Publishers’ advert revenue rebounded within the first half, but H2 is having a peep even brighter

The crisp autumn drag is now not any longer the supreme breath of unusual air washing over the media commerce this season.

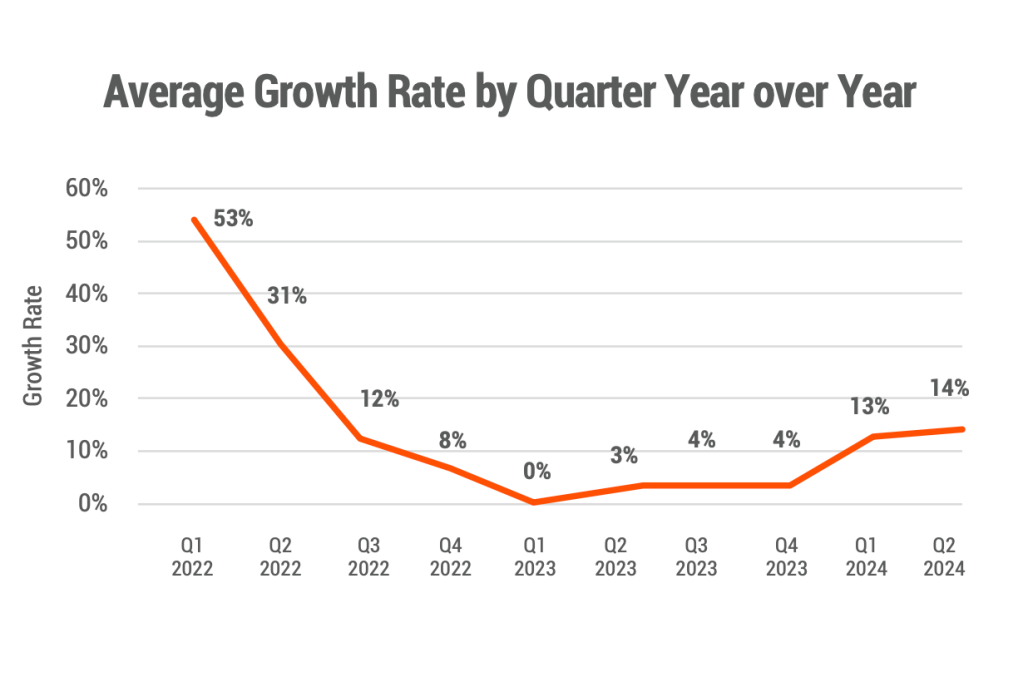

In step with basically the most in kind Media Ad Gross sales Pattern Flash Yarn from publisher advert administration provider Boostr, centered on the first half of 2024, there are many clear advert gross sales vogue lines showing that the doldrums of 2023 would be over — a minimal of for now.

Deal size of voice-sold selling campaigns (starting from customized dispute to programmatic assured) and RFP volume had been both up in Q1 and Q2 this twelve months. Meanwhile, clear rebounds are happening with revenue retention and overall common advert revenue development charges, among the more than 100 U.S.-basically based digital publishers surveyed for this voice that spend Boostr’s platform.

“There’s a quantity of impartial correct data, which it’s impartial correct to peep the commerce starting to rebound. I agree with we hit an inflection point for a quantity of media firms this twelve months,” acknowledged Patrick O’Leary, CEO and founding father of Boostr.

But three publishers told Digiday that while Q1 was as soon as stable, Q2 was as soon as serene quite “at ease,” which manner slight declines in advert revenue twelve months over twelve months, though they’re awaiting a bump within the second half to form up for that. One publisher exec, who spoke on the condition of anonymity, acknowledged that pre-booked revenue in H2 is up twelve months over twelve months and by all accounts it appears to be like to be just like the advert revenue earned in Q4 will form up for “a quantity of the gap” in Q2 this twelve months.

Right here’s a peep at how the digital media commerce fared within the first half of 2024.

