 3 days. There ranking been 500 ETFs launched in 2023,” Balchunas talked about. Per him, the 500 ETFs done a $450 million mixed volume on the fresh time, and the most productive one did $45 million.

To boot, Balchunas highlighted that Blackrock‘s BTC ETF demonstrates a greater efficiency than the 500 ETFs. “IBIT on my own is seeing extra activity than your complete ’23 Freshman Class,” he talked about. It is some distance extraordinary that half of of the ETFs launched in 2023 recorded an total buying and selling volume of “decrease than $1 million” on the fresh time.

Balchunas also confused out the sphere in acquiring volume, noting that it’s tougher than flows and resources. Here is for the reason that volume has to reach lend a hand in truth within the marketplace, which provides an “ETF lasting energy.”

Featured picture from iStock, chart from Tradingview.com

Disclaimer: The article is equipped for academic purposes only. It does now not record the opinions of NewsBTC on whether to rob, promote or lend a hand any investments and naturally investing carries dangers. You are suggested to habits your have research sooner than making any funding choices. Disclose recordsdata equipped on this net region completely at your have threat.