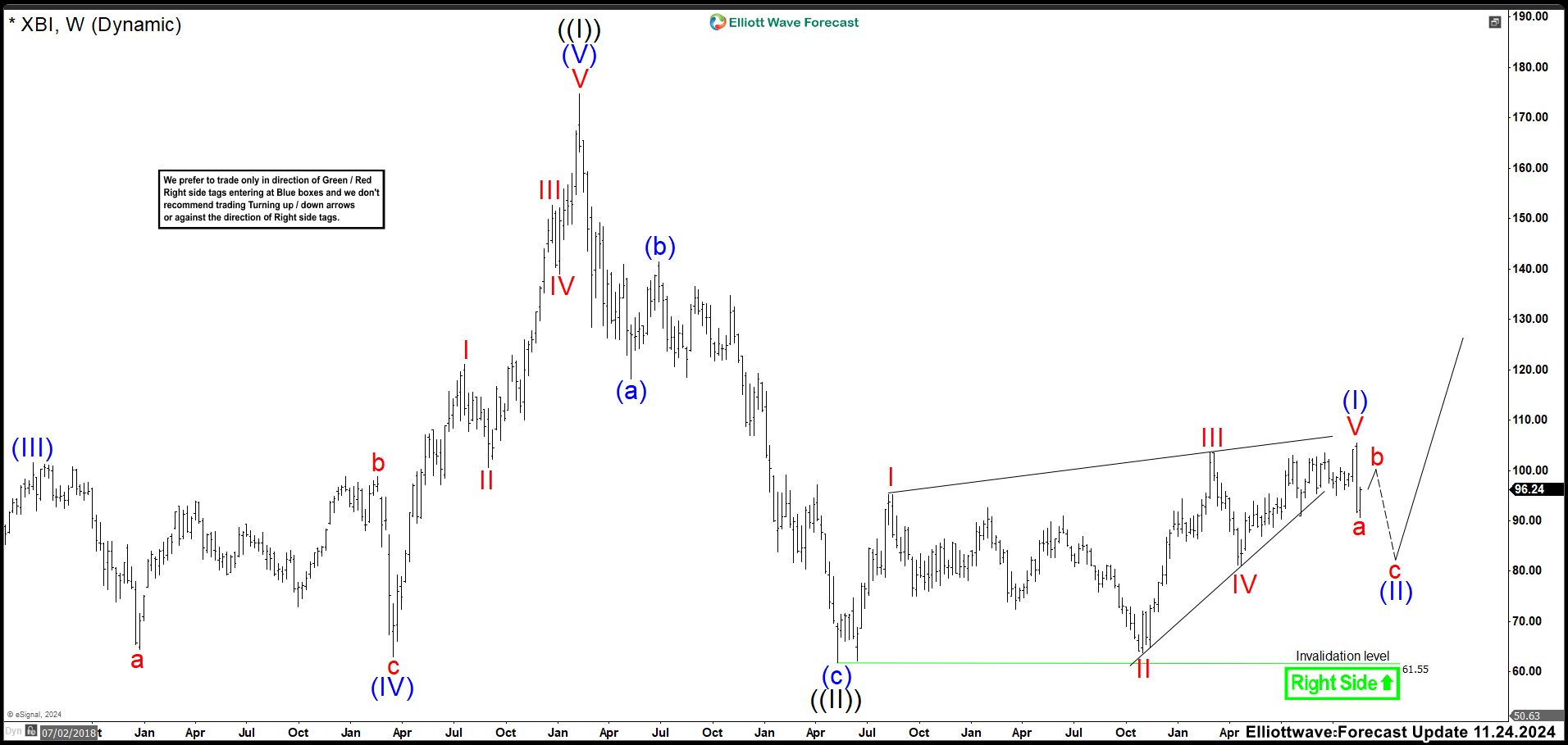

Biotech ETF (XBI) ended a diagonal – Buying for making an try to search out dips

The SPDR S&P Biotech ETF (XBI) is an alternate-traded fund that tracks the biotechnology segment of the S&P Total Market Index. This ETF enables patrons to manufacture publicity to natty, mid, and little-cap biotech stocks. Whereas you happen to’re desirous about biotechnology, XBI can even be fee exploring additional. Right here are some of its high holdings and their share weights: United Therapeutics Corporation (UTHR): 2.92%. Genuine Sciences Corporation (EXAS): 2.91%. Gilead Sciences, Inc. (GILD): 2.89%. Sarepta Therapeutics, Inc. (SRPT): 2.87%. Amgen Inc. (AMGN): 2.84%. Alnylam Prescribed tablets, Inc. (ALNY): 2.65%. Regeneron Prescribed tablets, Inc. (REGN): 2.64%. Vertex Prescribed tablets Incorporated (VRTX): 2.60%. AbbVie Inc. (ABBV): 2.60%. BioMarin Pharmaceutical Inc. (BMRN): 2.56%.

