Bitcoin’s ascent to $80K is pushed by in sort ETF demand, now not retail FOMO, says Cameron Winklevoss

Institutional traders gasoline Bitcoin’s boost through ETFs, marking a shift from outmoded retail-pushed rallies.

Key Takeaways

- Bitcoin’s climb to $80,000 is attributed to solid institutional demand through bid Bitcoin ETFs, moderately than retail FOMO.

- Residing Bitcoin ETFs accrued about $2.3 billion in rep inflows quickly after the US presidential elections.

Bitcoin reached $80,000 essentially attributable to constant institutional demand through bid Bitcoin ETFs moderately than retail investor assignment, in accordance to Gemini co-founder Cameron Winklevoss.

He believes that this “sticky” demand from institutional traders is a signal of prolonged-timeframe bullish sentiment, and that the present market cycle is quiet in its early stages.

“The aspect road to $80k bitcoin was paved with in sort ETF demand. No longer retail FOMO. Little fanfare. Of us gain ETFs, they don’t promote them. Right here’s sticky HODL-admire capital. Floor retains rising,” Winklevoss said. “We just received the coin toss, innings haven’t started.”

The performance of US crypto ETFs this week was largely certain by the outcomes of the presidential elections. After Trump declared his victory on November 5, bid Bitcoin and Ethereum ETFs reversed their style.

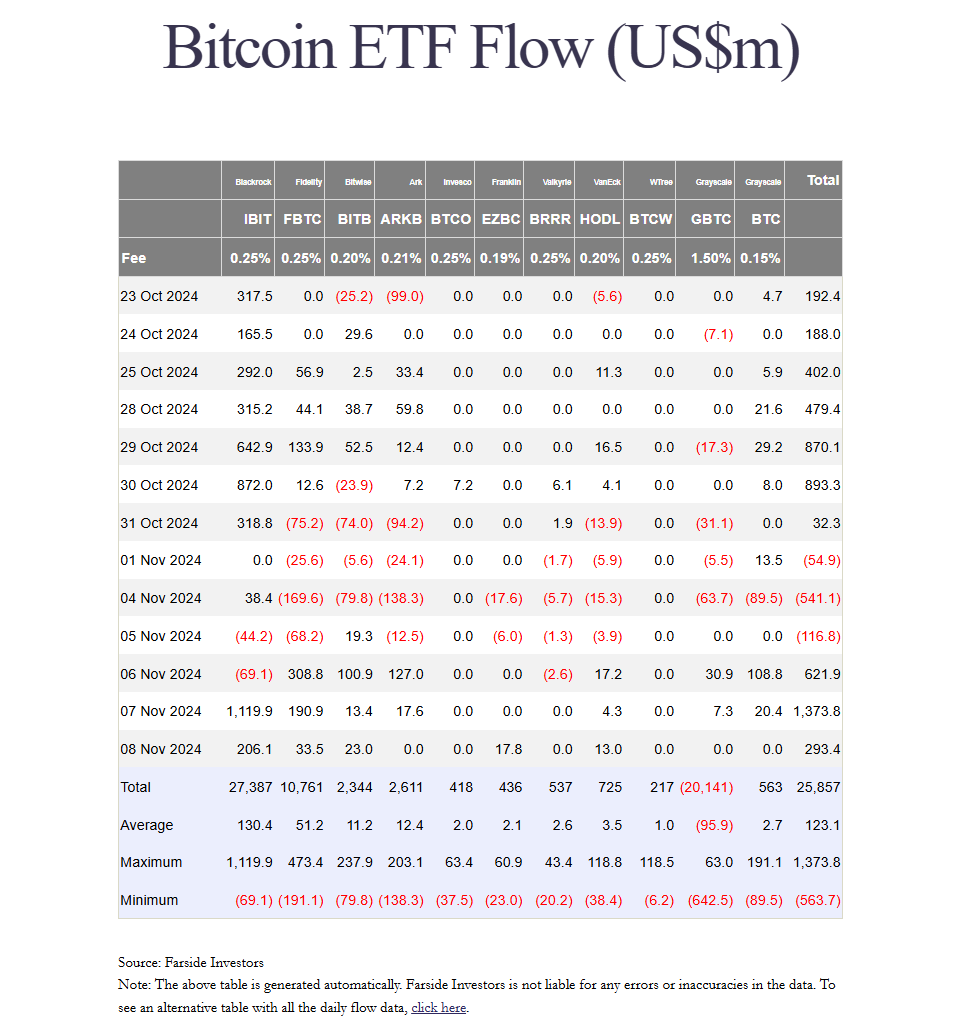

In step with Farside Investors data, the neighborhood of 11 bid Bitcoin ETFs attracted approximately $622 million in rep inflows on Wednesday. BlackRock’s IBIT done a fable $4.1 billion in trading volume with out reference to experiencing outflows that day.

IBIT subsequently recorded over $1 billion in rep inflows on Thursday, growing its assets under administration to bigger than $33 billion. The ETF has now exceeded the scale of BlackRock’s iShares Gold Trust (IAU).

Overall, US bid Bitcoin ETFs collectively accrued about $2.3 billion in rep inflows within the direction of the three trading days following Election Day. Other crypto products additionally benefited, with bid Ethereum ETFs drawing in the case of $218 million from Wednesday to Friday, Farside Investors data presentations.

Traditional supply-demand dynamic

Bitcoin is on a sizzling poke, and it’s all due to the of a supreme storm of issues. Institutions are scooping up Bitcoin through ETFs, while the halving tournament has tightened supply. This combination of issues could well maybe additionally push Bitcoin’s brand to six figures, in accordance to Bitwise CIO Matt Hougan.

Hougan additionally expects global financial adjustments, admire China’s stimulus measures and the Fed’s ardour fee decision, to carry Bitcoin’s costs.

The Fed and the Bank of England continued their easing financial policies on Thursday, with both central banks enforcing 25-foundation-level fee cuts. This adopted the Fed’s extra aggressive 50-foundation-level low cost in September.

Disclaimer