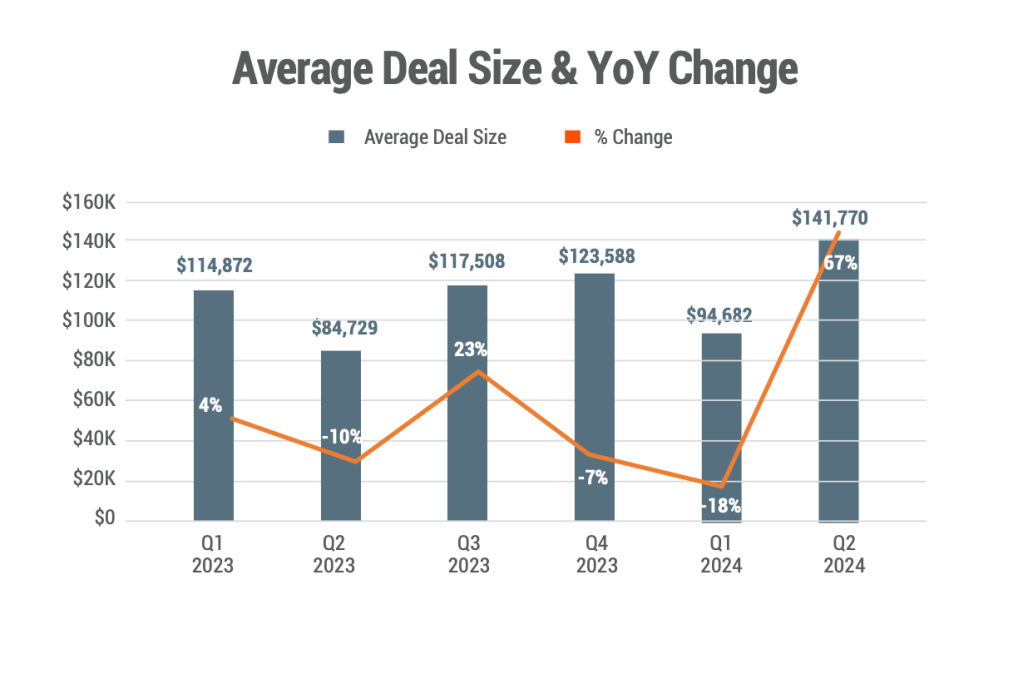

Whereas there may be serene a rebound with common advert revenue development charges, one in every of the standout stats from the voice was as soon as that the second quarter of the twelve months had the supreme common deal size since Q1 2023, at $141,770, up 67% twelve months over twelve months. The common deal size within the first quarter, nonetheless, was as soon as down 18% twelve months over twelve months at much less than $95,000.

Some of right here’s seasonal in nature, basically based on O’Leary. But a second media exec, who additionally spoke on the condition of anonymity, acknowledged they had been seeing overall development in deal sizes no longer impartial correct within the first half of 2024, but a persevered vogue within the serve half of the twelve months as effectively.

“A better share of our revenue is coming thru capabilities driven both by tournament sponsorships or customized dispute. So those are better overall deals to initiate with,” acknowledged the second media exec. “Whether or no longer which manner their overall budgets are up or I’m taking fragment, I don’t continuously know.”

RFP volume & class breakdown

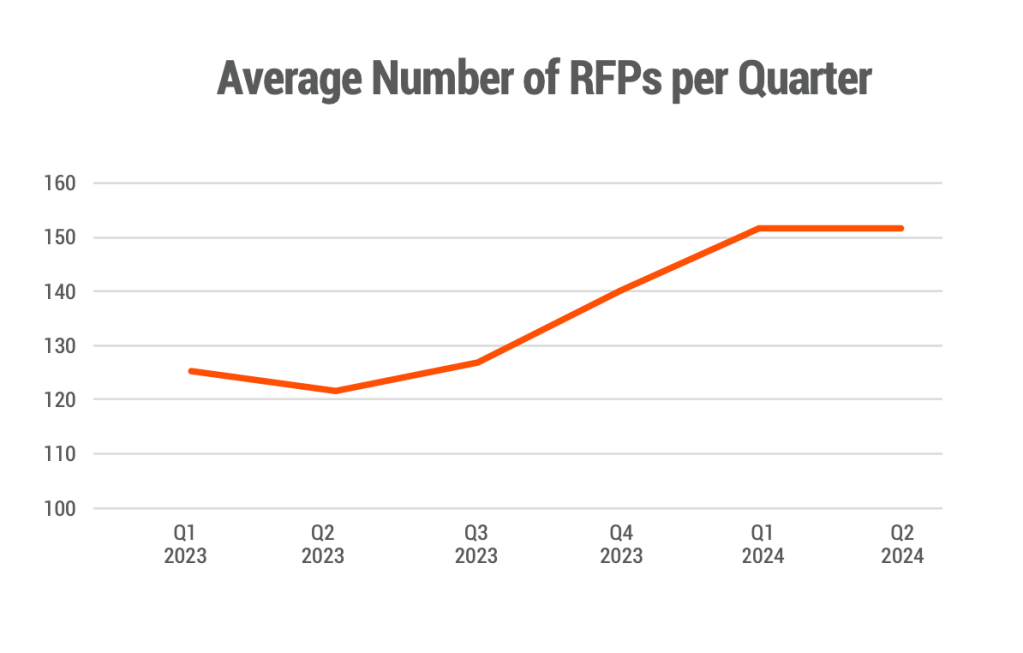

Yet every other upward vogue within the voice was as soon as RFP volume within the first half of the twelve months. In Q1, the substitute of proposal requests that the surveyed publishers bought from advertisers was as soon as up 9% twelve months over twelve months and up 17% twelve months over twelve months in Q2.

O’Leary acknowledged many of the advertiser classes quite of increased their RFP volume in Q1, with explicit twelve months-over-twelve months upticks in utilities and power (up 123%), genuine estate (up 93%) and legitimate companies and products (up 70%) within the quarter.

