Tokenized Treasury Market Cap Surpasses $2 Billion: Exploring Future Remark and Challenges

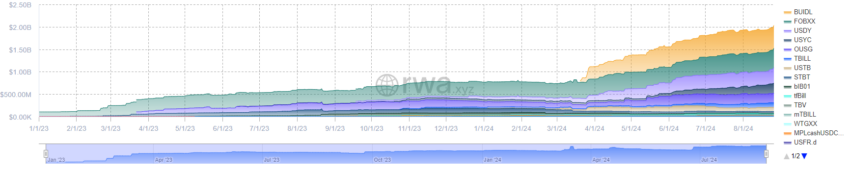

In accordance with RWA.xyz recordsdata, the tokenized treasury market has no longer too prolonged previously reached a most foremost milestone. In intellectual five months, it has exceeded a $2 billion market capitalization.

As this market continues to conform, the pressing request is: What lies ahead for tokenized treasuries?

Key Players Riding the Tokenized Treasury Remark

The hot surge in the tokenized treasury sector is essentially attributed to the spectacular efficiency of various key gamers. For event, as of August 25, the BlackRock USD Institutional Digital Liquidity Fund (BUIDL) leads the market with a capitalization of $502.67 million.

Following closely in the support of BUIDL are two completely different most foremost merchandise—Franklin Templeton’s Franklin OnChain US Authorities Cash Fund (FOBXX) and Ondo Finance’s Ondo US Dollar Yield (USDY). FOBXX has successfully captured a market capitalization of $425.46 million, while USDY has a market cap of $364.04 million. Past these most foremost gamers, completely different principal merchandise available in the market embody Hashnote’s US Treasury Yield (USYC) and Ondo Finance’s Ondo Short-Term US Authorities Bond Fund (OUSG), every of which substantially make contributions to the closing market piece.

Read extra: What Are Synthetic Resources?

Tokenized treasuries represent digital variations of passe US Treasury securities, allowing traders to exchange them seamlessly on public blockchains love Ethereum, Solana, and Stellar. This innovation enhances accessibility for individual and institutional traders, broadening the seemingly investor inferior by attracting global participants who could well no longer non-public thunder access to US Treasury markets.

Past the $2 Billion Sign: What’s Next?

Industry experts are assured that the expansion trajectory of tokenized treasuries is grand from over. The mammoth potential of this market is underscored by the giant dimension of the broader US Treasury securities market, valued at $27 trillion as of May 2024, per Statista recordsdata. With such a most foremost piece of assets yet to be tokenized, the replace for additional expansion remains enormous.

21.co’s analyst Tom Wan projected that the tokenized treasury market could well reach $3 billion by the extinguish of the 365 days. Growing ardour from decentralized independent organizations (DAOs) and decentralized finance (DeFi) projects will power this growth. These entities are eager to integrate tokenized US Treasuries into their portfolios to access steady, risk-free yields while closing for the duration of the blockchain ecosystem.

Eugene Ng, co-founder of OpenEden, reaffirms this projection. He emphasizes the growing seek recordsdata from for steady, high-yield investments in on the recent time’s financial atmosphere.

“In a high ardour-price atmosphere, the seek recordsdata from for increased-yielding, steady assets is powerful. Tokenized Treasury payments, offering aggressive returns with the backing of authorities securities, are poised to attract principal capital,” Ng remarked.

Kingsley Advani, founder and CEO of Allo.xyz, furthermore shared an identical sentiments. He envisions a broader adoption of tokenized treasuries as share of a assorted investment strategy for the duration of the DeFi ecosystem.

“We’re projecting a actually tough Q4 this 365 days. Stablecoins are about $200 billion. In TVL, we non-public now treasuries at about about a billion greenbacks. Deepest credit rating at about $10 billion. Treasuries, stablecoins, and interior most credit rating are early movers in the effect, and we’ll peer a continuation of that,” Advani elaborated to BeInCrypto.

Indeed, the seemingly positive aspects of tokenized treasuries lengthen previous intellectual investment. The aptitude to form DeFi merchandise, love yield-bearing stablecoins backed by tokenized Treasury payments, represents a most foremost replace for the market. These merchandise could well provide users additional benefits, honest like offsetting transaction charges, additional making improvements to the attraction of tokenized treasuries.

Read extra: RWA Tokenization: A Undercover agent at Security and Have confidence

Despite the seemingly, many peer the tokenized treasury market’s trajectory will furthermore rely on macroeconomic elements, including ardour price changes. However, a recent story from compare agency Kaiko highlighted that in a scenario where the Federal Reserve implements price cuts however accurate ardour rates live steady, Treasuries, including tokenized variations, could well grab their attraction because of the their inherent liquidity and safety. This element showcases the continuing relevance of tokenized treasuries as a steady investment in unsure financial events.

Disclaimer

In adherence to the Have confidence Mission guidelines, BeInCrypto is committed to independent, clear reporting. This news article objectives to present factual, timely recordsdata. However, readers are urged to ascertain facts independently and check with a skilled ahead of making any choices per this whine material. Please describe that our Terms and Stipulations, Privateness Policy, and Disclaimers were up to this level.