Michael Saylor Particulars Bitcoin Strategy to Power US Digital Economic system

Michael Saylor, the Executive Chairman of MicroStrategy, has outlined a Bitcoin technique to place the US as a world chief in the digital economy.

This switch comes as his firm expanded its Board of Administrators from six to nine people, incorporating notorious crypto advocates to beef up its strategic focal level on digital resources.

Saylor Advocates for Bitcoin Reserve

On December 20, Saylor explained that his vision revolves around enforcing a Strategic Bitcoin Reserve (SBR) to deal with financial challenges, strengthen the greenback’s dominance, and make unheard of enhance opportunities in the digital asset sector.

“A strategic digital asset policy can beef up the US greenback, neutralize the nationwide debt, and place The US as the realm chief in the 21st-century digital economy — empowering hundreds and hundreds of corporations, using enhance, and rising trillions in cost,” Saylor wrote on X.

Saylor’s proposal outlines how a sturdy digital asset policy could well make a capital markets renaissance, unlocking trillions in cost. He envisions a $10 trillion digital currency market using ask for US Treasuries whereas fostering enhance in digital resources.

He also believes that expanding this market could well extend the digital economy’s valuation from $1 trillion to $590 trillion, with the US leading the associated rate.

“Establishing a Bitcoin reserve [is] in a position to rising $16–81 trillion in wealth for the US Treasury [and] providing a pathway to offset nationwide debt,” Saylor stated.

Despite these courageous claims, critics adore mission capitalist Nic Carter live skeptical. Carter argues that the SBR concept lacks readability and could well destabilize markets rather than beef up the greenback.

He aspects to Bitcoin’s volatility, referencing its fresh trace dip from over $108,000 to $92,000, as evidence that it could maybe no longer be a first rate reserve asset. Furthermore, Carter believes this kind of switch could well undermine the greenback’s world place rather than strengthen it.

“I don’t strengthen a Strategic Bitcoin Reserve, and neither ought to nonetheless you,” Carter acknowledged.

New MicroStrategy Board Contributors Verbalize Crypto Skills

In line with a December 20 SEC filing, the board of Bitcoin-targeted firm has elected fresh board people. The fresh additions encompass Brian Brooks, worn Binance US CEO and a notorious figure in crypto regulation; Jane Dietze, Chief Funding Officer at Brown University; and Gregg Winiarski, Chief Ultimate Officer at Enthusiasts Holdings.

These fresh board people bring diverse skills across finance, skills, and emerging markets, aligning with MicroStrategy’s broader strategic desires. Brooks, in explicit, is broadly known for his regulatory and crypto skills. He has held leadership roles at high crypto corporations, including Coinbase and BitFury Community, and has also served as the Acting Comptroller of the Currency.

In the intervening time, Dietze has also served on the crypto asset administration agency Galaxy Digital board, whereas Winiarski has experience with a privately held world digital sports platform.

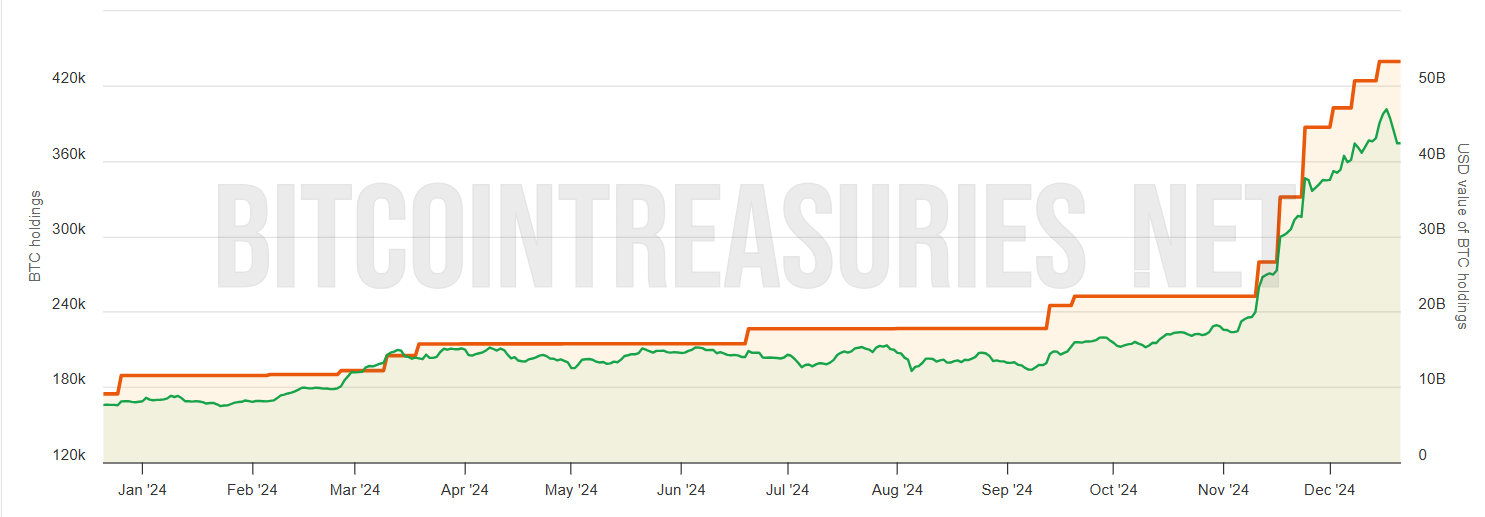

MicroStrategy is basically the most attention-grabbing publicly traded corporate holder of Bitcoin. In line with Bitcoin Treasuries files, the firm right now holds 439,000 Bitcoin valued at over $43 billion.

Disclaimer

In adherence to the Belief Project guidelines, BeInCrypto is committed to honest, transparent reporting. This files article aims to give upright, effectively timed files. Nonetheless, readers are suggested to confirm facts independently and seek the advice of with a genuine sooner than making any selections per this instruct. Please cloak that our Terms and Stipulations, Privateness Policy, and Disclaimers had been updated.