MQG Elliott Wave diagnosis and Elliott Wave forecast [Video]

ASX: MACQUARIE GROUP LIMITED – MQG Elliott Elliott Wave Technical Diagnosis TradingLounge (1D Chart).

Greetings, Our Elliott Wave diagnosis at present time updates the Australian Stock Substitute (ASX) with MACQUARIE GROUP LIMITED – MQG. We knowing MQG.ASX nonetheless having a push decrease, and preparing for a future 5-grey wave rally.

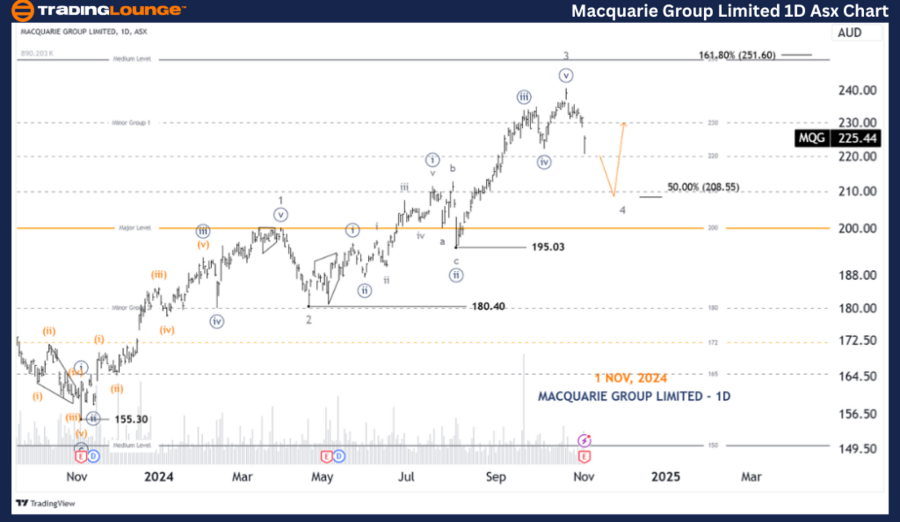

ASX: Macquarie Neighborhood Restricted – MQG 1D chart (Semilog scale) diagnosis

Characteristic: Predominant pattern (Minor stage, grey).

Mode: Motive.

Structure: Impulse.

Grunt: Wave 4-grey.

Critical factors: Wave 3-grey has ended and wave 4-grey is unfolding to push decrease, concentrated on round 208.55, after which wave 5-grey may perhaps additionally return to push elevated.

Invalidation point: 200.00.

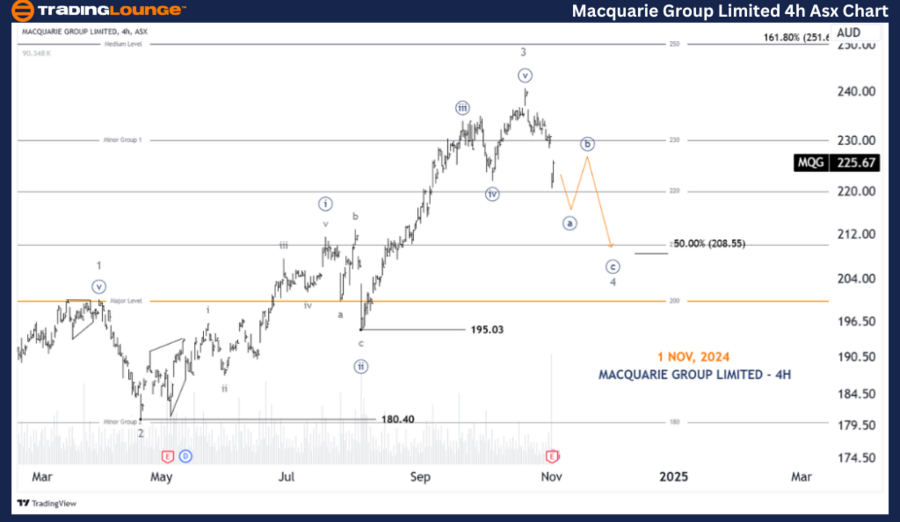

ASX: Macquarie Neighborhood Restricted – MQG four-hour chart diagnosis

Characteristic: Predominant pattern (Minor stage, grey).

Mode: Motive.

Structure: Impulse.

Grunt: Wave ((a))-navy of Wave 4-grey.

Critical factors: Wave 4-grey is unfolding to push decrease, and it is perchance increasing as a Zigzag, labeled ((a))((b))((c))-navy. Its retracement purpose will perchance continue to push decrease for one beyond regular time. And after wave 4-grey is complete, wave 5-grey may perhaps additionally return to push elevated.

Invalidation point: 200.00.

Conclusion

Our diagnosis, forecast of contextual trends, and non everlasting outlook for ASX: MACQUARIE GROUP LIMITED – MQG aim to present readers with insights into the recent market trends and the intention one can capitalize on them successfully. We provide explicit label factors that act as validation or invalidation signals for our wave count, enhancing the arrogance in our perspective. By combining these factors, we strive to present readers perchance the most purpose and dependable perspective on market trends.

Technical analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

ASX: Macquarie Neighborhood Restricted – MQG four-hour chart diagnosis [Video]

As with every funding different there is a risk of making losses on investments that Trading Lounge expresses opinions on.

Historical outcomes are no longer any guarantee of future returns. Some investments are inherently riskier than others. At worst, that it is possible you’ll additionally lose your complete funding. TradingLounge™ uses a range of technical diagnosis instruments, instrument and general fundamental diagnosis in addition as financial forecasts geared toward minimizing the aptitude for loss.

The advice we provide thru our TradingLounge™ internet sites and our TradingLounge™ Membership has been ready without brooding about your targets, financial pain or needs. Reliance on such advice, files or files is at your hold risk. The decision to alternate and the technique of trading is for you alone to spend. This info is of a general nature greatest, so that it is possible you’ll additionally fair nonetheless, earlier than acting upon any of the recommendations or advice offered by us, opt into consideration the appropriateness of the advice brooding about your hold targets, financial pain or needs. Subsequently, that it is possible you’ll additionally fair nonetheless consult your financial e book or accountant to determine whether trading in securities and derivatives merchandise is appropriate for you brooding about your financial conditions.

![MQG Elliott Wave diagnosis and Elliott Wave forecast [Video]](https://americatimes.us/wp-content/uploads/2024/11/136404-mqg-elliott-wave-diagnosis-and-elliott-wave-forecast-video.jpg)