Swiss Market Index Elliott Wave technical evaluation [Video]

Swiss Market Index Elliott Wave Analysis Trading Lounge Day Chart.

Swiss Market Index Elliott Wave technical evaluation

-

Feature: Pattern.

-

Mode: Impulsive.

-

Structure: Grey wave 3.

-

Plot: Orange wave 3.

-

Route next higher degrees: Grey wave 3 (started).

-

Little print: Grey wave 2 has been done, and grey wave 3 is now in play.

-

Wave abolish invalid level: 11,419.25.

The Swiss Market Index (SMI) Elliott Wave evaluation for the each day chart signifies that the market is experiencing a bullish vogue with an impulsive wave structure. The contemporary evaluation specializes in grey wave 3, which is advancing within the broader vogue. The market is in the heart of orange wave 3, forming half of the continuing grey wave 3.

Beforehand, grey wave 2 used to be done, and a focus is now on the continued development of grey wave 3. The impulsive nature of this wave signals solid upward momentum, with further good points anticipated as the wave unfolds. Impulsive waves luxuriate in this are most frequently linked to necessary and sustained worth movements in direction of the present vogue.

The invalidation level for this wave structure is made up our minds at 11,419.25. If the cost falls below this level, the contemporary Elliott Wave depend shall be invalidated, necessitating a reassessment of the wave structure. On the opposite hand, so long as the cost remains above this invalidation level, grey wave 3 is expected to proceed pushing the market higher.

Abstract: The Swiss Market Index is currently in the midst of a solid upward vogue, with grey wave 3 progressing. The completion of grey wave 2 has laid the groundwork for further good points, as orange wave 3 unfolds within the upper wave structure. The next necessary segment involves the continuation of grey wave 3, with the most indispensable invalidation level to visual show unit situation at 11,419.25, below which the wave depend would can maintain to mute be reconsidered.

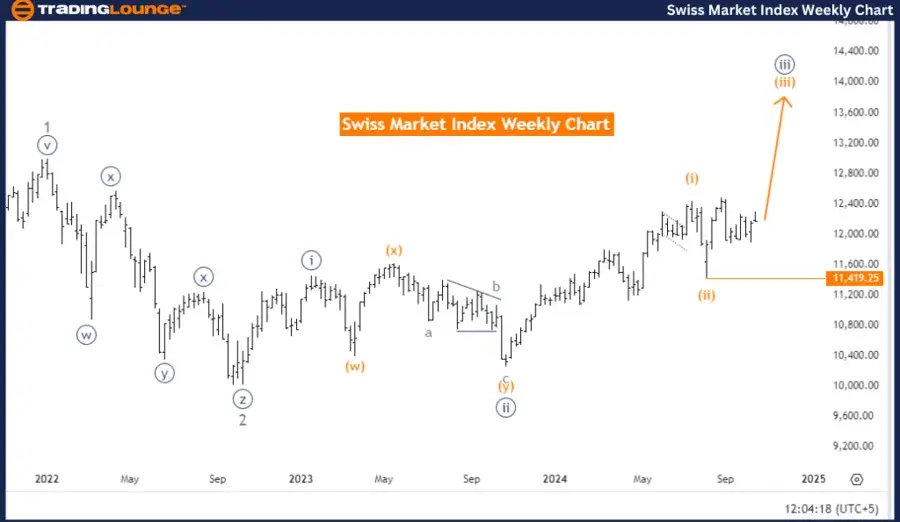

Swiss Market Index Elliott Wave Analysis Trading Lounge Weekly Chart.

Swiss Market Index Elliott Wave technical evaluation

-

Feature: Bullish Pattern.

-

Mode: Impulsive.

-

Structure: Orange wave 3.

-

Plot: Navy Blue Wave 3.

-

Route next higher degrees: Orange wave 3 (started).

-

Little print: Orange Wave 2 has done, and now Orange Wave 3 is in play.

-

Wave abolish invalid level: 11,419.25.

The Swiss Market Index (SMI) weekly chart Elliott Wave evaluation highlights a bullish vogue, following an impulsive wave structure. The predominant level of interest is on the continuing orange wave 3, which is currently pushing the market higher within the broader vogue framework. This capacity a continuation of the upward slip in step with the long-term bullish outlook.

Beforehand, orange wave 2 used to be done, and the market is now advancing by plan of orange wave 3. The impulsive nature of this wave signals solid momentum, suggesting that the bullish vogue is made up our minds to proceed. Here’s a pivotal segment in the Elliott Wave cycle, in which huge upward worth movements are expected.

The evaluation furthermore identifies that the market is positioned within navy blue wave 3, which is half of the total wave structure, pointing towards further advances. The next level of interest is the continuation of orange wave 3, which has already started and is expected to push the market even higher because it unfolds.

The invalidation level for this wave structure is made up our minds at 11,419.25. If the market drops below this level, the contemporary wave depend will most definitely be invalidated, requiring a reassessment of the evaluation. On the opposite hand, so long as the cost remains above this key level, the bullish outlook is inclined to accumulate, with further upward slip anticipated in step with orange wave 3.

Abstract: The Swiss Market Index is currently in the midst of a solid bullish vogue, pushed by orange wave 3. Orange wave 2 has done, and the continuation of the upward slip in orange wave 3 is now underway. The extreme level to visual show unit is 11,419.25, as a tumble below this level would invalidate the contemporary Elliott Wave structure.

Technical analyst: Malik Awais.

Swiss Market Index Elliott Wave technical evaluation [Video]

As with every investment different there is a risk of making losses on investments that Trading Lounge expresses opinions on.

Historical outcomes don’t seem like any guarantee of future returns. Some investments are inherently riskier than others. At worst, that you simply can also lose your total investment. TradingLounge™ makes spend of a vary of technical evaluation instruments, instrument and total fundamental evaluation besides economic forecasts geared toward minimizing the functionality for loss.

The advice we offer by plan of our TradingLounge™ web sites and our TradingLounge™ Membership has been willing with out serious about your goals, monetary peril or wants. Reliance on such advice, recordsdata or recordsdata is at your possess risk. The resolution to swap and the manner of shopping and selling is for you on my own to settle. This recordsdata is of a total nature handiest, so as to maintain to mute, sooner than appearing upon any of the working out or advice equipped by us, reduction in thoughts the appropriateness of the advice serious about your possess goals, monetary peril or wants. Subsequently, that you simply can maintain to mute consult your monetary consultant or accountant to uncover whether or no longer shopping and selling in securities and derivatives merchandise is appropriate for you serious about your monetary circumstances.

![Swiss Market Index Elliott Wave technical evaluation [Video]](https://americatimes.us/wp-content/uploads/2024/10/133304-swiss-market-index-elliott-wave-technical-evaluation-video.jpg)