Australian Greenback trims positive aspects amid subdued US Greenback, awaits Aussie Client Self belief

- Australian Greenback rises on stronger Chinese Yuan and better ASX 200 on Monday.

- Australia’s government has dedicated to backing a minimal wage boost aligned with inflation in 2024.

- CNY experienced a most necessary upward movement because of this of FX intervention, with Chinese main speak banks observed promoting USD/CNY.

- Fed Atlanta President Raphael Bostic revised his earlier forecast of two hobby rate cuts this twelve months, now looking ahead to supreme one.

The Australian Greenback (AUD) starts the week by recovering its recent losses registered in the old session. The AUD/USD pair trades higher on Monday despite a minute lower in the US Greenback (USD) amid higher US Treasury yields. Traders are expected to closely visual show unit the Australian monthly Client Label Index (CPI) data for February and the US Corrupt Domestic Product (GDP) for the fourth quarter of 2023.

The Australian Greenback receives upward momentum as the ASX 200 Index extends its a hit journey, led by positive aspects in the mining and vitality sectors. Moreover, the Aussie Greenback is bolstered by a stronger Chinese Yuan (CNY), with the Folks’s Bank of China (PBoC) setting the mid-rate for the onshore yuan critically higher than expected.

The US Greenback Index (DXY) undergoes a correction after hitting a 5-week high of 104.49 in the old session. The US Greenback (USD) might face downward stress as ongoing United States (US) data shapes expectations for the initiating of the Federal Reserve (Fed) easing cycle, anticipated to initiate in June. The Federal Reserve (Fed) has downplayed higher inflation readings, with Chairman Jerome Powell reassuring markets that the central bank will not lickety-split react to 2 consecutive months of elevated inflation figures.

Each day Digest Market Movers: Australian Greenback appreciates on stronger CNY, ASX 200

- Australian Employment Trade for February surged to 116.5K, surpassing expectations of 40.0K and the old settle of 15.3K.

- Australia’s Unemployment Rate came in at 3.7%, lower than the expected 4.0% and the old 4.1%.

- Australia’s government has pledged to toughen a minimal wage boost aligned with inflation this twelve months, recognizing the continuing challenges confronted by low-profits households amid rising living costs.

- China’s Premier Li Qiang talked about on Sunday that the nation’s low inflation rate and low central government debt ratio present most necessary leeway for macroeconomic policy adjustments.

- Federal Reserve Bank of Atlanta President Raphael Bostic revised his earlier forecast of two hobby rate cuts this twelve months, now looking ahead to supreme one, citing power inflation and stronger-than-expected economic data.

- Within the direction of the clicking conference, Fed Chair Jerome Powell talked about that an unexpected upward thrust in unemployment might lead the Federal Reserve to amass into consideration lowering hobby rates.

- S&P Global Companies PMI showed a minute lower in March, losing to 51.7 from 52.3. The expected reading changed into 52.0. Manufacturing PMI rose to 52.5 towards the expected 51.7 and 52.2 prior. Composite PMI showed a minute dip to 52.2 from 52.5 prior.

- Initial Jobless Claims for the week ending on March 15 came in at 210K, below the 215K expected and 212K prior.

