US Bitcoin Reserve Proposal: Experts Discuss Contemporary Frontiers in Crypto and Global Finance

The Trump administration’s proposal to attach a US Bitcoin reserve has sparked critical debate among monetary experts, crypto fans, and policymakers alike.

This switch objectives to legitimize Bitcoin as a express-backed reserve asset and marks a dramatic shift within the US authorities’s stance on cryptocurrencies. Historically regarded with skepticism, Bitcoin now stands on the cusp of becoming broadly identified as digital gold.

Fascinating From Bitcoin Reserve Hypothesis to Method

If the US have been to mix Bitcoin entirely, it would place of dwelling itself as a leader in monetary know-how while countering the upward thrust of express-managed digital currencies like China’s digital yuan.

On the opposite hand, this coverage raises severe questions: Could also it trigger a worldwide “crypto palms shuffle”? Will it rev up introduction within the crypto ecosystem or undermine Bitcoin’s decentralized ethos?

The proposal for the reserve, launched by US Senator Cynthia Lummis, suggests that the Treasury and the Federal Reserve develop 200,000 Bitcoins once a year over 5 years, totaling a million BTC, approximately 5% of the general worldwide provide.

“A Bitcoin reserve idea would essentially reshape the narrative around Bitcoin, elevating it from a speculative asset to a strategic monetary instrument,” acknowledged Bill Qian, Chairman of Cypher Capital in an interview with BeInCrypto.

This shift would signal a recognition of Bitcoin’s lengthy-period of time doable, prompting institutional investors to re-review their positions. Within two weeks, calls for a Bitcoin reserve institution in Russia and the city of Vancouver signaled that this can also very smartly be the starting up of a worldwide pattern.

For Qian, the implications extend previous funding programs. He argues that institutional investors and crypto companies are seemingly to verify this as validation of Bitcoin’s lengthy-period of time doable. For that reason, it might perhaps perhaps instructed a wave of capital allocation in direction of Bitcoin as institutions place of dwelling themselves to take advantage of its digital gold attributes.

This switch could perhaps perhaps moreover affect corporate habits, making Bitcoin a extra mainstream price for industry transactions. Bill Hughes, Head of Global Regulatory Issues at Consensys, believes legitimizing Bitcoin as a reserve asset could perhaps perhaps have a trickle-down attain on corporate adoption.

“If Bitcoin is solely ample for the Federal Authorities to retain on its balance sheet, it is simply ample for any US firm. We could perhaps perhaps birth seeing corporate transactions that involve Bitcoin as consideration, severely for gargantuan-buck figure transactions,” Hughes acknowledged in an interview with BeInCrypto.

Could also This Procedure off a Global Crypto Hands Escape?

A US Bitcoin reserve could perhaps perhaps moreover have deep geopolitical implications, doubtlessly sparking a worldwide shuffle for crypto property. Ji Kim, Chief Lawful and Policy Officer on the Crypto Council for Innovation, views the proposal as a strategic switch.

“Here’s obvious proof of the an increasing number of primary position digital property and Bitcoin in utter will play all through markets. Digital property desires to be idea of a strategic asset class by our authorities, correct as gold, oil, and totally different bodily property have been for hundreds of years,” Kim acknowledged in an interview with BeInCrypto.

While the US is exploring the institution of a Bitcoin reserve, rising economies are already leveraging cryptocurrencies to sever encourage reliance on the US buck. El Salvador, as an illustration, has been actively amassing Bitcoin since adopting it as just soft in 2021.

The fresh surge in BTC rate has been smartly-known by Salvadoran President Nayib Bukele, who has previously claimed that adopting Bitcoin could perhaps perhaps keep Salvadorans up to $400 million once a year in remittance costs. While some difficulty such insurance policies could perhaps perhaps develop worldwide tensions, Kim sees it in any other case.

“This could occasionally perhaps also just tranquil no longer trigger tensions or warfare. With the US having fun with a lead position in growing just regulatory frameworks, recognition of digital property can drive a extra interconnected world with elevated particular person company and empowerment,” he added.

