Bernstein Predicts DeFi Market Would maybe presumably presumably additionally Produce Properly With US Price Cuts

Bernstein analysts indicate that DeFi may maybe create neatly if the Federal Reserve cuts US curiosity charges. Global liquidity and rate differentials may maybe indicate key for crypto.

These predictions contradict mounting concerns that rate cuts will damage investment in Bitcoin and Ethereum.

Price Cuts Would maybe presumably presumably Spell Wretchedness

As the US economic system continues its doldrums of perceived inflation and cost-of-residing will increase, stress is rising to carve Fed curiosity charges. Three Democratic Senators called for “aggressive” measures, Bloomberg reported Monday, citing Capitol Hill rumors that impending rate cuts would be gentle.

Of their letter, Senators Elizabeth Warren, Sheldon Whitehouse, and John Hickenlooper called for a 75-level rate carve to “mitigate doable risks to the labor market.” The cuts’ right terms are disputed between diversified factions, however it’s extremely likely that some originate of them will lag.

In the eyes of the crypto group, alternatively, these proposed cuts are extra controversial. Surveys from Bitfinex claim that Bitcoin’s tag may maybe jump right this moment upon rate cuts, however its records suggests that signals finally flip bearish within the aftermath.

Maruf Yusupov, CEO of Deenar, knowledgeable BeInCrypto that the contemporary macroeconomic trends occupy precipitated a main distinction between Bitcoin and gold.

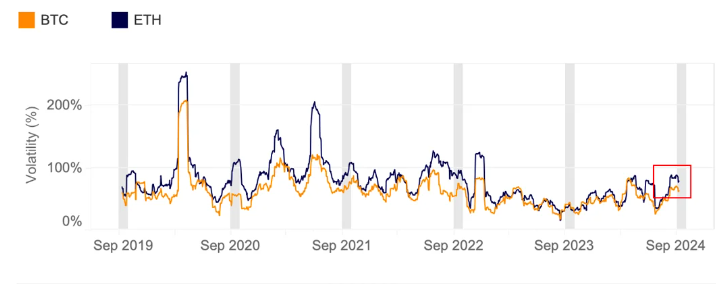

“While Bitcoin has dropped as low as $57,578.35 amid an intense burst of volatility, the worth of gold has maintained a explicit assert to $2,579.21. The explanations for this Bitcoin trend are now not far-fetched and are hinged on the uncertainty surrounding the capability Ardour rate carve from the US Federal Reserve. No topic the doubtlessly particular prospect of this carve for the broader market, patrons are easy cautious of overall uncertainty,” Yusupov said in an uncommon interview.

Certainly, decreased curiosity charges incentivize unusual investment in US markets, however they additionally signal overall weakness. Bitcoin is perceived as a threat-on asset, and therefore, rate cuts may maybe even occupy unintended consequences. General, investment goes up, however the market shuns riskier sources.

“Yet any other major trend between each and every sources is the walk in their key ETF products over the final month. Merchants are majorly taking bets to preserve their capital at a time when there are signs of economic turmoil. The restricted volatility of Gold has made it a entertaining alternative within the frenzy to hedge in opposition to the underlying uncertainty. This pivot has viewed the Bitcoin ETF product shed off the intense capital currently, with BlackRock surprisingly joining the outflow trend,” Yusupov outlined.

Be taught extra: How To Rating Paid in Bitcoin (BTC): Every thing You Need To Know

Furthermore, September is recurrently a outdated college month for the inventory market, self reliant of these cuts. For crypto markets, these challenges may maybe indicate daunting.

Bernstein’s Bullish Epic

Nevertheless, a document from analysts at Bernstein is painting a rosier image. Analysts Gautam Chhugani, Mahika Sapra, and Sanskar Chindalia claimed that DeFi as an industry is able to steal relieve of unusual alternatives.

Particularly, world merchants can provide liquidity on decentralized markets for USD-backed stablecoins. On this means, DeFi can steal relieve of US-explicit market stipulations and manufacture yields from the dollar’s performance.

This sentiment echoes some of Arthur Hayes’ August 2024 commentary on rate cuts. Particularly, he paid special consideration to curiosity rate differentials between the US and diversified currencies, especially the yen. World merchants can utilize these differentials utilizing DeFi to inaugurate up unusual profits.

“With a rate carve likely all over the corner, DeFi yields see swish again. This may maybe be the catalyst to reboot crypto credit ranking markets and revive curiosity in DeFi and Ethereum,” claimed Bernstein’s analysts.

Be taught extra: Top 11 DeFi Protocols To Defend an Stare on in 2024

These predictions occupy spurred Bernstein to add Ethereum-primarily primarily primarily based liquidity protocol Aave to its portfolio. Particularly, the firm added Aave at the expense of two spinoff protocols, GMX and Synthetix, which were eradicated.

This clearly signals two market trends that Bernstein anticipates. To start with, lending markets and world liquidity may maybe indicate the major to prolonged-timeframe beneficial properties. 2d, despite contemporary miserable performance, it’s making a bet on Ethereum and protocols built on its blockchain.

To this level, many factors are easy within the air. If rate cuts steal spot in any respect, they’d be between 25 and 75 functions. Nevertheless, Bernstein’s mettlesome predictions may maybe assist assemble optimism within the suppose.

Disclaimer

In adherence to the Belief Mission guidelines, BeInCrypto is devoted to fair, clear reporting. This records article objectives to offer fair correct, timely records. Nevertheless, readers are suggested to examine facts independently and seek the advice of with a expert earlier than making any choices primarily primarily primarily based on this grunt. Please level to that our Terms and Stipulations, Privacy Coverage, and Disclaimers were updated.