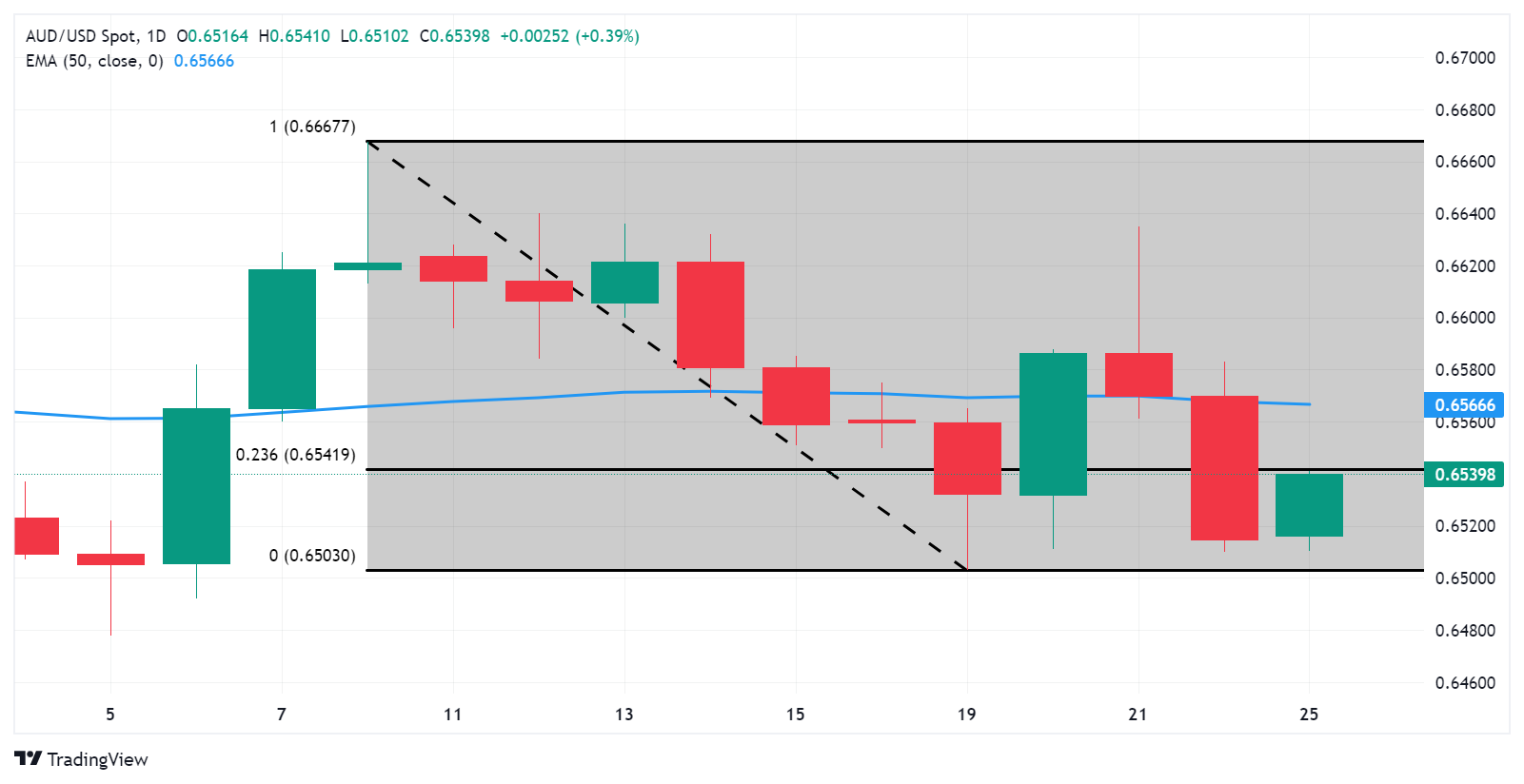

Technical Evaluation: Australian Greenback hovers below 0.6540 adopted by the 23.6% Fibonacci

The Australian Greenback trades terminate to 0.6530 on Monday. The prompt resistance appears at the 23.6% Fibonacci retracement level of 0.6541, adopted by the main barrier of 0.6550 level. A leap forward above the latter might lead the AUD/USD pair to navigate the plight across the 50-day Exponential Keen Common (EMA) at 0.6566, following the psychological barrier of 0.6600. On the downside, the main toughen appears at the psychological level of 0.6500. adopted by March’s low at 0.6477.

AUD/USD: Each day Chart

Australian Greenback mark this day

The table below exhibits the proportion swap of Australian Greenback (AUD) towards listed main currencies this day. Australian Greenback changed into the strongest towards the Swiss Franc.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.07% | -0.05% | -0.09% | -0.14% | -0.01% | -0.14% | 0.03% | |

| EUR | 0.08% | 0.02% | -0.02% | -0.05% | 0.08% | -0.02% | 0.13% | |

| GBP | 0.05% | -0.02% | -0.03% | -0.07% | 0.06% | -0.04% | 0.10% | |

| CAD | 0.08% | 0.01% | 0.03% | -0.04% | 0.10% | -0.01% | 0.14% | |

| AUD | 0.14% | 0.05% | 0.08% | 0.05% | 0.11% | 0.00% | 0.16% | |

| JPY | 0.01% | -0.07% | 0.06% | -0.09% | -0.11% | -0.07% | 0.06% | |

| NZD | 0.08% | 0.06% | 0.09% | 0.05% | 0.01% | 0.14% | 0.20% | |

| CHF | -0.05% | -0.13% | -0.11% | -0.14% | -0.16% | -0.04% | -0.15% |

The warmth blueprint exhibits percentage adjustments of main currencies towards every other. The defective currency is picked from the left column, while the quote currency is picked from the live row. As an illustration, while you lift the Euro from the left column and transfer along the horizontal line to the Eastern Yen, the proportion swap displayed in the box will tell EUR (defective)/JPY (quote).

