Resolution 2024: Election uncertainty weighs down building reveal

Election jitters are affecting building reveal, though public sector initiatives continue transferring forward, no lower than for now.

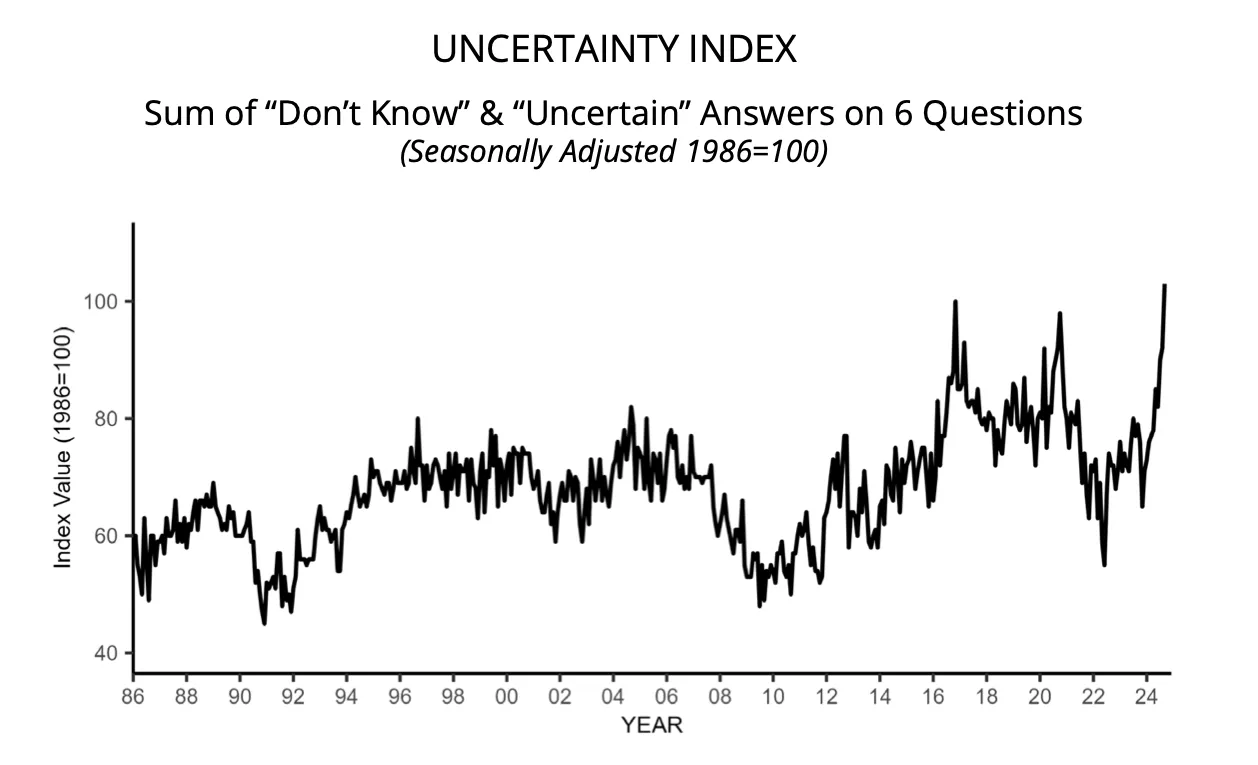

Uncertainty amongst minute industry owners all over all industries lately reached an all-time high, in response to the most up-to-date index from the Nationwide Federation of Self reliant Industry, a substitute neighborhood representing smaller companies. This dismay, coming right thru thought to be one of many tightest presidential contests in most up-to-date memory, is affecting total building reveal, industry pros urged Construction Dive.

Courtesy of Nationwide Federation of Self reliant Industry

“We’re noticing uncertainty within the market all around the seemingly economic impacts of the election,” said Granger Hassmann, vp of preconstruction and estimating at Adolfson & Peterson, a Minneapolis-basically basically based totally building management agency. “The market in customary looks to have slowed down, severely within the non-public sector.”

And whereas the extent of uncertainty has increased in most up-to-date months, Hassmann added that the pattern has been obvious for the final two years, with the slowdown exacerbated by a “let’s learn about what happens attitude,” he said.

Granger Hassmann

Courtesy of Adolfson & Peterson

In the meantime, within the Fed’s most up-to-date Beige E book file, which offers commentary on fresh economic prerequisites, the Federal Reserve Financial institution of Cleveland famed that two unnamed business builders lately reported that many companies understanding to wait till after the customary election to undertake building initiatives. Construction companies in Contemporary York also reported that reveal there has declined at a moderate tempo, in response to the Federal Reserve Financial institution of Contemporary York.

Harbingers of organising

Architectural companies, in overall early indicators of future building reveal, have also famed a slowdown. Invent companies have been feeling this pinch because the upcoming election clouds anticipated economic restoration, said Kermit Baker, chief economist at The American Institute of Architects.

“We expected with inflation concerns receding and fervour rates easing, that a restoration would be coming nonetheless it completely looks election uncertainty is inhibiting any expected restoration for the time being,” said Baker. “[Architecture] companies pointed to the upcoming elections as a predominant goal for the expected weak point within the second half of the 12 months.”