In July, we explained how we bought a blue box on XBI and the device in which we generated over 18% in profits. Moreover, we saved originate the chance that the ETF will continue to upward push and also can attain around 108.45. To arrangement how we handled the change from the blue box, it’s good to presumably perchance well presumably also try the worn weblog here: Biotech ETF (XBI) Rallied from the Blue Field Hitting Target

XBI weekly chart March 23rd 2024

Within the chart above for the month of March, we can gape the course we are waiting for for XBI. It had accomplished a Sizable Sizable Cycle at 174.79 excessive and then made a correction. The pullback developed a zig zag structure where wave (a) ended at 118.23 low. Straight, we had a brief wave (b) that reached 141.50 excessive and then resumed with the bearish lag. Wave (c) extended reaching the 61.78 low to total wave ((II)). At this level, we regarded for a bullish continuation; nonetheless, by that date the structure turned into as soon as no longer obvious. Since with handiest get 3 waves, it ought to even be a diagonal or a nest-kind structure. The coincidence with the 2 structures is that both had to apt sooner than continuing upwards and we lean against the diagonal on account of it’s more conservative, as we gape in the chart.

XBI weekly chart November 25th 2024

The wave I of the diagonal ended at 95.17 excessive. Then wave II built a zig zag correction with a flat structure in the heart. This pullback ended at 63.80 low and rally again. Wave III did a stable rally as wave I reaching 103.53 excessive. The retracement as wave IV accomplished at 81.14. The ideal push to the upside turned into as soon as reasonably irregular. It will even be labeled as a ending diagonal to 105.47 excessive, finishing up wave V and wave (I). At this time, the wave (II) has started adn we are taking a arrangement to extinguish 3, 7 or 11 swings correction where we desire to know the dips against 61.78 low.

FURTHER DISCLOSURES AND DISCLAIMER CONCERNING RISK, RESPONSIBILITY

AND LIABILITY

Buying and selling in the International Alternate market is a disturbing change where above moderate returns are on hand for educated and skilled patrons who’re willing to capture above moderate risk.

Nonetheless, sooner than deciding to participate in International Alternate (FX) procuring and selling, you ought to scrupulously capture into consideration your investment targets, stage of xperience and risk flee for food. Enact no longer invest or change capital it’s good to presumably perchance well presumably no longer provide you with the money for to lose. EME PROCESSING AND CONSULTING, LLC, THEIR REPRESENTATIVES, AND ANYONE WORKING FOR OR WITHIN WWW.ELLIOTTWAVE- FORECAST.COM is now to not blame for any loss from any fabricate of distributed advice, signal,

evaluation, or sing.

Again, we fully DISCLOSE to the Subscriber low that the Provider as an entire, the particular person Parties, Representatives, or home owners shall no longer be at risk of any and all Subscribers for any losses or damages on account of any action taken by the Subscriber from any change arrangement or signal posted on

the on-line scheme(s) distributed by device of any fabricate of social-media, email, the on-line scheme, and/or any varied digital, written, verbal, or future fabricate of communication . All evaluation, procuring and selling signals, procuring and selling ideas, all charts, communicated interpretations of the wave counts, and all sing from any media fabricate produced by www.Elliottwave-forecast.com and/or the Representatives are totally the opinions and handiest efforts of the respective author(s).

In overall Forex instruments are extremely leveraged, and merchants can lose some or all of their preliminary margin funds. All sing offered by www.Elliottwave-forecast.com is expressed in true faith and is supposed to motivate Subscribers put the marketplace, but it’s never assured. There could be not any “holy grail” to procuring and selling or forecasting the market and we are unsuitable most ceaselessly worship each person else.

Please realize and settle for the chance involved when making any procuring and selling and/or investment resolution.

UNDERSTAND that all the sing we provide is safe by device of copyright of EME PROCESSING AND CONSULTING, LLC. It is illegal to disseminate in any fabricate of communication any piece or all of our proprietary recordsdata with out particular authorization.

UNDERSTAND that you just moreover agree to no longer allow persons that are no longer PAID SUBSCRIBERS to gaze any of the sing no longer released publicly. IF YOU ARE FOUND TO BE IN VIOLATION OF THESE RESTRICTIONS you or your firm (because the Subscriber) will possible be charged fully without a nick fee for one one year subscription to our Premium Plus Map at $1,799.88 for EACH person or firm

who bought any of our sing illegally by device of the respected intermediary’s (Subscriber in violation of terms) channel(s) of communication.