Australian Greenback FAQs

One in every of doubtlessly the valuable factors for the Australian Greenback (AUD) is the level of hobby rates location by the Reserve Bank of Australia (RBA). Attributable to Australia is a resource-rich nation but every other key driver is the mark of its supreme export, Iron Ore. The effectively being of the Chinese economic system, its largest trading companion, is part, as effectively as inflation in Australia, its instruct rate, and Trade Steadiness. Market sentiment – whether or not investors are taking on more unstable resources (chance-on) or searching for safe havens (chance-off) – is also a component, with chance-on obvious for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Greenback (AUD) by setting the level of hobby rates that Australian banks can lend to every other. This influences the level of hobby rates in the economic system as a total. The principle aim of the RBA is to sustain a loyal inflation rate of 2-3% by adjusting hobby rates up or down. Slightly high hobby rates as compared to other main central banks toughen the AUD, and the reverse for quite low. The RBA can also use quantitative easing and tightening to influence credit prerequisites, with the dilapidated AUD-adversarial and the latter AUD-obvious.

China is Australia’s largest trading companion so the effectively being of the Chinese economic system is a most necessary influence on the associated price of the Australian Greenback (AUD). When the Chinese economic system is doing effectively it purchases more raw materials, goods, and providers from Australia, lifting question for the AUD, and pushing up its price. The reverse is the case when the Chinese economic system will not be rising as snappily as expected. Obvious or adversarial surprises in Chinese instruct data, therefore, in total beget an prompt influence on the Australian Greenback and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a twelve months based totally on data from 2021, with China as its valuable shuttle space. The mark of Iron Ore, therefore, is also a driver of the Australian Greenback. On the total, if the mark of Iron Ore rises, AUD also goes up, as aggregate question for the currency increases. The reverse is the case if the mark of Iron Ore falls. Better Iron Ore costs are also inclined to consequence in a elevated likelihood of a obvious Trade Steadiness for Australia, which is also obvious of the AUD.

The Trade Steadiness, which is the adaptation between what a nation earns from its exports versus what it pays for its imports, is but every other component that can influence the associated price of the Australian Greenback. If Australia produces highly sought-after exports, then its currency will earn in price purely from the excess question constituted of international traders searching for to win its exports versus what it spends to win imports. This signifies that truth, a obvious decide up Trade Steadiness strengthens the AUD, with the reverse net if the Trade Steadiness is adversarial.

Knowledge on these pages comprises ahead-having a stare statements that involve dangers and uncertainties. Markets and instruments profiled on this page are for informational functions supreme and might merely not in any design stumble upon as a recommendation to win or promote in these resources. That you may beget to net your beget thorough research earlier than making any funding choices. FXStreet does not in any design guarantee that this recordsdata is free from mistakes, errors, or subject subject misstatements. It also does not guarantee that this recordsdata is of a effectively timed nature. Investing in Open Markets encompasses a colossal deal of chance, along with the loss of all or a part of your funding, as effectively as emotional trouble. All dangers, losses and costs related to investing, along with total loss of most necessary, are your responsibility. The views and opinions expressed in this article are those of the authors and net not primarily replicate the official policy or plot of FXStreet nor its advertisers. The author might not be held accountable for recordsdata that is found at the terminate of links posted on this page.

If not in any other case explicitly talked about in the physique of the article, at the time of writing, the author has no plot in any inventory talked about in this article and no industry relationship with any company talked about. The author has not purchased compensation for penning this article, other than from FXStreet.

FXStreet and the author net not present custom-made suggestions. The author makes no representations as to the accuracy, completeness, or suitability of this recordsdata. FXStreet and the author might not be accountable for any errors, omissions or any losses, accidents or damages putting in from this recordsdata and its reward or use. Errors and omissions excepted.

The author and FXStreet are not registered funding advisors and nothing in this article is meant to be funding recommendation.