In the realm of energy and affect, the US Bitcoin reserve could perhaps perhaps counterbalance China’s rising affect through its express-backed digital yuan. Shall we embrace, the express accepts digital yuan funds in settlements in China’s Belt and Road Initiative projects. This highlights Beijing’s probability of inauspicious the US buck’s dominance in worldwide commerce.

“The US must act now if it hopes to retain monetary leadership. By adopting Bitcoin, the US no longer only hedges against inflation however moreover signals its commitment to innovation, which is severe within the face of China’s expanding digital forex ambitions,” Qian acknowledged.

On the opposite hand, totally different experts caution that a US Bitcoin reserve could perhaps perhaps no longer entirely neutralize the digital yuan’s geopolitical leverage. No longer like Bitcoin, which remains decentralized, the digital yuan gives express-backed guarantees and seamless integration into China’s domestic and commerce networks.

Risks and Criticisms of a Bitcoin Reserve

Even with all its promises, the Bitcoin reserve idea has risks. Bitcoin’s designate volatility poses a doable area, severely for taxpayer exposure. Hughes soft-pedals this affirm, arguing that Bitcoin’s most in vogue scale limits its impact on the broader economy.

“Bitcoin’s exercise within the economy and overall market cap must fetch bigger by orders of magnitude sooner than it might perhaps perhaps noticeably impact the US economy. Even a huge commitment of capital by the US authorities to the Bitcoin reserve could perhaps perhaps be scarcely seen,” Qian explained.

One other affirm is whether or no longer express involvement in Bitcoin could perhaps perhaps break its decentralized ethos. Hughes dismisses this notion, stressing that authorities possession does no longer equate to manipulate.

“The purpose of the network is to enable anybody to retain and transact with the asset. That involves entities and even governments. The US authorities owning BTC will only abet broader adoption as a retailer of rate,” he acknowledged.

The US Bitcoin reserve idea could perhaps perhaps pave the system for extra crypto-pleasant regulation, as Hughes components out.

“You is seemingly to be seeing talk of a Bitcoin reserve going on of dwelling in parallel with promises that the US is now entirely birth for industry in blockchain tool development. One does no longer result within the totally different, however they reinforce each and each totally different,” he concluded.

Advancing US Crypto Mining Infrastructure

Moreover, if worldwide locations like China or Russia respond by accelerating their crypto initiatives, it might perhaps perhaps result in elevated rivals in areas like mining and digital infrastructure.

In accordance with a fresh JP Morgan legend, “Bitcoin Mining: An Investor’s Recordsdata to Bitcoin Mining and HPC,” 14 publicly listed Bitcoin miners within the US retain watch over a file 29% of the network. Most of this growth in hashrate comes from US-essentially based Bitcoin miners, especially public mining companies. States like Texas have emerged as leaders, leveraging abundant renewable vitality to energy mining operations.

