Avalanche (AVAX) Place Bounces Support Above $30 – Has it Reached a Bottom?

The Avalanche (AVAX) stamp has fallen by virtually 40% since its 2023 excessive of $50 on December 24.

Despite the bearish pattern, AVAX trades in a corrective pattern and bounced sharply the day prior to this.

Avalanche Falls After Yearly Excessive

The technical diagnosis of the weekly time frame presentations that the AVAX stamp has fallen since reaching a excessive of $50 in December 2023. The lower has been swift, with the stamp constructing a bearish engulfing candlestick the following week (red icon).

The day prior to this, AVAX fell to a low of $27.21 and bounced. The leap validated a prolonged-time interval horizontal dwelling from which the stamp previously broke out. AVAX is in the process of constructing a prolonged lower wick (green icon).

The weekly Relative Strength Index (RSI) offers an undetermined discovering out.

When evaluating market circumstances, merchants utilize the RSI as a momentum indicator to fetch out whether a market is overbought or oversold and whether to obtain or promote an asset.

If the RSI discovering out is above 50 and the pattern is upward, bulls calm enjoy a bonus, nevertheless if the discovering out is below 50, the opposite is correct. The RSI is falling nevertheless above 50, a signal of an undetermined pattern.

What Are Analysts Asserting?

Cryptocurrency merchants and analysts on X enjoy a bullish scrutinize of the prolonged creep pattern. MTI Trading believes that AVAX has virtually reached its bottom. He tweeted:

$AVAX is already 45% down. Rather of bit more and likewise you would possibly presumably enjoy got an appropriate entry for the bull creep. While you happen to love to need to be more protected suitable now stay awake for the following steal signal!

Wolf Of Altcoins means that AVAX will most certainly be one in all the cryptocurrencies that will increase 10x this bull creep, whereas TOP GAINER TODAY mentioned that AVAX will inch to $50 or even $100.

AVAX Place Prediction: Is the Bottom Shut?

The technical diagnosis of the day after day time frame would now not insist the pattern’s direction. Alternatively, it means that AVAX will attain a bottom rapidly.

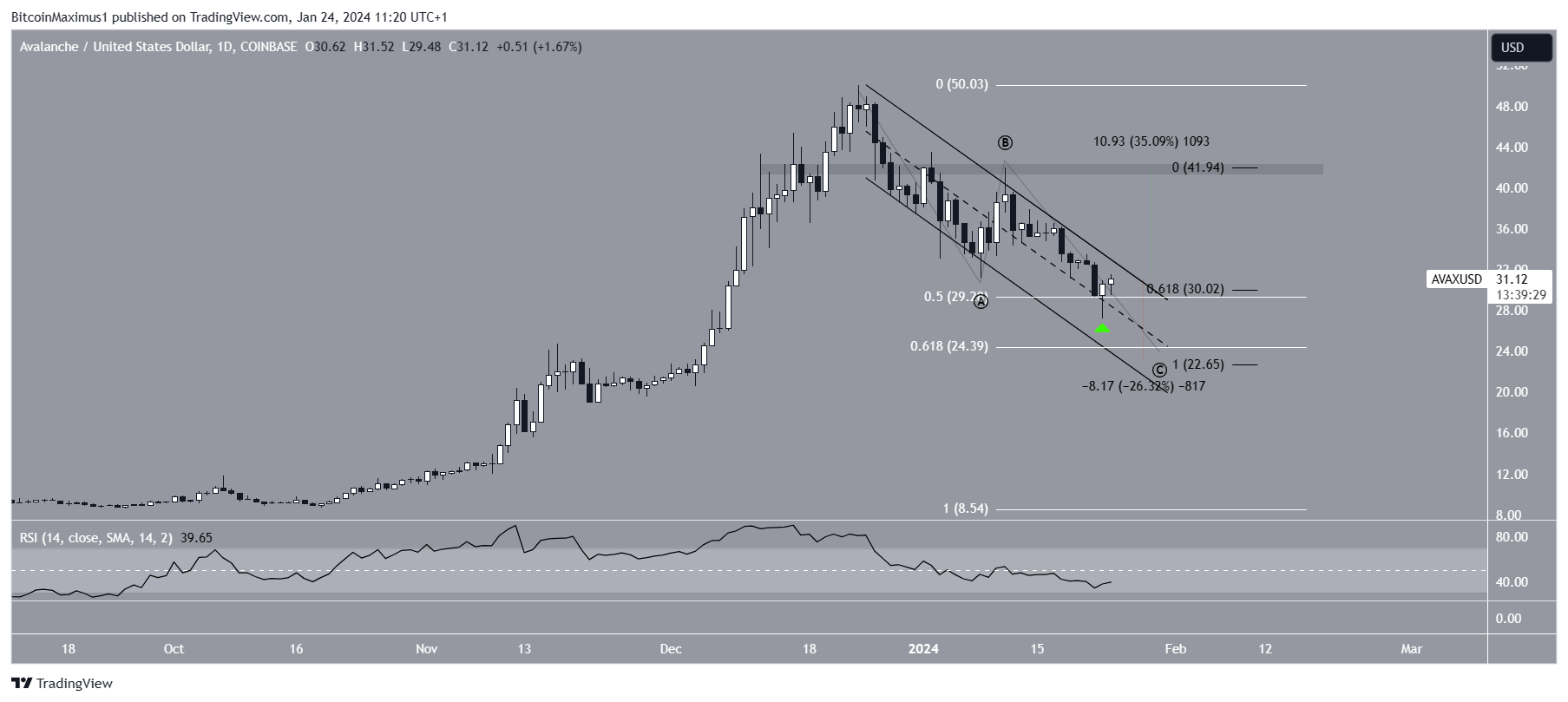

Ensuing from the December 2023 excessive, AVAX has fallen internal a descending parallel channel. Such channels steadily possess corrective actions.

The day prior to this, AVAX bounced on the channel’s midline (green icon) and the 0.5 Fib retracement toughen stage.

The wave depend also helps the introduction of a bottom. Technical analysts make utilize of the Elliott Wave belief as a technique to establish routine prolonged-time interval stamp patterns and investor psychology, which helps them favor the direction of a pattern.

The presumably wave depend means that AVAX is in the C wave of an A-B-C corrective constructing. To this level, waves A:C enjoy a 1:0.618 ratio. Alternatively, the day after day RSI would now not insist the underside for the explanation that indicator is below 50.

If AVAX breaks out from the channel, it would possibly magnify 35% to the closest resistance at $42.

Despite the bullish AVAX stamp prediction, falling below the day prior to this’s low of $27.22 will mean the stamp is calm correcting. Then, AVAX can fall 26% to the channel’s toughen pattern line at $22.65. It would possibly presumably well give waves A:C a 1:1 ratio.

For BeInCrypto‘s newest crypto market diagnosis, click here.

Disclaimer

Per the Belief Mission pointers, this stamp diagnosis article is for informational functions handiest and would possibly presumably well now not be regarded as monetary or funding advice. BeInCrypto is dedicated to acceptable, self sustaining reporting, nevertheless market circumstances are field to commerce without evaluate. Constantly conduct your possess study and consult with a talented sooner than making any monetary choices. Please indicate that our Phrases and Conditions, Privateness Policy, and Disclaimers were as much as this level.