Within the second quarter, high twelve months-over-twelve months development classes for RFP volumes integrated utilities and power (up 100%), tech and telcomm (up 68%) and legitimate companies and products (up 63%), but a pair classes saw slight twelve months-over-twelve months decreases: grownup and gambling (down 36%) and genuine estate (down 13%).

The second media exec reported that tech, legitimate companies and products and opulent had been three stable classes up to now this twelve months, though they’re awaiting a decline in luxurious come 2025 basically based on among the firms’ contemporary earnings.

“RFP volumes had been up … but [advertisers are] giving [publishers] much less time to initiate these objects,” acknowledged O’Leary. “More of it is miles happening in-quarter and they’re better … There’s impartial correct a quantity of extra stress to attain issues.”

Booked-in quarter stats had been high, but that appears to be like to be to be altering in H2

One vogue that’s held, impartial about since the pandemic, has been the in-quarter booking.

O’Leary acknowledged that 65% of the deals that came about in Q1 had been booked and started inside of the quarter, and in Q2 that quantity increased to 71%, that manner some distance fewer deals had been booked earlier than the quarter starting.

Because there are heavier pick campaigns being booked within the second half of the twelve months, like customized dispute and tournament sponsorships, the second media exec acknowledged their gross sales team is dispensed longer lead times to devise and attain the deals. “We’re manner forward in bookings for Q4 but [I’m still] tendering my excitement at this point, so we’re seeing that form of early booking vogue [come back into the fold],” they acknowledged.

Given it’s an election twelve months as effectively, the scamper of political advertisers is causing some stress on non-political advertisers to scoop up advert stock, critically within the serve half of the twelve months, which is taking into legend more clarity in media pros’ revenue forecasting.

A Third media exec, who spoke anonymously for this legend, acknowledged, “All media sources upward thrust in a political local climate, and the of us who in actual fact fight are the advertisers which can also be looking out for stock to favor that the political campaigns agree with left available. Which is why I agree with you’re seeing … more voice exhaust happening within the second half of the twelve months, because they know within the occasion that they don’t favor it up, that it obtained’t be available come that final push of the election.”

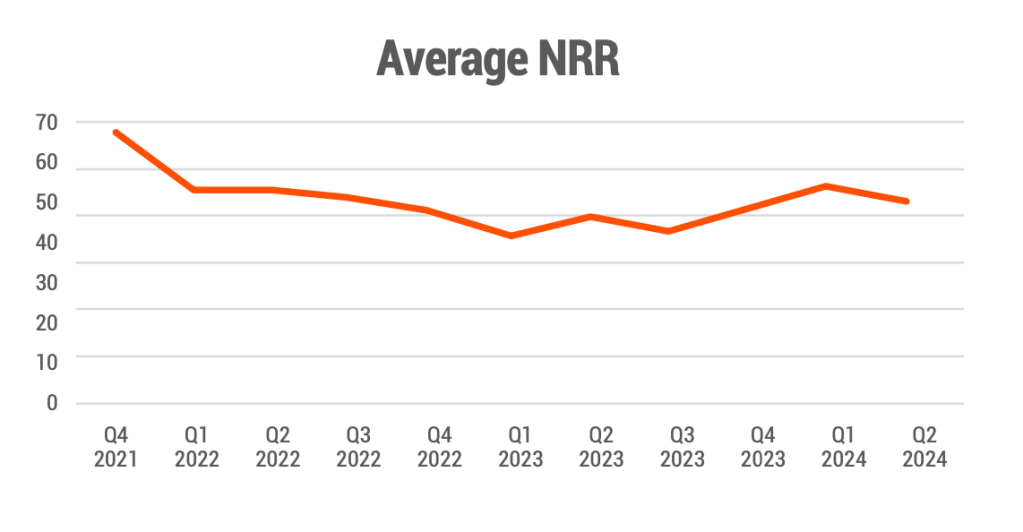

Income retention is taking a turn for the upper

Fetch revenue retention (NRR) — which measures advert revenue coming from present clientele versus unusual advertisers — has improved within the first two quarters of the twelve months compared to 2023, but it’s serene quite flat from the previous two years. This stat showed an uptick of 13% twelve months over twelve months in Q1, with 55% of publishers’ advert revenue, on common, coming from present advertisers within the quarter. And in Q2, NRR was as soon as 51%, up 4% twelve months over twelve months.

“All americans was as soon as looking forward to a recession final twelve months, sitting on the sidelines. It appears to be like like that dread is over,” acknowledged O’Leary.

“The first half of the twelve months, I agree with some budgets had been being held serve or reserved, and I agree with we’re starting to peep those budgets win unlocked within the second half of the twelve months,” acknowledged Amanda Martin, CRO of Mediavine, which sells commercials for more than 11,000 digital publishers. Q2 in explicit was as soon as quite at ease, she reported.

And while some of right here’s because of the the seasonality upswing of the serve half of the twelve months being stronger for a basically programmatic publisher, Martin acknowledged “we peep the second half of 2024 to be trending in a stable route.”