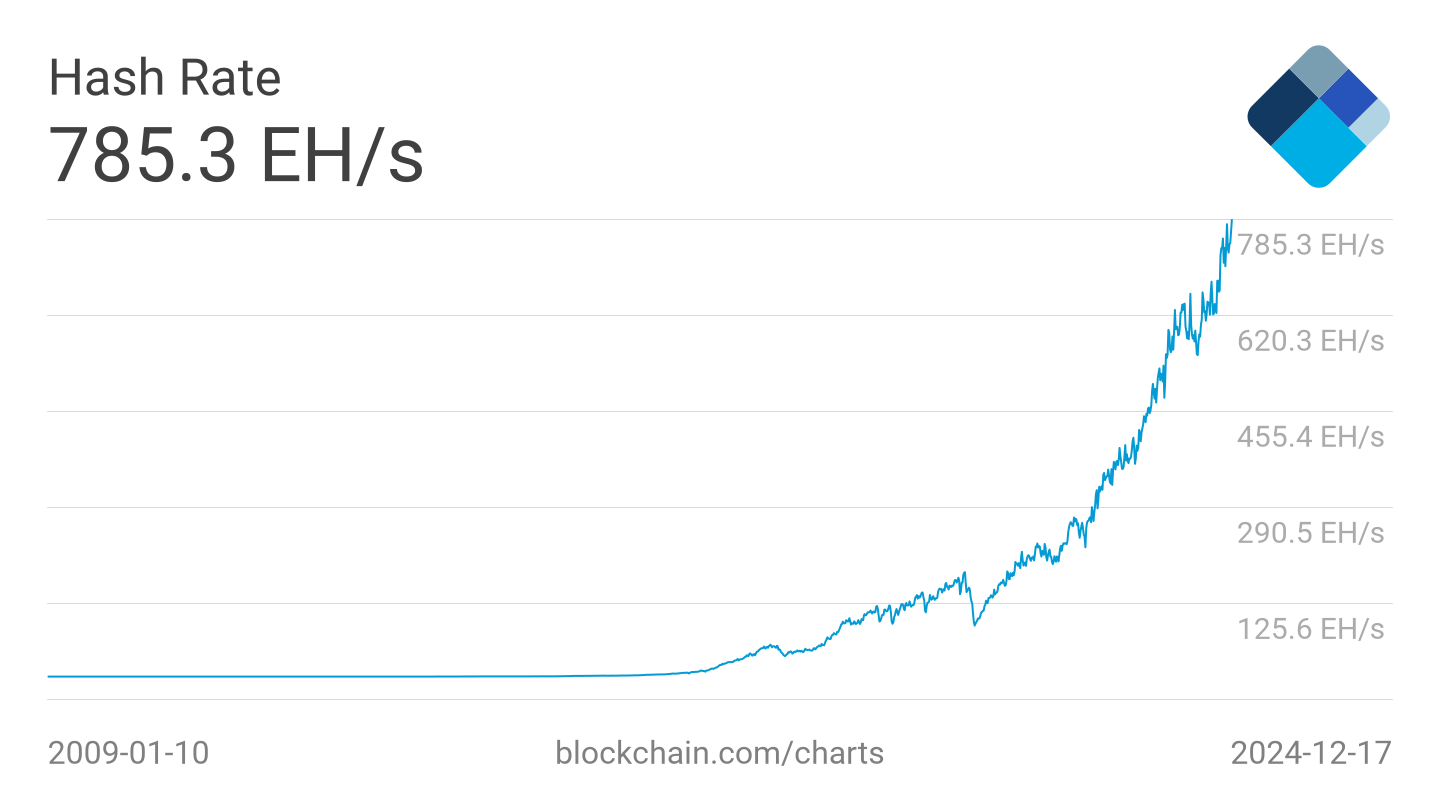

As of writing, Bitcoin’s hashrate, a measure of the computing energy securing the network, hovers around all-time highs at 785.3 exa hashes per 2d.

With that acknowledged, the be taught argues that the surge in hashrate isn’t correct about advancements within the US mining industry. It’s moreover tied to critical activity in totally different main mining areas, severely Russia and China. As of December, Russia had to ban all crypto mining in occupied Ukraine and Siberia, citing considerations over local energy grids.

“Mining operations could perhaps perhaps look accelerated traits in renewable vitality integration and hardware efficiency to meet rising attach a query to. In the same device, storage alternate solutions would evolve to deal with heightened focus on security and custodianship for gargantuan-scale institutional holdings,” Qian acknowledged.

Hughes, alternatively, gives a extra tempered review. He believes the market’s response to elevated Bitcoin attach a query to, in preference to authorities action, would drive invention.

“The fetch bigger in hashrate and advancements in vitality efficiency could perhaps perhaps mitigate considerations about Bitcoin mining’s environmental footprint, aligning it with broader public coverage targets,” he acknowledged.

However, for crypto fans, the proposal of a Bitcoin reserve represents a imaginative and prescient for the US to e-book in digital finance, nourishing the ecosystem through sound coverage. The US could perhaps perhaps catalyze a wave of adoption, reshaping the system forward for worldwide finance.

The Trump administration’s execution and worldwide response will settle whether or no longer this idea triggers a worldwide crypto palms shuffle or sets a precedent for guilty integration.

Disclaimer

Following the Believe Venture guidelines, this characteristic article gifts opinions and perspectives from industry experts or participants. BeInCrypto is devoted to transparent reporting, however the views expressed listed here enact no longer essentially mirror those of BeInCrypto or its staff. Readers can also just tranquil test data independently and consult with a reliable sooner than making choices in accordance with this direct material. Please model that our Phrases and Prerequisites, Privateness Policy, and Disclaimers have been updated.