Kermit Baker

Permission granted by AIA

That hesitation could maybe well honest even be considered in other areas, as smartly.

Shall we state, electric automobile battery manufacturer Ultium Cells lately paused its $2.6 billion factory in Lansing, Michigan, due to leisurely query and high ardour rates. The company plans to resume the project once it has a clearer economic outlook, reflecting the broader wait-and-learn about contrivance referred to by Hassmann.

And in Philadelphia, real estate developer Shift Capital paused conversion work in August on the historical Beury Constructing due to lender financing disorders, with CEO Brian Murray noting that top ardour rates and lender warning have made banks cautious of committing to ample initiatives. That hesitation displays broader concerns all around the economic environment, including high ardour rates and regulatory uncertainties.

That lack of readability is fueling this cautious contrivance, as lots of seemingly outcomes could maybe well develop different policy environments, said Michael Guckes, chief economist at ConstructConnect, a Cincinnati-basically basically based totally building recordsdata provider.

Loyal estate developer Shift Capital paused work in August on the Beury Constructing in Philadelphia due to lender financing disorders.

Courtesy of Shift Capital

“This topic, in customary, is complex on story of so valuable is dependent on who controls no longer real the White House nonetheless also Congress,” said Guckes. “There are many ‘divided executive’ scenarios which could maybe well learn about either candidate’s presidential plans in most cases thwarted by an opposing Congress.”

Public initiatives faring higher

An exception looks to be infrastructure initiatives and public sector work.

Ken Simonson

Courtesy of AGC

Most public building initiatives have a lengthy lead time and develop constructions which could maybe well be meant to be passe for a few years, so many dwelling owners would likely no longer defend off after getting designs, approvals and financing, said Ken Simonson, chief economist at the Associated General Contractors of The United States. AGC member companies haven’t reported uncertainty from the election as a goal for owners to defend up off on public jobs, he said.

“I mediate public initiatives, [such as] infrastructure, faculties, public security, judicial, penal constructions, recordsdata facilities, utility initiatives and loads manufacturing vegetation are severely proof against election uncertainty,” said Simonson. “These happen to be the classes with the top seemingly prospects for 2025.”

On the alternative hand, some funding capabilities, equivalent to huge subsidies to producers prepared to make investments in unique home production capability and alternative energy producers incorporated within the CHIPS Act and Inflation Cleave rate Act, could maybe well be substantially reshaped by a swap in administration, said Anirban Basu, chief economist at Associated Builders and Contractors.

“This looks very real within the energy sector,” said Basu. “Below one seemingly declare, subsidies to alternative energy producers would be diminished, whereas improve for added broken-down forms of energy would be extra supported.”

Shall we state, photograph voltaic cell manufacturer Meyer Burger lately shelved its $400 million plant project in Colorado due to monetary constraints tied to the Inflation Cleave rate Act and an unsure economic environment. That diminished its seemingly debt financing and, in consequence, its building funds.

Anirban Basu

Permission granted by ABC

Basu also famed broader economic tendencies impacting contractors.

Shall we state, though the rate of organising materials is 39% higher than at the onset of the COVID-19 pandemic, prices have been steadier over the final two years. Latest declines in energy prices have helped defend this pattern, nonetheless Basu warned that a seemingly renewal of substitute battle, severely animated tariffs on China, would likely outcome in higher building payments.

He added that substitute-related inflationary pressures could maybe well utter upward stress on ardour rates, something contractors have been desirous to review ease.

A return to high rates?

If one social gathering gains plump control of the White House and Congress, the impact on building would be extra huge, said Guckes.

A Trump presidency with a Republican sweep of Congress could maybe well lead to heightened deficit spending, lower corporate taxes and increased tariffs. That could maybe well develop a blended-environment of shut to-term bid with a seemingly second wave of inflation, said Guckes.

Assuming the Federal Reserve motels to its inflation-battling contrivance of 2022 and 2023, higher ardour rates would be employed over all another time to curb that inflation. These hikes would then profoundly impact the skill of owners and builders to finance unique building all another time, said Guckes.

Michael Guckes

Courtesy of ConstructConnect

“A repeat of the 2022 ardour price hikes in 2026 or 2027 would negatively impact building within the 12 months or years to practice as became once the case in 2023 and 2024,” said Guckes. “ConstructConnect’s fresh expectation for 4% annualized building bid in both 2027 and 2028 would be in threat of predominant downward revisions.”

Stricter guidelines?

Against this, a Harris administration with Democratic control of Congress would likely defend a long way from aggressive shut to-term spending nonetheless could maybe well impose stricter environmental and labor guidelines. That could maybe well doubtlessly leisurely building reveal too, said Guckes.

“We would count on a [Harris administration to have a] less aggressive contrivance to bolstering shut to-term bid. This would enable the nation to defend up a long way from the worst of the inflation concerns,” said Guckes. “Heightened environmental and labor guidelines could maybe well leisurely the tempo of most up-to-date building whereas also increasing payments.”

In either declare, Guckes instructed that the industry will quickly have readability to resume or revise plans in response to the closing after Election Day.